Trump’s reciprocal tariff could hurt India’s Gems and Jewellery Sector

US inflation tapers sharply to 7.7% in October 2022

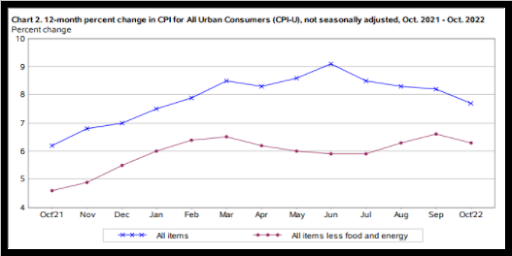

There was finally a piece of good news flowing in from the US and it was in the form a sharper than expected fall in the rate of consumer inflation. Till June 2022, the consumer inflation was on consistently moving up before it finally peaked in the month of June at a level of 9.1%. Between June 2022 and October 2022, the consumer inflation has tapered by 140 bps from 9.1% to 7.7%. One can argue that, perhaps, the 140 bps fall in consumer inflation is paltry compared to the 375 bps of monetary tightening, but the good news is that in October, the consumer inflation was lower than the consensus street expectation.

Chart Source: US Bureau of Labour Statistics

Why the Dow and NASDAQ were totally delighted?

On Thursday, the Dow rallied more than 3% but the NASDAQ rallied over 7% in a single day. October was important because it was the first time since February 2022 that the US consumer inflation had fallen below 8%. One needs to accept the Fed caveat that “Rate hikes can only do part of the job in containing inflation by restricting consumption. The tougher job is on the supply side, which will have a time lag”. The reason the Dow and the NASDAQ gave a roaring welcome to the inflation number is that it is signal that the Fed would now sober down in its anti-inflation stance and inflation expectations may also taper.

After a gap of the last few months, there has been a sharp fall in inflation across categories. Otherwise, fuel inflation would head lower but food and core inflation would continue to head higher due to supply chain bottlenecks. That has changed. In October 2022, yoy inflation was lower across all the 3 major categories viz. food inflation, energy inflation and core inflation. The food and core inflation tapered only to the extent of 30 to 50 basis points, but there were some important sub-trends. For instance, (food at home) category has seen a sharp fall in inflation, while core inflation spikes are more fuel related.

How the break-up of 7.7% inflation looks like?

Here is how the 4 key components of US consumer inflation panned out in the month of October 2022.

|

Category |

Oct 2022 (YOY) |

Category |

Oct 2022 (YOY) |

|

Food Inflation |

10.90% |

Core Inflation |

6.30% |

|

Energy Inflation |

17.60% |

Headline Consumer Inflation |

7.70% |

Data Source: US Bureau of Labour Statistics

Let us look at some important takeaways from the inflation data.

a) Food inflation may have fallen yoy, but was 0.6% higher on a sequential basis. In the food basket, vegetables and fresh fruits saw a fall in sequential inflation, while cereals and dairy products were higher.

b) Under energy, fuel oil saw yoy inflation rise from 58% to 68%. Which was offset by a fall in the prices of gasoline, electricity and piped gas supplies.

c) Core inflation may have tapered by just 30 basis points, but most of the pressure came from oil dependent services like energy services, airline fares and transport related services. So, it is still fuel that is making core inflation sticky.

d) While the yoy inflation is lower, the high frequency MOM inflation for October 2022 continued to be higher by 0.4%, after touching a low of 0.00% in July. Food inflation on a sequential basis increased by 60 bps and was higher for 4 out of 6 grocery categories.

e) On a MOM basis, Energy index rose 1.8% after falling 3 months in a row. Electricity increased by 0.1%, but natural gas was sharply down -4.6% MOM. Core inflation was also up 60 bps MOM, with stress from oil related energy services, airfares and transport.

What will Fed do, and can India breathe easier?

Will the Fed stop pause rate hikes for now? That looks very unlikely since inflation is still high at 7.7%, compared to the Fed’s 2% target. Also MOM inflation is still rising. But this is likely to confirm the hints from the Fed in its statement about going slower on future rate hikes. The Fed is likely to restrict itself to hiking rates by just 50 bps in December and a few rate hikes of 25 bps each. The terminal rate for the Fed may now look closer to 5% than above 5%. Even the US government is not too happy with the dollar strength and so they have an incentive to go slow on rate hikes.

What does this mean for India? US inflation coming down to 7.7% may be value accretive to India in two ways. Firstly, RBI has less to worry about monetary divergence. Having raised the repo rates by 190 bps, it can afford to go slow or even pause at its next meeting in December. At least, the growth levers will be safe. Secondly, the risk of recession had come at a time when India was betting big on exports. With US inflation sharply lower, it mitigates the risk that too much hawkishness may push the global economies into recession. That is also good news for Indian IT companies, as they depend heavily on global tech spending.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

02

5paisa Research Team

5paisa Research Team

Global Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.