Which small cap stocks have attracted FIIs the most?

Last Updated: 8th December 2022 - 10:22 pm

Foreign institutional investors and foreign portfolio investors have historically dictated the movement of Indian stock markets. However, with the rising flow of domestic money in the local bourses, especially after the 2016 demonetisation drive and asset prices getting punctured in the real estate market, this is slowly changing.

Indeed, a lot of the current froth in the market where the top benchmark indices are trading near their all-time highs is attributed to the domestic investors—both mutual funds and retail investors.

One segment of the stock market that is usually seen as a haven for punters looking to make a quick buck with trading opportunities and retail investors who get attracted by lower per share price is the small cap space. These are companies with a market capitalisation of less than Rs 5,000 crore.

This segment tends to have a high beta and usually swings much more in a volatile market condition.

Offshore investors usually don’t play in this segment as most of these stocks tend to be below their investment mandate radar. But that doesn’t exclude FII/FPI participation wholly from such stocks.

In fact, many investors and analysts try to fish for hidden gems that can be a mid-cap or even a large cap over the medium to long term.

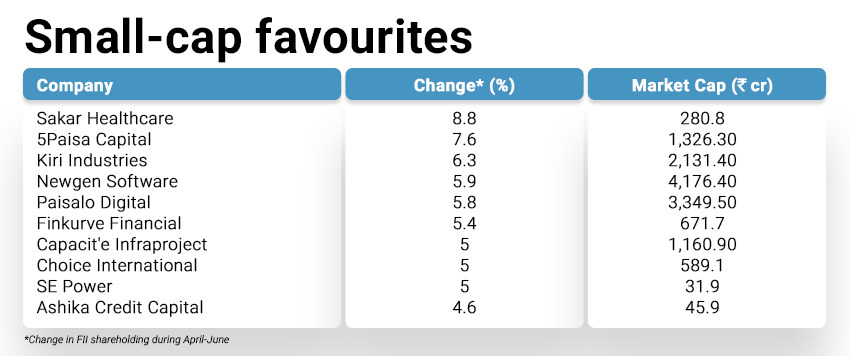

We dived into the data for the April-June quarter and spotted over 100 small-cap stocks where FIIs or FPIs increased their stake by at least 0.6 percentage points during the three months.

Top small caps

FIIs increased their stake in ten small cap stocks by at least four percentage points last quarter. Barring two stocks, all the others command a market cap of Rs 500 crore or more.

At the top of the heap is Sakar Healthcare, a drugmaker based in Ahmedabad that saw FIIs pull up their stake by as much as 8.8%. However, this wasn’t because of a horde of portfolio investors buying the stock but due to a single FPI, Cobra India (Mauritius), buying a stake via a preferential allotment. This entity is associated with Swiss healthcare investor HBM.

Stock brokerage firm 5Paisa Capital, the parent of this website, is another notable name that attracted FII interest with their holding rising 7.6%. During the quarter the company attracted two more FII shareholders to take the number of such investors to eight. Of the existing four key FPIs, WF Asian Reconnaissance Fund Ltd, in particular, pulled up its holding. An entity associated with Canada’s Fairfax also bought additional shares.

Chemical producer Kiri Industries, tech firm Newgen Software, construction company Capacit’e Infraprojects and power solutions company SE Power were the other firms where the FII stake went up 4% or more last quarter.

The financial services sector, in particular, was a hot draw with four companies making the cut in this list.

These were Ashika Credit, Choice International, financial and remittance services firm Finkurve, which operates under the Arvog brand, and lender Paisalo Digital, which is trying to reinvent itself as a fintech firm.

Other small caps on FII radar

In addition, FIIs or FPIs were stoked about a bunch of other small-cap stocks and hiked their stake by 2-4% in around 20 such companies.

These include some well-known companies such as JK Tyre & Industries, Dhampur Sugar Mills, Rupa & Company, Bajaj Consumer Care, Raymond, Shalby, Hind Rectifiers, Hathway Cable, JSW Ispat and NRB Bearings.

Other small caps in this list include Ritesh Properties, Hindustan Everest, Karda Constructions, Dhanvarsha Finvest, Orient Cement, Seamec, PTC India, Visaka Industries, Gujarat State Fertilizers and Shakti Pumps.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team