Marcellus to Launch Global AIF in February for Diversification

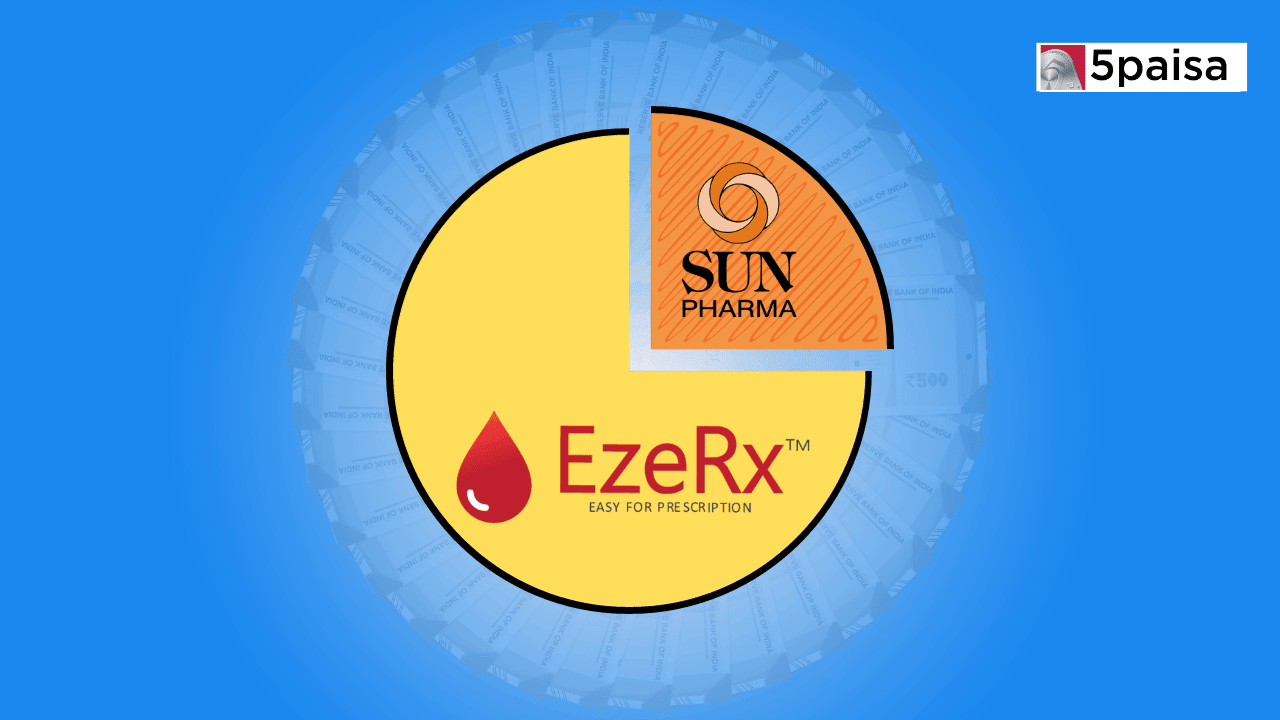

Sun Pharma Acquires Stakes in Ezerx Health and Agatsa Software

Last Updated: 6th October 2023 - 08:51 pm

Pharmaceutical giant Sun Pharmaceutical Industries Ltd. has made strategic moves to diversify its product portfolio in the field of non-invasive medical technology. On October 6, 2023, Sun Pharma announced its acquisition of a 37.76% stake in Ezerx Health Tech Private Ltd, valued at ₹28.69 crore. Ezerx Health specializes in the production, marketing, and distribution of non-invasive diagnostic and ancillary medical devices, both in India and internationally. This investment aligns with Sun Pharma's commitment to expand its presence in the non-invasive medical technology sector.

Ezerx Health, founded in 2018, focuses on innovative non-invasive screening solutions for early detection of primary health parameters. In the fiscal year 2022-23, Ezerx reported revenue of ₹6.15 crore. The acquisition of Ezerx shares is expected to be finalized by October 2023, after the fulfillment of certain conditions.

Further Expansion with Agatsa Software

In addition to its investment in Ezerx Health, Sun Pharma is strengthening its position in the non-invasive medical device market with an additional agreement. Sun Pharma initially acquired a 26.09% stake in Agatsa Software Private Ltd on February 18, 2023. With this new agreement, Sun Pharma's total proposed acquisition in Agatsa will increase to 30.13%.

Agatsa Software Private Ltd., headquartered in Noida, Uttar Pradesh, is dedicated to the research, development, and commercialization of non-invasive medical devices within the diagnostic health segment. In the fiscal year 2023, Agatsa reported revenue from operations amounting to ₹1.10 crore, indicating its growth potential in the non-invasive medical device market. The purchase of the additional 4.04% stake from existing shareholders is expected to be completed by December 2023, subject to certain conditions.

Investment Timeline

Sun Pharma is also progressing with its planned investments. From the total investment of ₹22 crore, as previously announced on February 18, 2023, an investment of ₹12 crore is anticipated to be completed by November 2023. The remaining ₹10 crore investment is expected to follow within 9-12 months, contingent upon specific conditions being met.

Financial Performance

For the April-June quarter, Sun Pharmaceutical Industries Ltd. reported a 1.9% year-on-year decrease in consolidated net profit, totaling ₹2,022.5 crore, compared to ₹2,060.8 crore for the same quarter last year. This decrease was attributed to a one-time exceptional loss of ₹322.87 crore. Excluding this exceptional loss, the net profit amounted to ₹2,345.4 crore, marking a 13.8% increase year-on-year. The company also reported an 11% increase in consolidated revenue, reaching ₹11,941 crore, and a 27.9% EBITDA margin for the quarter, up 230 basis points from the same period the previous year.

Analyst Recommendations and Stock Performance

Leading brokerages HSBC and Nomura have expressed optimism about Sun Pharma's prospects. HSBC has given a 'buy' rating with a target price of ₹1,275 per share, while Nomura maintains a bullish stance with a target price of ₹1,313 per share.

Sun Pharma's stock has given a positive return of 11.45% over the last six months, aligning closely with the benchmark Nifty50 index's performance, which also recorded an 11.49% return over the same period. Over the past year, Sun Pharma's stock went up by 18.22%, and if we look back over the past five years, the stock has almost doubled investor’s value, giving investors a solid 91% return on their investment. So, it's been a profitable ride for those who've invested in Sun Pharma for a long time.

In summary, Sun Pharma's strategic investments in Ezerx Health and Agatsa Software highlight the company's commitment to expanding its presence in the non-invasive medical technology sector. These moves are complemented by positive financial performance and analyst recommendations, signaling a promising future for the pharmaceutical giant.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team