Content

- Fundamental or Technical - Which Analysis is Better?

- Fundamental Analysis vs Technical Analysis- The power of mixing the two

- Use both fundamental and technical analysis to make the best investment decisions

- Fundamental drivers of price- The Basics of Fundamental and Technical Analysis

- Value of technical indicators- The Basics of Fundamental and Technical Analysis

- Technical Analysis or Fundamental Analysis, which is better?

- Wrapping Up

Fundamental or Technical - Which Analysis is Better?

Fundamental analysis is based on evaluating economic factors such as the price of a company's assets, its sales and profit record and its dividend payout ratio.

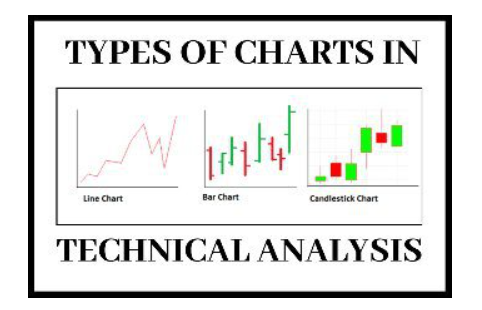

Technical analysis is based on charting and other mathematical techniques used to evaluate the stock's price movements.

We will attempt to answer in this article: which type of analysis is better?

More Articles to Explore

- Difference between NSDL and CDSL

- Lowest brokerage charges in India for online trading

- How to find your demat account number using PAN card

- What are bonus shares and how do they work?

- How to transfer shares from one demat account to another?

- What is BO ID?

- Open demat account without a PAN card - a complete guide

- What are DP charges?

- What is DP ID in a demat account

- How to transfer money from demat account to bank account

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.