Nifty 50 Defies Trends, Moves in Sync with Volatility Index for Days

What to expect from the RBI Monetary Policy on for June 2023, Thursday?

The 3-day RBI Monetary Policy Committee (MPC) meeting, which commenced on 06th June 2023, will conclude on 08th June 2023. When the RBI announces the policy statement on 08th June, the big question is what will the central bank do on rates? The last rate hike by the RBI was in February 2023. In fact, between May 2022 and February 2023, the RBI had hiked rates by 250 bps taking the repo rates from 4.00% to 6.50%. However, in the April 2023 policy, the RBI MPC decided to change course and maintain status quo on rates as it wanted the full impact of its hawkishness to sink in the form of lower inflation.

In the last 3 months, CPI inflation has come down to 4.70%. This may be technically above the median inflation rate of 4%, but well within the RBI outer tolerance limit for inflation at 6%. It does give hope that the CPI inflation could now follow the downward trend of WPI inflation that has dipped from a high of 16% into negative territory in the latest month. The other factor is growth. The good news is that despite the persistent hawkishness of the RBI, GDP growth for FY23 stayed robust at 7.2%, even on a higher base of FY22. With macros being supportive, the RBI did not want to take chances. In the latest Bloomberg survey of economists, there is unanimity in the view that RBI will hold rates at 6.5% in June 2023.

RBI April Policy versus RBI June policy

April was the first time in the last 11 months that the RBI paused on rates and now the consensus is that RBI will maintain status quo in the June policy too. Here is a quick look at what the RBI announced in the April policy and how it will be treated in the June policy.

April 2023 Policy: RBI held the repo rates at 6.50% in the April 2023 policy statement. Repo rates were up 250 bps from the lows of May 2022 and 135 bps above pre-COVID repo rate.

June Policy Expectations: The RBI is likely to maintain the repo rates at 6.5% in the June policy, which means status quo for 2 policies in succession. For now, rate cuts are not on the cards considering that inflation due to supply chain constraints are still a reality.

April 2023 Policy: In the April policy statement, RBI had maintained its stance focused on withdrawal of accommodation. This has been the stance since the start of hawkishness by the RBI in May 2022.

June Policy Expectations: For now, it is likely that the RBI will maintain the stance of the policy as withdrawal of accommodation. While a shift to neutral stance may happen in future, it looks unlikely now due to surplus liquidity in the banking system.

April 2023 Policy: In the April 2023 policy statement, the RBI governor, Shaktikanta Das specifically called it a temporary pause in rates. The indication was that it was just an experiment and the RBI would not give up on hawkishness till inflation came to 4% levels.

June Policy Expectations: Will the RBI call out the top of interest rate cycle. While the RBI has already indicated that in recent statements, it is unlikely to call the top considering that other central banks in the world are still hawkish and so the RBI would want to keep its window of leeway open in a worst case scenario.

April 2023 Policy: For FY24, the RBI had maintained the GDP growth estimate at 6.5% and the consumer inflation at 5.2%. However, it must be remembered that FY23 GDP growth was 20 bps higher than the original RBI estimates.

June Policy Expectations: June may give the confidence to the RBI MPC to reduce the inflation target for FY24 from the 5.2% level. Such reduction may be marginal and is likely to keep target inflation for FY24 at 5% or above. However, on the growth front, the RBI is unlikely to tamper with the 6.5% growth projection, which is already higher than what the World Bank and the IMF have been projecting for FY24.

Since the repo rate would remain at 6.5%, the other linked rates would also stay the same in June 2023 policy. The SDF rate will stay pegged at 6.25%; 25 basis points below the repo rate. On the other hand, the Bank rate and MSF rates would also stay at 6.75%, pegged 25 basis points above repo rates. The SDF rate, MSF Rate and the bank rate are derived rates for which the repo rate acts as the base.

June 2023 policy will be a lot more about liquidity

That is the key. The Indian banking and financial system have been facing surplus liquidity in the last few weeks. For example, in the latest week, the surplus liquidity in the banking system was pegged at Rs2.25 trillion. Normally, whenever the RBI finds the surplus liquidity above the Rs2 trillion mark, it sucks up the surplus liquidity through reverse repos or SDF deals. While the RBI may not be tightening the financial markets by hiking rates, it would still be tightening the financial market liquidity through absorption of surplus liquidity in the system through reverse repos. That is why the withdrawal of accommodation stance is likely to stay in the June policy also.

What has triggered this surge in liquidity in recent weeks. There have been several factors. Firstly, the surge in government capital spending in recent weeks has been a key factor. Secondly, the government has been intervening in the forex markets by buying dollars to prevent the rupee from appreciating rapidly and impacting exports. When RBI buys dollars, it infuses rupee liquidity into the financial system. The third factor is the withdrawal of the Rs2,000 denomination note, and that has also added to surplus liquidity in the banking system. With so much liquidity sloshing around in the financial system, the RBI would still be tightening through the back door.

What will be the trajectory of the RBI monetary policy?

The June 2023 policy is delicately poised. There has been a delayed monsoon and indications are that either there could be a shortfall in rainfall or delays could impact the sowing season. Either ways, Kharif output is likely to be impacted and food inflation could be the first casualty. That has normally been a key trigger for monetary policy, hence the RBI would not want to make any commitment at this juncture till there is greater clarity.

June policy would be more like a wait and watch policy with the RBI trying to absorb additional data points like IIP growth, consumer inflation, Kharif output and other high frequency data points. The RBI would also have one eye on the global situation, where most of the key central banks have not yet given up on hawkishness.

- Flat ₹20 Brokerage

- Next-gen Trading

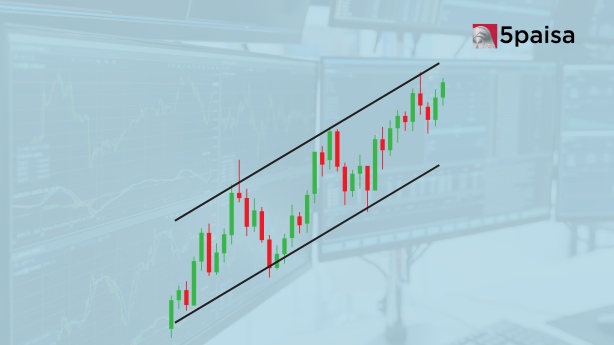

- Advance Charting

- Actionable Ideas

Trending on 5paisa

06

5paisa Research Team

5paisa Research Team

Indian Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.