Available modes of transferring funds to your 5paisa Account:

Below mentioned are the modes of transferring funds to your 5paisa Account:

UPI Apps:

By using 5paisa’s App, transfer funds instantly from your mapped Bank A/c via any of the UPI Apps (GPay, PhonePe, BHIM, Paytm, etc.) installed on your same device.

UPI IDs:

By using 5paisa’s App or Web Platform, transfer funds instantly from your mapped Bank A/c via entering your UPI ID (VPA) & accepting the collect request received on your respective device where the UPI App is installed which is linked to that specific UPI ID.

UPI QR (For Web Only):

By using 5paisa's Web Platform, you can instantly transfer funds from your mapped bank account by selecting 'UPI QR' mode & scanning the QR Code shown on the Website.

- Note: UPI transfer has a limit of ₹2,00,000 per day. Still, your bank may have further restrictions on the amount per transaction that you will have to check with your banks. Also, few UPI Apps may have a limit of ₹1,00,000 per transaction.

Net Banking:

By using 5paisa’s App or Web Platform, transfer funds from your mapped Bank A/c via entering your Net Banking Credentials once redirected to the Bank’s Portal.

- Note: At 5paisa, Net Banking transfer limit is ₹25,00,00,000 per transaction. Still, your bank may have further restrictions on the amount per transaction that you will have to check with your banks or modify the same by going to the respective limits section on your Net Banking Portal. You will not be able to transfer funds if your daily bank limit has been exhausted.

- To view the list of Net Banking supported Banks, please refer to the below mentioned details.

IMPS / NEFT / RTGS:

By using 5paisa’s App or Web Platform, fetch the Beneficiary Account Number & register the same on your Net Banking Portal so as to transfer the funds directly from your Bank A/c to 5paisa’s Bank A/c via IMPS / NEFT / RTGS.

- Note: At 5paisa, NEFT / RTGS transfer limit is ₹30,00,00,000. For IMPS there is a limit of ₹2,00,000 to ₹5,00,000 depending on the banks.

- Click here to view the Beneficiary Details of 5paisa.

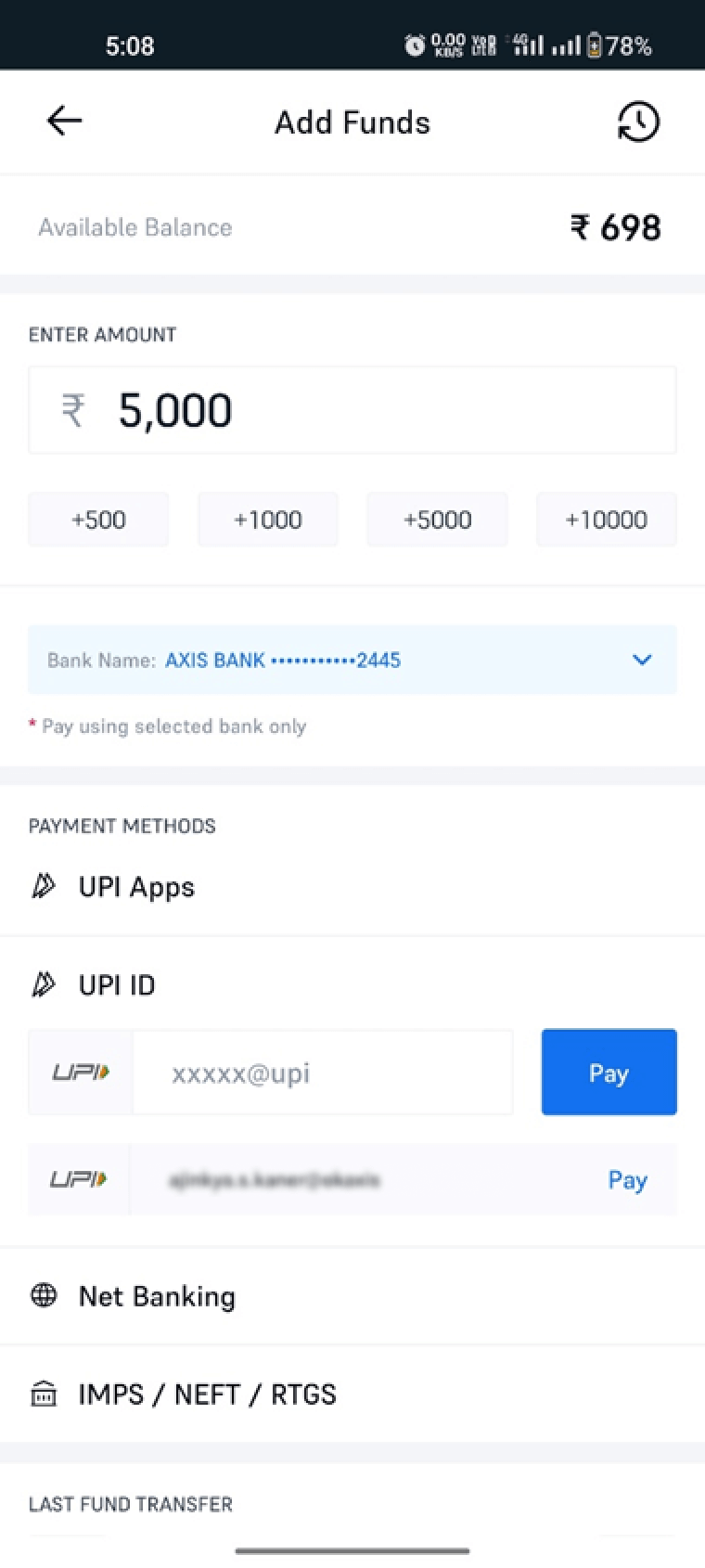

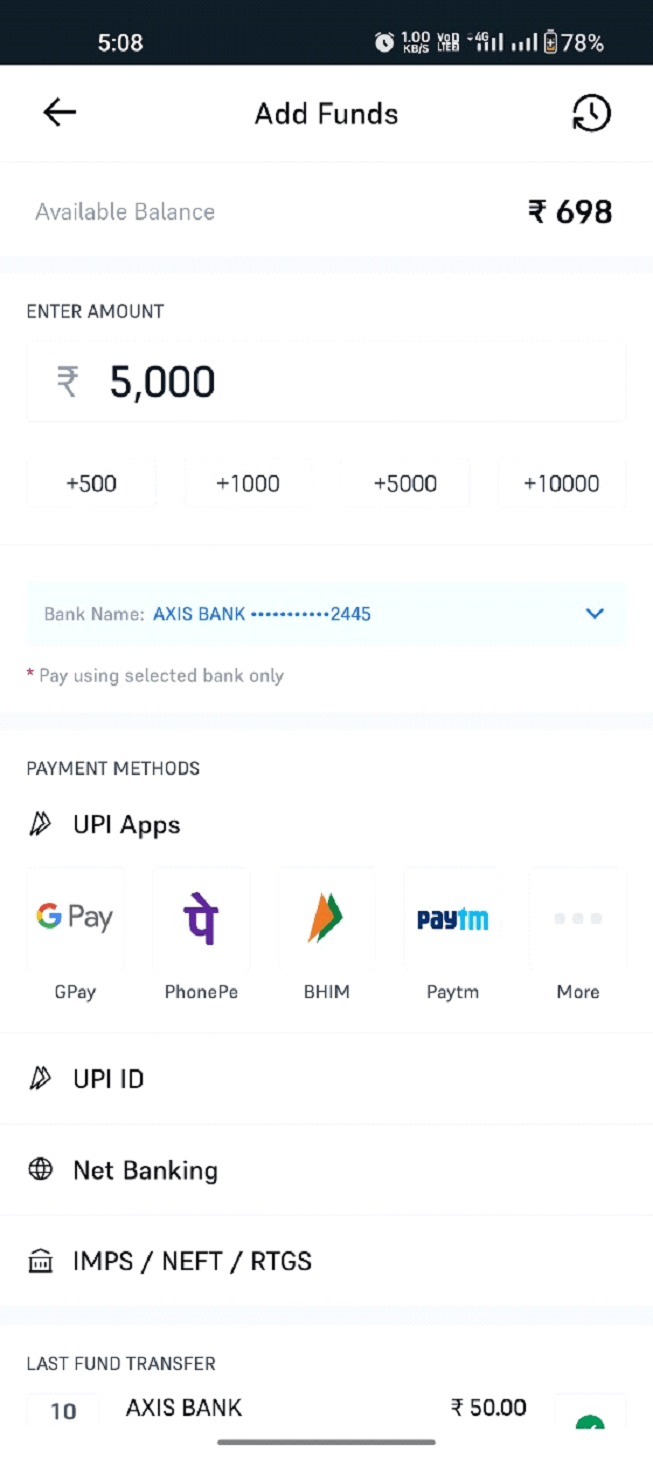

Steps to Transfer funds using ‘UPI Apps’:

You can quickly transfer funds using the widely used UPI method with instant credit. To transfer funds through UPI Apps, follow these simple steps:

- Log in to the 5paisa Mobile App.

- Click on the 'User' option and select 'Add Funds.'

- Enter the amount you wish to transfer and choose the bank account you want to pay with.

- Click on the UPI App you wish to use for payment. You can browse all UPI-supported apps on your phone by clicking on 'More.'

- NOTE: Choose the same Bank A/c in the UPI App that you will be selecting in the 5paisa App while doing the transaction.

Complete your transaction as per the instructions on the UPI App. Please refer to the screenshot below for further assistance.

NOTE - Please refer to the list of supported banks for UPI Payment Mode at the bottom of the page.

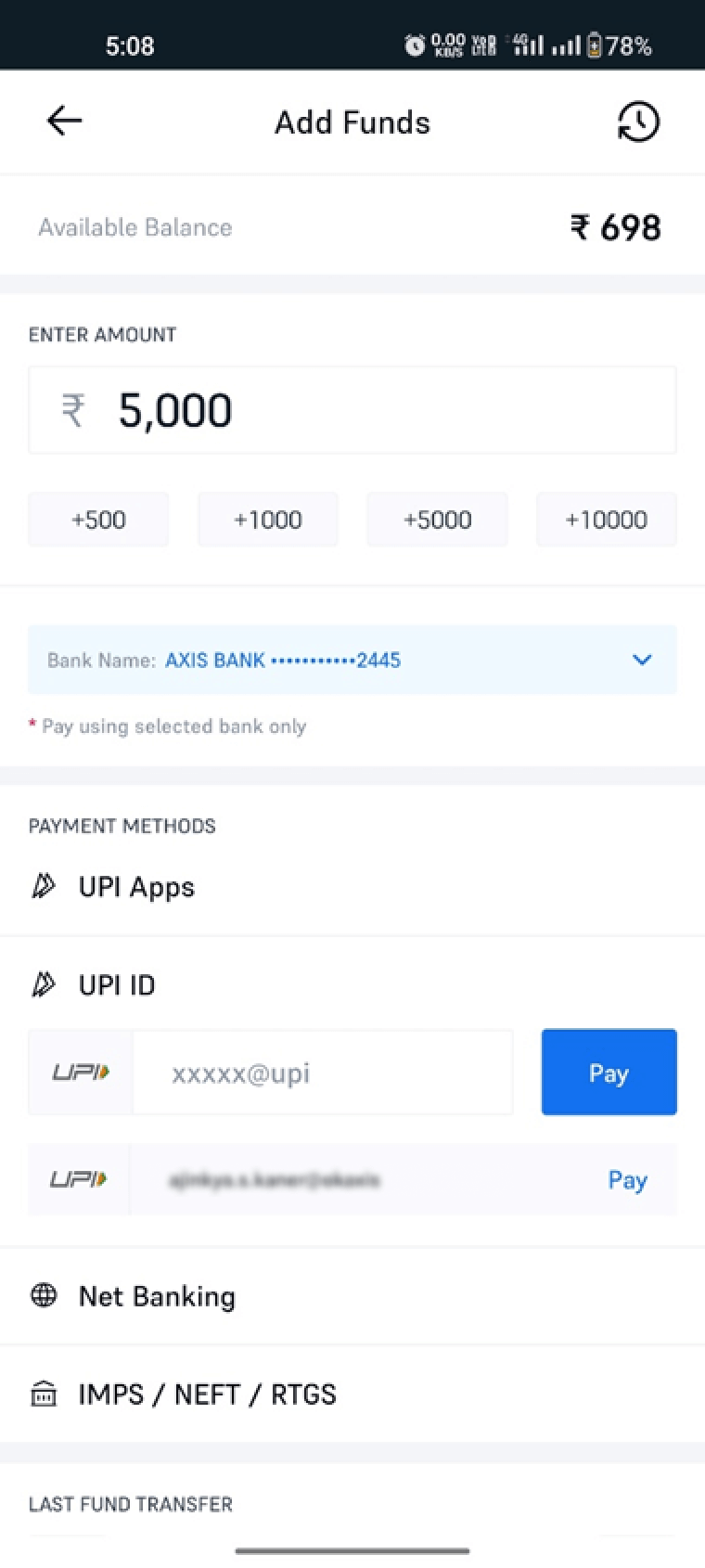

Steps to transfer funds using ‘UPI ID’:

You can quickly transfer funds using the widely used UPI method with instant credit. To transfer funds through UPI ID, follow these simple steps:

- NOTE: You can use these steps for transferring funds via UPI mode if you don't have the UPI App installed in the same mobile

funds through UPI using a UPI ID that is not linked to the same mobile.

If you don't have the UPI ID linked to the same mobile, you can still transfer funds by following these steps:

- Log in to the 5paisa Mobile App.

- Click on the 'User' option and select 'Add Funds.'

- Enter the amount you wish to transfer and choose the bank account you want to pay with.

- Click on 'UPI ID' and enter the UPI ID you want to make the payment to.

- Click on 'Pay.' You will receive a collect request from 5paisa on your UPI app.

- Enter your UPI PIN to complete the transaction.

Notes:

- UPI transfers are subject to a daily limit of ₹2,00,000/-. However, your bank may have additional restrictions on the maximum amount allowed per transaction, so we advise you to check with your bank beforehand.

- If you receive a UPI collection request from 5paisa, please make sure to approve the transaction within 10 minutes, as the request will expire after that. If you fail to approve it within the stipulated time, the request will be marked as expired.

- To avoid any delays or refund issues, please ensure that the UPI ID (VPA) you are paying with is linked to the bank account registered with 5paisa. Any funds transferred using an unregistered bank account will be refunded back to the source account within 5-7 working days.

- Please note that push transactions to our UPI ID are not allowed. Only transactions initiated from 5paisa will be accepted. Therefore, you should not send money directly to our UPI ID.

Fund Updation Time:

When you transfer funds to your trading account, the funds are usually updated instantly. However, in certain scenarios, there may be delays in fund updation. Here are some common scenarios and what you can expect:

Scenario 1: You transfer funds from a bank account that is not registered with 5paisa.If the transfer is successful, the funds will be refunded to your account instantly (in most cases) or within 48-72 hours.

Scenario 2: Your payment is successful, but 5paisa shows the transaction as failed. This could happen if your bank has not confirmed the debit transaction with NPCI. In this case, the transaction will be marked as pending at 5paisa until it is confirmed by your bank. Typically, such transactions are reconfirmed within 15-30 minutes. If the transaction ultimately fails, the bank will refund the amount back to your account within 48-72 hours. Once the transaction is confirmed, 5paisa will update your trading account instantly.

Scenario 3: Your payment fails, and the amount is debited from your account, and 5paisa also shows the transaction as failed. What happens: In this case, your money will be credited back to your account within 48-72 hours. You can also check with your bank for more information on when the refund will be processed.

Note - Please refer to the list of supported banks for UPI Payment Mode at the bottom of the page.

Steps to transfer funds using ‘Net Banking’:

To transfer funds using this method, you must have an activated net banking facility. 5paisa offers a payment gateway for the following banks. Please refer to the list below to check if your bank is supported:

Here's a step-by-step guide on how to transfer funds from your bank account using Net banking to your 5paisa trading account:

- Open the 5paisa mobile app and log in.

- Go to the "User" tab and select "Add Funds".

- Enter the amount you wish to transfer.

- Click on the "Net banking" option.

- You will be redirected to your bank's website.

- Log in to your net banking account using your bank credentials.

- Authorize the transaction to complete it.

- The amount will be credited to your 5paisa trading account.

If you choose to transfer funds via Net Banking using our Payment Gateway, please note that the following transaction charges will apply:

| Charges | Basic Plan |

|---|---|

| Net Banking- Pay In | ₹10 |

While transferring funds using net banking, the transaction status is usually confirmed in real-time, and the funds are updated in your 5paisa trading account immediately. However, there are some scenarios where you may experience a delay in the fund updation process.

Scenario 1: If your transaction was successful, and the amount was debited from your bank account, but the 5paisa transaction status shows as "failure," it may be due to an issue at the bank's server end. Your bank will reconcile such transactions on the next working day and update the transaction status to success or refund the amount back to your account. In such a scenario, it may take 48-72 hours for the funds to be updated in your trading account, depending on your bank's reconciliation process.

Scenario 2: : If your transaction was successful, but the funds are not updated in your trading account, it may be because your bank has delayed confirming the transaction, and 5paisa has received the transaction status as pending from your bank. Such transactions are usually confirmed by your bank in 45-60 minutes after active reconciliation. In this scenario, it may take 45-60 minutes for the funds to be updated in your trading account.

For all other unusual scenarios, it usually takes 15-30 minutes for the funds to be updated in your trading account.

Note - Please refer to the list of supported banks for UPI Payment Mode at the bottom of the page. If your registered bank is not in that list, you can transfer the funds through other methods.

Steps to transferring funds using IMPS/NEFT/RTGS:

You can easily transfer funds from your bank account to your trading account with 5paisa by following these simple steps. There is no need for any documentation, and the transfer is instant, available 24/7.

To initiate the fund transfer process to your 5paisa trading account, follow the below steps:

- Login to your 5paisa account through the website or mobile app.

- Go to the "Add Funds" section available in the User option.

- Select the "IMPS/NEFT/RTGS" tab.

- Note down your unique account number displayed on the screen.

- Initiate an IMPS/NEFT/RTGS transfer from your bank account using the unique account number as the beneficiary account number.

- Your funds will be instantly credited to your 5paisa trading account.

To fetch your Unique Account Number: Click Here

Note:

Please note that your account is unique to your client code and should not be shared with anyone else. To ensure a smooth transaction, please transfer funds from your registered bank account that is mapped with 5paisa. If funds are transferred from an unregistered bank account, they will be refunded back to the source account within 5-7 days.

It's important to keep in mind that the maximum limit for fund transfer via Smart Collect is Rs.30 Cr. per transaction.

To add 5paisa as a beneficiary in your bank account, please follow these steps:

- Log in to your bank's website or mobile app using your credentials.

- Look for the "Funds Transfer" option and click on it.

- Select "Add Beneficiary."

- Enter the beneficiary name, account number, and IFSC code provided by 5paisa.

- Select "SAVINGS" as the account type if it is required by your bank.

- Select "CORPORATE OFFICE” as the Branch Name if it is required by your bank

Note: If you are unable to find this facility in your bank account, please contact your bank or visit a branch to transfer funds.

Additional Details of the Account Type & Branch Name:

| IFSC Code | Bank Name | Account Type | Branch Name | Address |

|---|---|---|---|---|

| UTIB0CCH274 | Axis Bank | Savings | Centralised Collection Hub | 5th Floor, Gigaplex, Airoli Knowledge Park, Airoli , Mumbai, Maharashtra |

Funds updation time:

Please note that funds updation may take up to 15 minutes depending on your bank's transaction processing time. Typically, transfers made through IMPS are updated quickly, while transfers made through NEFT/RTGS may take longer to be updated i.e., a few hours depending on processing time of the Bank. For faster updates, we suggest using IMPS.

If your funds pay-in transaction is not successfully updated in the ledger within the mentioned timeframe, please send an email to support@5paisa.com with your client code, transaction proof (including transaction reference), and bank statement.

We request you to start using 'Smart Collect' as a preferred mode for adding funds via IMPS/NEFT/RTGS as we have discontinued the ICICI Bank E-collection Account (FPAISA) effective from 10th Oct 2022 & YES Bank E-collection Account (5PAISA) effective from 30th Jun 2023.

Funds transferred to any of these two E-collect Accounts, shall be auto-refunded within 3-5 working days.

For any further clarification, you can submit your query HERE

Steps to check the status of your payment:

To check the status of your payment update, please follow these steps:

On the Mobile Platform:

- Login to your 5paisa account.

- Click on the "User" tab.

- Click on "Net Available Margin".

- From there, you can access your Funds or Ledger section.

- Also, you can refer to the “History Section” from the top right icon of Add Funds Page to get all the details of the last 30 transactions

On the Website Platform:

- Login to your account on the 5paisa website.

- On the left-hand side menu, click on "Funds & Ledger."

- This will take you to the funds and ledger section, where you can view your account balance

- Also, you can refer to the “History Section” from the top right icon of Add Funds Page to get all the details of the last 30 transactions

These steps will help you access the relevant page where you can check the status of your payment update.

NOTE:

Please note that funds should only be transferred to 5paisa Capital Limited through the web portal or mobile app, or by transferring funds to the bank accounts held in the company's name, as provided on the company's website. Do not transfer funds to any personal accounts of any entities.

5paisa shall not be liable for any transfer of funds made to personal accounts or any other account other than the modes prescribed on the website. Please ensure that you transfer funds only through the prescribed modes to avoid any inconvenience.

List of Banks supporting the NET BANKING Payment Mode:

| Sr. No. | Bank Name |

|---|---|

| 1 | ANDHRA BANK |

| 2 | AU SMALL FINANCE BANK LIMITED |

| 3 | AXIS BANK |

| 4 | BANK OF BARODA |

| 5 | BANK OF INDIA |

| 6 | BANK OF MAHARASHTRA |

| 7 | CANARA BANK |

| 8 | CATHOLIC SYRIAN BANK LIMITED |

| 9 | CITY UNION BANK LIMITED |

| 10 | CORPORATION BANK |

| 11 | DCB BANK LIMITED |

| 12 | DEUTSCHE BANK |

| 13 | DHANALAKSHMI BANK |

| 14 | EQUITAS SMALL FINANCE BANK LIMITED |

| 15 | FEDERAL BANK |

| 16 | HDFC BANK |

| 17 | ICICI BANK LIMITED |

| 18 | IDBI BANK |

| 19 | IDFC BANK LIMITED |

| 20 | IDFC FIRST BANK |

| 21 | INDIAN BANK |

| 22 | INDIAN OVERSEAS BANK |

| 23 | INDUSIND BANK |

| 24 | JAMMU AND KASHMIR BANK LIMITED |

| 25 | KARNATAKA BANK LIMITED |

| 26 | KARUR VYSYA BANK |

| 27 | KOTAK MAHINDRA BANK |

| 28 | LAXMI VILAS BANK |

| 29 | ORIENTAL BANK OF COMMERCE |

| 30 | PUNJAB NATIONAL BANK |

| 31 | RBL Bank |

| 32 | SARASWAT CO OP BANK LTD |

| 33 | SOUTH INDIAN BANK |

| 34 | STANDARD CHARTERED BANK |

| 35 | STATE BANK OF BIKANER AND JAIPUR |

| 36 | STATE BANK OF HYDERABAD |

| 37 | STATE BANK OF INDIA |

| 38 | STATE BANK OF MYSORE |

| 39 | STATE BANK OF PATIALA |

| 40 | STATE BANK OF TRAVANCORE |

| 41 | TAMILNAD MERCANTILE BANK LIMITED |

| 42 | UCO BANK |

| 43 | UNION BANK OF INDIA |

| 44 | UNITED BANK OF INDIA |

| 45 | YES BANK |

List of Banks supporting the UPI Payment Mode:

| Sr. No. | Bank Name |

|---|---|

| 1 | A. P Mahesh Bank |

| 2 | Abhyudaya Co-op Bank |

| 3 | Adarsh Cooperative Bank Ltd |

| 4 | Ahmedabad Mercanatile Co-op Bank |

| 5 | Airtel Payments Bank |

| 6 | Allahabad Bank |

| 7 | Andhra Bank |

| 8 | Andhra Pragathi Grameena Bank |

| 9 | Andhra Pragathi Grameena Vikas Bank |

| 10 | Apna Sahakari Bank |

| 11 | Assam Gramin VIkash Bank |

| 12 | Associate Co-operative Bank Limited,Surat |

| 13 | AU Small Finance Bank |

| 14 | Axis Bank |

| 15 | Banaskantha Mercantile Co-operative Bank Limited |

| 16 | Bandhan Bank |

| 17 | Bank of America |

| 18 | Bank Of Baroda |

| 19 | Bank Of India |

| 20 | Bank of Maharashtra |

| 21 | Baroda Central Co-operative Bank |

| 22 | Baroda Gujarat Gramin Bank |

| 23 | Baroda Rajasthan Khetriya Gramin Bank |

| 24 | Baroda Uttar Pradesh Gramin Bank |

| 25 | Bassein Catholic Coop Bank |

| 26 | Bhagini Nivedita Sahakari Bank Ltd,Pune |

| 27 | Bharat Co-operative Bank |

| 28 | Bhilwara Urban Co-operative Bank Ltd |

| 29 | Canara Bank |

| 30 | Capital Small Finance Bank |

| 31 | Catholic Syrian Bank |

| 32 | Central Bank of india |

| 33 | Chaitanya Godavari Grameena Bank |

| 34 | Chartered Sahakari Bank Niyamitha |

| 35 | Chhattisgarh Rajya Gramin Bank |

| 36 | Citibank Retail |

| 37 | Citizen Co-operative Bank Ltd - Noida |

| 38 | Citizens Co-operative Bank Ltd. |

| 39 | City Union Bank |

| 40 | Costal Local Area Bank Ltd |

| 41 | Dakshin Bihar Gramin Bank |

| 42 | DBS Digi Bank |

| 43 | DCB Bank |

| 44 | Dena Bank |

| 45 | Dena Gujarat Gramin Bank |

| 46 | Deutsche Bank AG |

| 47 | Dhanalaxmi bank |

| 48 | Dombivli Nagrik Sahakari Bank |

| 49 | Equitas Small Finance Bank |

| 50 | ESAF Small Finance Bank |

| 51 | Federal Bank |

| 52 | Fincare Small Finance Bank |

| 53 | Fingrowth Co-operative Bank Ltd |

| 54 | FINO Payments Bank |

| 55 | Gopinath Patil Parsik Janata Sahakari Bank |

| 56 | HDFC |

| 57 | Himachal Pradesh Gramin Bank |

| 58 | HSBC |

| 59 | Hutatma Sahakari Bank Ltd |

| 60 | ICICI Bank |

| 61 | IDBI Bank |

| 62 | IDFC |

| 63 | India Post Payment Bank |

| 64 | Indian Bank |

| 65 | Indian Overseas Bank |

| 66 | Indore Paraspar Sahakari Bank Ltd |

| 67 | IndusInd Bank |

| 68 | Irinjalakuda Town Co-Operative Bank Ltd |

| 69 | J & K Grameen Bank |

| 70 | Jalgaona Janata Sahkari Bank |

| 71 | Jalna Merchant's Co-operative Bank Ltd. |

| 72 | Jammu & Kashmir Bank |

| 73 | Jana Small Finance Bank |

| 74 | Janakalyan Sahakari Bank |

| 75 | Janaseva Sahakari Bank Ltd Pune |

| 76 | Janaseva Sahakari Bank (Borivli) LTD |

| 77 | Janta Sahakari Bank Pune |

| 78 | Jio Payments Bank |

| 79 | Jivan Commercial co-operative Bank Ltd. |

| 80 | Kallappanna Awade Ichalkaranji Janata Sahakari Bank Ltd. |

| 81 | Kalupur Commercial Co-operative Bank |

| 82 | Karnataka Bank |

| 83 | Karnataka vikas Gramin Bank |

| 84 | Karur Vysaya Bank |

| 85 | Kashi Gomti Samyut Gramin Bank |

| 86 | Kerala Gramin Bank |

| 87 | Konkan Merchantile Co-Operative Bank Ltd |

| 88 | Kolhapur District Central Co-operative Bank Limited |

| 89 | Kotak Mahindra Bank |

| 90 | Krishna Bhima Samruddhi Local Area Bank |

| 91 | Maharashtra Grameen Bank |

| 92 | Maharashtra state co opp Bank |

| 93 | Malad Sahakari Bank |

| 94 | Malviya Urban Co-operative Bank Limited |

| 95 | Manipur Rural Bank |

| 96 | Manvi Pattana Souharda Sahakari Bank |

| 97 | Maratha Cooprative Bank Ltd |

| 98 | Meghalaya Rural Bank |

| 99 | Mizoram Rural Bank |

| 100 | Model Co-operative Bank Limited |

| 101 | Nagarik Sahakari Bank Maryadit, Vidisha |

| 102 | Nanital Bank Ltd |

| 103 | NKGSB |

| 104 | North East Small Finance Bank |

| 105 | NSDL Payments Bank |

| 106 | Nutan Nagrik Sahakari Bank |

| 107 | Pali Urban Co-operative Bank Ltd. |

| 108 | Paschim Banga Gramin Bank |

| 109 | Patan Nagrik Sahakari Bank Ltd |

| 110 | Paytm Payments Bank |

| 111 | Pragathi Krishna Gramin Bank |

| 112 | Prathama Bank |

| 113 | Prime Co-operative Bank Ltd. |

| 114 | Priyadarshini Nagari Sahakari Bank Ltd. |

| 115 | Pune Cantonment Sahakari Bank Ltd |

| 116 | Punjab and Maharastra Co. bank |

| 117 | Punjab and Sind Bank |

| 118 | Punjab Gramin Bank |

| 119 | Punjab National Bank |

| 120 | Rajasthan Marudhara Gramin Bank |

| 121 | Rajkot Nagari Sahakari Bank Ltd |

| 122 | Rani Channamma Mahila Sahakari Bank Belagavi |

| 123 | Samarth Sahakari Bank Limited |

| 124 | Samruddhi Co-op bank ltd |

| 125 | Sandue Pattana Souharda Sahakari Bank |

| 126 | Sarva Haryana Gramin Bank |

| 127 | Sarva UP Gramin Bank |

| 128 | Sarvodaya Commercial Co-operative Bank |

| 129 | Saurashtra Gramin Bank |

| 130 | SBM BANK (INDIA) LIMITED |

| 131 | Shivalik Mercantile Co-op. Bank Ltd. |

| 132 | Shree Dharati Co-operative Bank Ltd. |

| 133 | Shree Kadi Nagarik Sahakari Bank Ltd |

| 134 | Shri Arihant Co-operative Bank Ltd. |

| 135 | Shri Basaveshwar Sahakari Bank Niyamit, Bagalkot |

| 136 | Shri Chhatrapathi Rajarsshi Shahu Bank |

| 137 | Shri Mahila Sewa Sahakari Bank Limited |

| 138 | Shri Rajkot District Co-operative Bank Ltd |

| 139 | Shri Veershaiv Co-op Bank Ltd. |

| 140 | Sindhudurg Co-operative Bank |

| 141 | Smriti Nagrik Sahakari Bank Maryadit, Mandsaur |

| 142 | South Indian Bank |

| 143 | Sri Vasavamba Cooperative Bank Ltd |

| 144 | Standard Chartered |

| 145 | State Bank Of India |

| 146 | Sterling Urban Co-operative Bank Ltd |

| 147 | Suco Souharda Sahakari bank |

| 148 | Surat People Cooperative Bank |

| 149 | Suryoday Small Finance Bank Ltd |

| 150 | Sutex Co operative Bank |

| 151 | Suvarnayug Sahakari Bank Ltd |

| 152 | SVC Co-operative Bank |

| 153 | Syndicate Bank |

| 154 | Tamilnad Mercantile Bank |

| 155 | Telangana Gramin Bank |