How to fill a Dematerialisation Request Form

5paisa Research Team

Last Updated: 31 Jan, 2025 04:43 PM IST

Content

- What is a Dematerialisation Request Form (DRF)?

- What are the Types of DRF (Demat Request Form)?

- How to Fill a DRF (Demat Request Form)?

- Conclusion

"Demat Request Form" (DRF), you must have heard of at some point during your investing career. The Demat (Dematerialisation) account has made it easier and more accessible to invest in securities like stocks, bonds, and mutual funds in the contemporary financial world. You can hold your securities electronically with a demat account, doing away with the requirement for paper certificates.

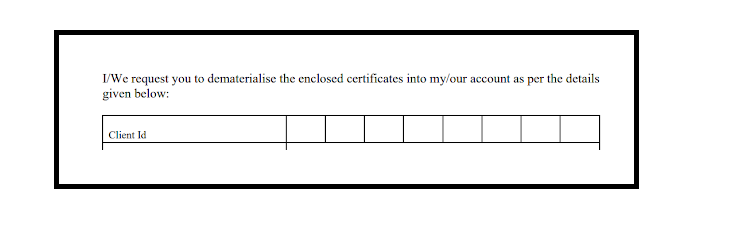

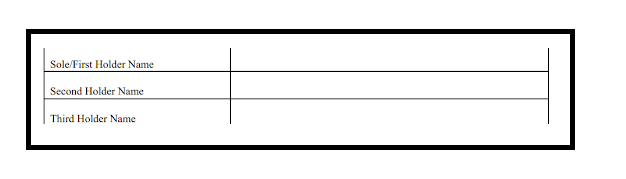

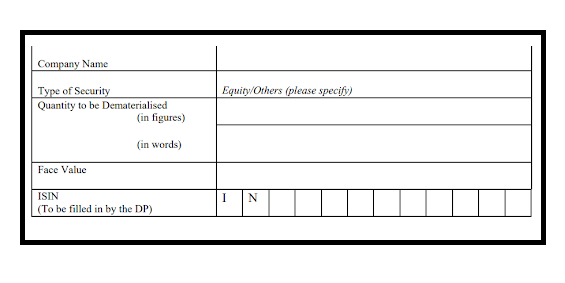

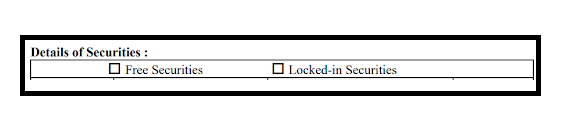

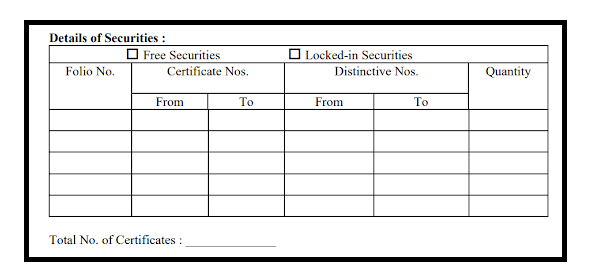

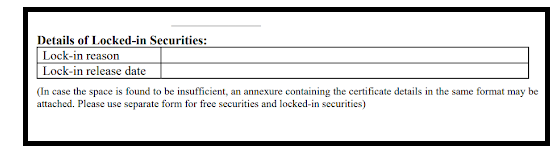

You must fill out a Demat Request Form, also known as the DRF form, in order to start the process of converting your paper share certificates into an electronic format or moving your shares across Demat accounts.

We will go into the specifics of what a DRF is, its types, and how to fill it out appropriately in this article.

More About Demat Account

- How to Check Your Demat Account Status

- What is Demat Debit and Pledge Instruction(DDPI)?

- Loan Against Shares

- How to Find Demat Account Number from PAN

- How to fill a Dematerialisation Request Form

- Dematerialization of Shares: Process and Benefits

- What Is DP ID In The Demat Account

- What Is Dematerialization of Shares?

- What Is a Demat Account Holding Statement?

- Low Brokerage Charges in India

- How to Choose Right Demat Account – Key Factors & Tips

- Do we need a Demat Account for Mutual Funds?

- Aims and Objectives of Demat Account

- What is BO ID?

- What is a bonus share?

- How to Close a Demat Account

- How to Open Demat Account Without Aadhaar Card

- Open Demat Account Without A PAN Card - A Complete Guide

- Myths & Facts about Demat Account

- What is Collateral Amount in Demat Account?

- What Are DP Charges?

- How to Link Aadhaar Number With Demat Account?

- How to Convert Demat to BSDA?

- Dos and Don'ts of Demat Account

- Difference between NSDL and CDSL

- Advantages and Disadvantages of Opening a Demat Account

- Loan Against Demat Shares- 5 Things to know

- What is NSDL Demat Account?

- NRI Demat Account Opening Process

- What is a Basic Service Demat Account?

- How to Transfer Money from Demat Account to Bank Account

- How to Find Demat Account Number?

- How to Buy Shares through Demat Account?

- How many Demat Accounts one can have?

- Demat Account Charges Explained

- Eligibility to Open a Demat Account

- How to Transfer Shares from One Demat Account to Another?

- Types of Demat Account in India

- Dematerialisation & Rematerialisation: Meaning and Process

- Difference between Demat and Trading Account

- How to add nominee in Demat Account - A Guide

- How To Use Demat Account? - An Overview

- Benefits of a Demat Account

- Documents Required to Open a Demat Account

- How to Open Demat Account Online?

- What is Demat Account? Read More

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Frequently Asked Questions

A Demat account stores your shares and investments electronically, while a trading account lets you buy and sell those shares. Think of the Demat account as a storage space and the trading account as the tool for making transactions.

Yes, many service providers let you submit the Dematerialisation Request Form (DRF) online. It’s best to check with your provider for their specific process.

Yes, a small fee is charged to convert physical shares into electronic form. The fee depends on the number of shares you're converting.

It usually takes about 15 to 30 days to complete the dematerialisation process once you submit the DRF form.

Yes, you can convert jointly held shares. Just make sure that all the joint holders sign the DRF form and provide the required details.