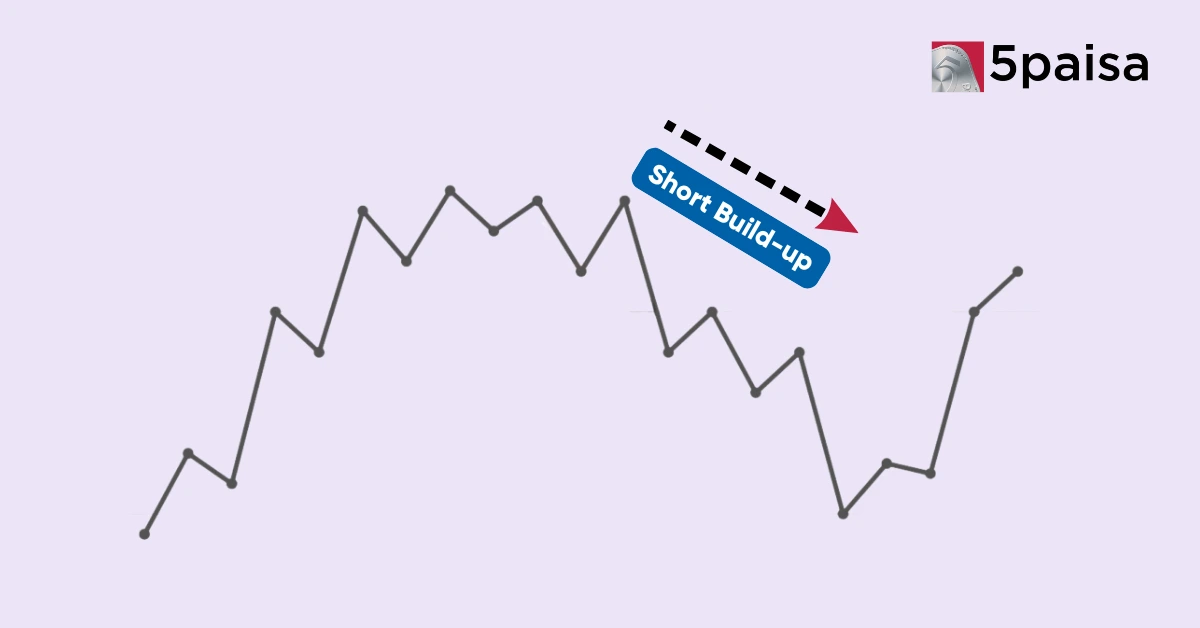

Short Build Up in Options: A Trend to Follow or Avoid?

Top Robo Advisory Myths Busted

The concept of robo advisory has gained momentum over the last couple of years and it has been termed as a popular alternative to traditional financial advisors. However, there are some misconceptions that common people have about robo-advisors.

Here are some robo-advisor myths:

Robo-Advisors are only for young

A lot of people have this misconception that robo-advisors are suitable only for the young who are aged between 23-30. As robo-advisors use advanced technology, there is a delusion that it is suitable for tech-savvy and gadget-loving individuals. However, the truth is that the average age of people who use robo-advisory as a method of investment across the world is 40.

Robo-advisors will replace humans

A larger section of the society thinks that robo-advisors will replace humans in the near future. However, this is not possible as there are people who want control of their own money and want to sit down with their financial planner and discuss each investment personally. This is a human behaviour which will not change easily. So, there are always going to be people who would want to be in charge of their own money, for which a traditional financial platform will be required.

Robo-advisors use pre-constructed portfolios

While a lot of people are under the misconception that robo-advisors use pre-constructed portfolios in order to generate their results, the fact is that robo-advisors construct a personalised portfolio for their clients based on their needs. A robo-advisor generates results based on the client’s risk appetite and financial goals. Robo-advisors show you real-time results based on all the information you provide.

Robo-advisors are riskier

As far as robo-advisory is concerned, a lot of people are under the myth that it is risky and not secure. However, not many know that robo-advisors are regulated and compliance is enforced. All the information that an individual provides is secure as robo-advisors use bank-level security measures to keep a client’s data safe.

With 5paisa, experience 100% automated personalised solutions for both your insurance (Insurance Advisor) and mutual fund (Auto Investor) needs. Just answer a set of very simple questions, and our automated results will suggest the best portfolio that suits your needs.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

5paisa Research Team

5paisa Research Team