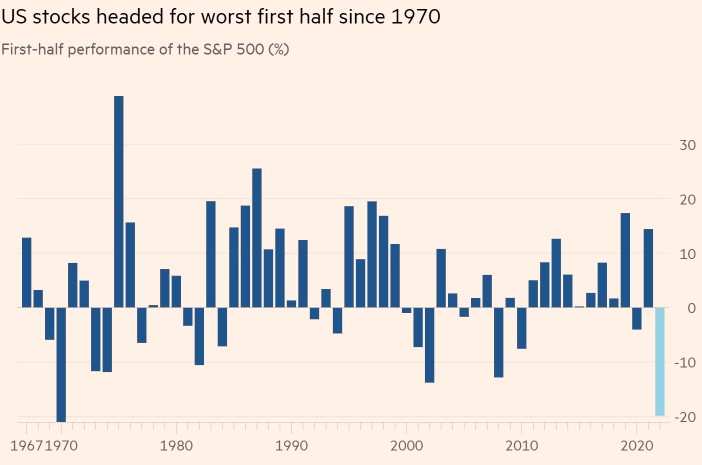

US stock indices finish worst first half in more than 50 years

Last Updated: 1st July 2022 - 06:31 pm

We all know that the US stocks are under pressure, but a perspective always helps us to better understand the magnitude of the fall. The fall in the first half of calendar 2022 ending on 30th June was so sharp, that the S&P 500 delivered the worst negative returns in over 50 years. US stocks have recorded their worst first half in more than 50 years after a rabid sell-off was triggered by the Federal Reserve attempting a tad to aggressively to curb persistent inflation which eventually led to growth concerns and fears of an outright recession.

Chart Source: FT, London

The S&P 500 fell by a whopping 20.6% for the first six months, pegging the market into a firm bear market grip. Wall Street equities have not endured such a punishing start since 1970, when equities sold off. Back in 1970, the sell-off was largely in response to a recession that ended the longest period of economic expansion in American history. There were much larger geopolitical problems by the early seventies including the oil embargoes, the end of the gold standard etc. Year 2022 is the worst first half since 1970.

In terms of wealth damage, the impact is humongous. For instance, just the value depletion in the US tocks is more than $9 trillion and still counting. This is largely on the back of fears of a recession in the US and in Europe. When the Fed started hiking rates, the first objection was that they may have started too late to be on time to subvert inflation. However, that has given rise to a much bigger problem, wherein too much of hawkishness now threatens to derail the growth engine and push the US economy into a recession. That led the fall.

Start Investing in 5 mins*

Get Benefits worth 2100* | Rs.20 Flat Per Order | 0% Brokerage

The fall in the S&P 500 at over 20% is symbolic of a index dipping into a bear market. However, this is still looking better if you compare with the 30% fall in the NASDAQ where tech stocks have taken it on the chin. The aggressive rate hikes are likely to strengthen the dollar which is already evident with the dollar index at a 20-year high. That is likely to strengthen the dollar and a strong dollar is not great news for tech companies since many of the NASDAQ champions depend heavily on the flow or revenues and profits from abroad.

The hit on the markets has been across the board. On the S&P 500, the price fall has been across sectoral indices. Energy was the only exception with a rise of 29% since the start of the current year. Among the sectors to fall the most in the year 2022 include the consumer discretionary stocks down 33% and the utility stocks also lower. Inflation appears to have seeped into almost everything and that is the concern that the market indices are reflecting. The correction has been rather steep, especially in the high beta names.

Jerome Powell has a justification for the same.

He feels that if the central bank did not raise interest rates high enough to combat inflation quickly, it would be a crisis of confidence for the Fed. The US with around 8.6% annualized inflation could entail a lot of pain for the most vulnerable segments of the Indian economy. Hence, any focus on growth without addressing the inflation problem adequately was ruled out. Fed and the RBI have been raising rates at a rapid pace and this has put a lot of pressure on the markets.

We need to await the outcome of the Fed, but the damage has been done. Fed played with liquidity for too long and it is coming back to roost. Citi also lowered its year-end forecast for the S&P 500 from 4,700 to 4,200 points on Wednesday. While that new target implies a roughly 11% increase from the benchmark’s current level, economists at the bank also placed the odds of a global recession at 50%. That is not great news.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team