Marcellus to Launch Global AIF in February for Diversification

Reliance Retail in Advanced talks with Gulf, Singapore funds on $1.5 billion investment

Last Updated: 14th September 2023 - 08:38 pm

Reliance Retail, India's retail giant led by Asia's wealthiest individual, Mukesh Ambani, is on the brink of securing a significant investment deal with prominent global investors, including sovereign wealth funds from Singapore, Abu Dhabi, and Saudi Arabia. The company aims to raise a substantial sum of approximately $3.5 billion, with $1.5 billion anticipated to come from these discussions.

Investment Progress

The negotiations with investors are part of Reliance Retail's internal target to secure $3.5 billion in investments by the end of September, according to sources with direct knowledge of the matter. This strategic move follows recent investments, including a $1 billion commitment from Qatar Investment Authority (QIA) and a $250 million infusion from KKR & Co.

Prominent Investors

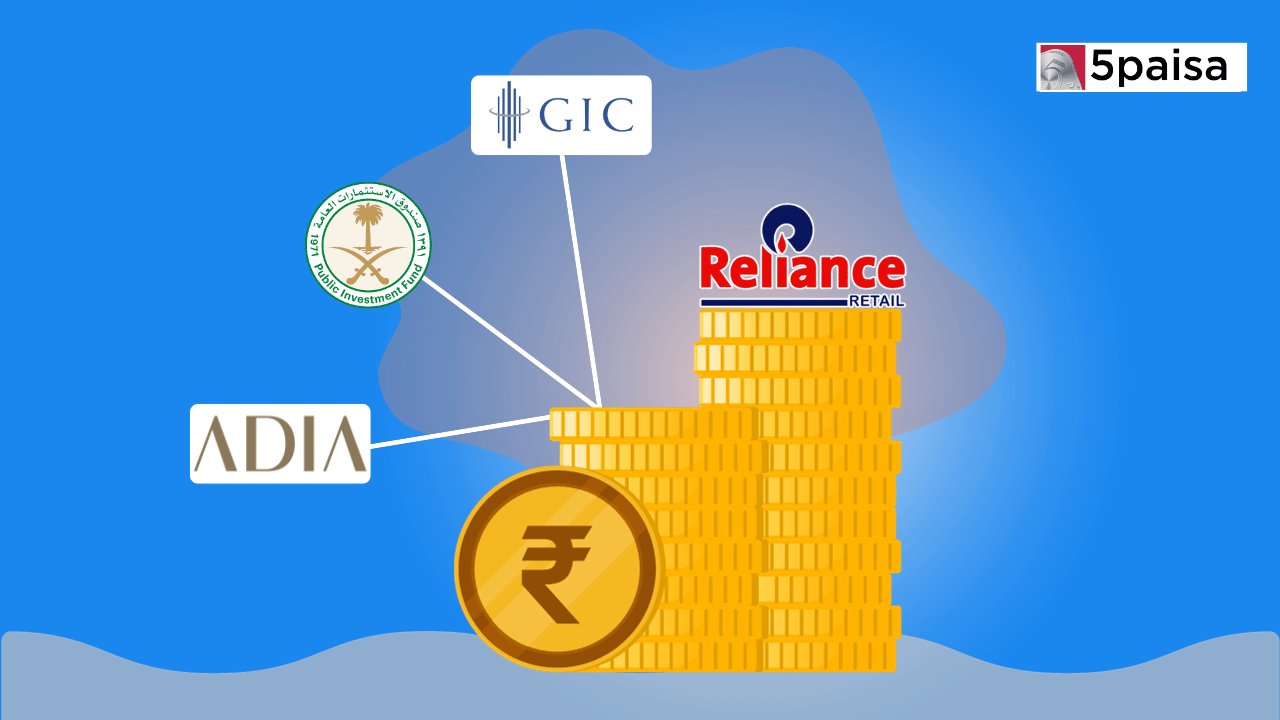

Singapore's GIC, the Abu Dhabi Investment Authority (ADIA), and Saudi Arabia's Public Investment Fund (PIF) are actively considering substantial investments of at least $500 million each in Reliance Retail. It's important to note that the actual investment figures from some of these investors may vary. Moreover, Reliance Retail is exploring potential discussions with one or two additional investors, suggesting that the fundraising plans remain dynamic.

Global Investment Powerhouses

GIC, ADIA, and PIF collectively hold a 4.4% stake in Reliance Retail, underscoring their substantial influence as major stakeholders. These entities are globally recognized as some of the most prominent and influential investment funds. In addition to external investments, Reliance Industries, the parent company of Reliance Retail, is considering active participation in the ongoing fundraising round of $3.5 billion. This underscores the strategic importance of this capital infusion for the broader Reliance conglomerate.

Previous Investments and Valuation

In 2020, Reliance Retail sold a 10.09% stake, valuing the company at ₹4.68 trillion (approximately $56.4 billion at current exchange rates). In this transaction, GIC and ADIA jointly invested $664 million each, while PIF contributed $1.15 billion. Investors such as ADIA have expressed their strategy of targeting leading businesses in Asia with strong growth potential driven by regional consumption patterns.

Reliance Retail's Market Presence

Reliance Retail has established itself as India's largest retailer, boasting an extensive network of over 18,500 stores and digital commerce platforms. The company serves nearly 27 crore loyal customers across various sectors, including grocery, consumer electronics, fashion, lifestyle, and pharmaceuticals. Reliance Retail has also formed strategic partnerships with renowned brands such as Jimmy Choo, Marks & Spencer, and Pret A Manger.

Competition and Ambitions

While competing with global giants like Amazon and Walmart's Flipkart, Reliance Retail remains steadfast in its pursuit of achieving ambitious growth and expansion within the Indian retail sector. As the negotiations progress, the company remains focused on reaching its fundraising target, with these investments expected to play a pivotal role in its future endeavors.

Reliance Industries Q1 FY 2023-24 Results: A Comprehensive Overview

Reliance Industries (RIL) recently disclosed its financial results for the first quarter of the fiscal year 2023-24, showcasing a mixed bag of performance metrics. The conglomerate reported a net profit of ₹16,011 crore, reflecting a 10.8% decline from the ₹17,955 crore recorded in the same period the previous year. However, a closer examination reveals a multifaceted story.

In terms of revenue, RIL's gross revenue from operations for Q1 stood at ₹231,132 crore, marking a 4.6% dip compared to ₹242,529 crore in the prior year. Nevertheless, the company's operational performance remained resilient, with earnings before interest, taxes, depreciation, and amortization (EBITDA) reaching ₹38,093 crore, slightly exceeding the ₹37,997 crore from the previous year.

The impact on RIL's overall performance was primarily driven by challenges in the Oil-to-Chemicals (O2C) sector. In contrast, the retail and telecom arms demonstrated robust growth.

Reliance Retail, a significant division of RIL, reported exceptional results. Net profit surged by 18.8% to ₹2,448 crore, a notable increase from ₹2,061 crore in the corresponding period last year. Gross revenue from operations witnessed a remarkable uptick of 19%, reaching ₹69,962 crore, compared to ₹58,554 crore in the year-ago period. The EBITDA also exhibited substantial growth, reaching ₹5,151 crore, compared to ₹3,849 crore in the prior year.

Reliance Retail's success story was further emphasized by its ability to attract a record 249 million footfalls across various formats and locations during the quarter, marking a substantial year-on-year growth of 42%. The company also expanded its physical store network, adding 555 new stores, thereby increasing the total store count to 18,446 by the end of the quarter, with a cumulative operating area of 70.6 million square feet.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team