NAPS Global India IPO: Listing, Performance, and Analysis

What you must know about Bansal Wire Industries IPO?

About Bansal Wire Industries Ltd

Bansal Wire Industries Ltd was incorporated in the year as a stainless steel wire manufacturing company. Bansal Wire Industries Ltd principally operates in 3 verticals viz., high carbon steel wire, low carbon steel wire, and stainless steel wire. In its current product portfolio, Bansal Wire Industries Ltd manufactures more than 3,000 different types of steel wire products, ranging across length and thickness; and often times it is also customized to the unique needs of the customers. The company has more than 5,000 customers in different industries, which helps the company to grow. The company also has a flexible pricing structure such that the prices are dynamically fixed depending on the input cost pressures exerted by the raw materials. Apart from a strong presence in India, Bansal Wire Industries Ltd also has a presence in more than 50 countries globally, which it caters through the export route. Over the years, Bansal Wire Industries Ltd has emerged as a key player in the global market in the supply of various grades of stainless steel wires.

Some of the major sectors that the company supplies wires to include the automotive sector, hardware, agriculture, general engineering, consumer durables, auto ancillaries, infrastructure, as well as to the power and transmission sector. Bansal Wire Industries Ltd is the largest stainless steel wire manufacturing company in India and also the second largest steel wire manufacturing company by volume. Bansal Wire Industries Ltd has a production capacity of 72,176 metric tonnes per annum (MTPA) of stainless steel wires and a capacity of 2,06,466 MTPA in steel wires. Bansal Wire Industries has a 20% market share in stainless steel wires in India while its market share in steel wires is at 4%. The business model of the company is de-risked in the sense that; no single customer accounts for more than 5% of sales, and no individual sector or segment constitutes more than 25% of sales. This ensures that the sales and profits of the company are not too vulnerable to specific product or industry life cycles.

The IPO entirely comprises only of a fresh issue or shares. The fresh funds will be used for repaying / prepaying some of its outstanding debts and also the debt of its subsidiary companies. In addition, the funds will also be applied towards working capital needs and also partially for general corporate purposes. The promoters of the company are Arun Gupta, Anita Gupta, Pranav Bansal, and Arun Kumar Gupta HUF. The promoters currently have 95.78% stake in the company, which will get diluted post the IPO to 77.98%. The IPO will be lead managed by SBI Capital Markets and DAM Capital Advisors (formerly IDFC Securities) ; while KFIN Technologies Ltd will be the IPO registrar.

Highlights of Bansal Wire Industries Ltd IPO

Here are the key highlights of the public issue of the Bansal Wire Industries Ltd IPO:

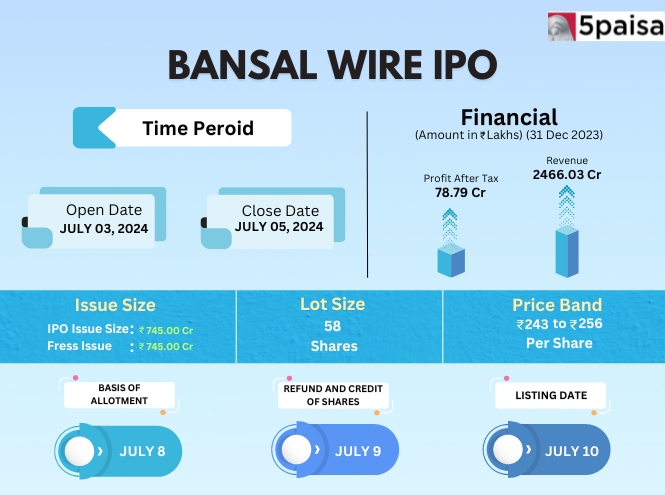

• The IPO of Bansal Wire Industries Ltd will be open from July 03rd, 2024 to July 05th, 2024; both days inclusive. The stock of Bansal Wire Industries Ltd has a face value of ₹5 per share and the price band for the book building IPO has been set in the range of ₹243 to ₹256 per share.

• The IPO of Bansal Wire Industries Ltd will be purely a fresh issue of shares with no offer for sale (OFS) component. The fresh issue brings in fresh funds into the company, but is also EPS and equity dilutive. The OFS is just a transfer of ownership; and hence neither EPS nor equity dilutive.

• The fresh issue portion of the IPO of Bansal Wire Industries Ltd comprises the issue of 2,91,01,562 shares (291.02 lakh shares approximately), which at the upper price band of ₹256 per share will translate into a fresh issue size of ₹745.00 crore.

• Since there is no offer for sale, the fresh issue will also double up as the overall size of the IPO. Therefore, the total IPO of Bansal Wire Industries Ltd will comprise of the fresh issue of 2,91,01,562 shares (291.02 lakh shares approximately) which at the upper end of the price band of ₹256 per share aggregates to total issue size of ₹745.00 crore.

Bansal Wire Industries IPO: Key Dates and Application Process

The IPO of Bansal Wire Industries Ltd opens on Wednesday, 03rd July 2024 and closes on Friday, 05th July 2024. The Bansal Wire Industries Ltd IPO bid date is from 03rd July 2024 at 10.00 AM to 05th July 2024 at 5.00 PM. The Cut-off time for UPI Mandate confirmation is 5 PM on the issue closing day; which is 05th July 2024.

| Event | Tentative Date |

| Anchor Bidding and Allocation Date | 02nd July 2024 |

| IPO Open Date | 03rd July 2024 |

| IPO Close Date | 05th July 2024 |

| Basis of Allotment | 08th July 2024 |

| Refunds Initiation to Non-Allottees | 09th July 2024 |

| Credit of Shares to Demat Accounts | 09th July 2024 |

| List Date on NSE and BSE | 10th July 2024 |

Investors can apply either through their existing trading account or the ASBA application can be directly logged through the internet banking account. This can only be done through the authorized list of self-certified syndicate banks (SCSB). In an ASBA application, the requisite amount is only blocked at the time of application and the necessary amount is debited only on allotment. It must be noted that in ASBA applications, there is no refund concept. The total application amount is blocked under the ASBA (applications supported by blocked amounts) system. Once the allotment is finalized, only the amount is debited to the extent of the allotment made and the lien on the balance amount is automatically released in the bank account. The credit of shares to the demat account on July 09th 2024, will be visible to investors under the ISIN Code – (INE0B9K01025). This allocation to the demat account is only applicable to the extent of the allocation of shares and if no allocations are made in the IPO, then no credit would be visible in the demat account.

Bansal Wire Industries IPO: Promoter Holdings and Investor Allocation Quota

The promoters of the company are Arun Gupta, Anita Gupta, Pranav Bansal, and Arun Kumar Gupta HUF. The promoters currently have 95.78% stake in the company, which will get diluted post the IPO to 77.98%. As per the terms of the offer, not more than 50% of the net offer is reserved for the qualified institutional buyers (QIBs), while not less than 35% of the net offer size is reserved for the retail investors. The residual 15% is kept aside for the HNI / NII investors. The table below captures the allocation to various categories.

| Investor Category | Shares Allocated in the IPO |

| Employee Reservation | There is no allocation for employees in the RHP |

| Anchor Allocation | Will be carved out of the QIB Portion |

| QIB Shares Offered | 1,45,50,781 shares (50.00% of the total IPO offer size) |

| NII (HNI) Shares Offered | 43,65,234 shares (15.00% of the total IPO offer size) |

| Retail Shares Offered | 1,01,85,547 shares (35.00% of the total IPO offer size) |

| Total Shares Offered | 2,91,01,562 shares (100.00% of total IPO offer size) |

It may be noted here that the Net Offer above refers to the quantity net of employee and promoter quota, as indicated above. There is no specific dedicated employee quota of shares as indicated in the red herring prospectus (RHP). The anchor portion, will be carved out of the QIB portion and the QIB portion available to the public will be reduced proportionately.

Lot Sizes for Investing in the Bansal Wire Industries IPO

Lot size is the minimum number of shares that the investor has to put in as part of the IPO application. The lot size only applies for the IPO and once it is listed then it can be even traded in multiples of 1 shares since it is a mainboard issue. Investors in the IPO can only invest in minimum lot size and in multiples thereof. In the case of Bansal Wire Industries Ltd, the minimum lot size is 58 shares with upper band indicative value of ₹14,848. The table below captures the minimum and maximum lots sizes applicable for different categories of investors in the IPO of Bansal Wire Industries Ltd.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 94 | ₹24,064 |

| Retail (Max) | 13 | 1,786 | ₹4,57,984 |

| S-HNI (Min) | 14 | 1, 880 | ₹4,80,320 |

| S-HNI (Max) | 67 | 3,216 | ₹8,22,336 |

| B-HNI (Min) | 68 | 3,944 | ₹10,09,664 |

It may be noted here that for the B-HNI category and for the QIB (qualified institutional buyer) category, there are no upper limits applicable.

Financial Performance of Bansal Wire Industries Ltd

The table below captures the key financials of Bansal Wire Industries Ltd for the last 3 completed financial years.

| Particulars | FY24 | FY23 | FY22 |

|---|---|---|---|

| Net Revenues (₹ in crore) | 2,466.03 | 2,413.01 | 2,198.36 |

| Sales Growth (%) | 2.20% | 9.76% | |

| Profit after Tax (₹ in crore) | 78.80 | 59.93 | 57.29 |

| PAT Margins (%) | 3.20% | 2.48% | 2.61% |

| Total Equity (₹ in crore) | 422.37 | 282.51 | 223.01 |

| Total Assets (₹ in crore) | 1,264.01 | 749.05 | 695.48 |

| Return on Equity (%) | 18.66% | 21.21% | 25.69% |

| Return on Assets (%) | 6.23% | 8.00% | 8.24% |

| Asset Turnover Ratio (X) | 1.95 | 3.22 | 3.16 |

| Earnings per share (₹) | 6.18 | 4.70 | 4.58 |

There are few key takeaways from the financials of Bansal Wire Industries Ltd which can be enumerated as under:

a) In the last 3 years, revenue growth has been rather modest. For instance, between FY22 and FY24, the sales have grown overall by about 12%. However, the good news is that the net profits have grown by 38% in this same period, showing much better management of the scalability of the business.

b) PAT margins are low at around 3.2%, but this is the type of net margins you can expect in this particular sector. However, the ROE at 18.66% and ROA at 6.23% are much better, although the trend has been falling margins in the last 3 years. That is a question that Bansal Wire Industries will have to address to its shareholders.

c) The company has relatively healthy sweating of assets at around 1.95X in the latest year, and this is a very robust level of asset turnover ratio, although this ratio has also been falling in the last 3 years.

While net margins have improved, the ROE and the ROA have not kept pace with the growth in assets.

Valuation metrics of the Bansal Wire Industries IPO

Let us turn to the valuations part. On the latest year diluted EPS of ₹6.18, the upper band stock price of ₹256 gets discounted at a P/E ratio of 41-42 times of current earnings. That is fairly high valuations from the standpoint of steel wire manufacturing companies, although the profits should also catch up with the growth in capital and assets in the coming quarters.

Here are some qualitative advantages that Bansal Wire Industries Ltd brings to the table:

• The company has a customer presence across sectors with over 3,000 stock keeping units (SKUs) to cater to more than 5,000 different customers. This has kept the customer concentration quite low.

• The company has leadership in stainless wires and steel wires and this gives them economies of scale to keep costs in check.

If you add up the qualitative factors and the valuation on P/E of FY24, the story looks to be leaving something on the table for the investors. However, this is subject to the investors adopting a longer term approach to the stock since it would need a few more quarters to justify the growth in capital and assets. Investors must also be prepared for a higher risk level exposure.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

04

5paisa Research Team

5paisa Research Team

05

5paisa Research Team

5paisa Research Team

06

5paisa Research Team

5paisa Research Team

IPOs Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.