India's Pharma Sector on Edge: Will U.S. Tariffs Affect the Lifeline of Generic Drugs?

LIC completes one year on the Indian stock exchanges

The IPO of LIC was certainly the most awaited IPOs in the Indian market. In May 2022, the IPO finally happened at a price of Rs949, making LIC among the ten most valuable companies in India by market cap. At an IPO size of Rs20,557 crore, it was the biggest Indian IPO ever. However, the performance in the last one year since listing has been far from satisfactory.

Looking back at the LIC IPO

The LIC IPO completed one year of its listing journey on 17-May 2023. In the IPO, the government of India had offloaded 3.5% of its holding in LIC or 22,13,74,920 equity shares at a price of Rs949 per share. Retail investors had been offered a discount of Rs45 per share so their effective price was Rs904 per share. However, over the last one year, the stock is down nearly 40% from the issue price of Rs949 to the current market price of around Rs567 per share. That is not just a 40% loss but nearly Rs2.38 trillion of market value wiped out.

The stock listed at a 9% discount at Rs867 but fell vertically after that. While the IPO of LIC was Rs6 trillion at the time of the IPO, it stands at below Rs3.80 trillion today. Ironically, most brokerage houses had been bullish on the IPO. While domestic mutual fund had splurged on the IPO, FPIs had largely stayed away. Ask any analyst and they would still tell you to hold for the long term, but that is not too comforting for someone holding on for the last 1 year.

What drove the fall in LIC stock?

Ask any analyst and the standard response would be that the issue was grossly overpriced if you compare to the profitability of the private insurance companies. Clearly, that had to balance out. However, there were other headwinds too. For example, weak market conditions and changes in tax policy had a negative impact. For instance, the new tax regime allows people to pay much lower tax by forfeiting exemptions. That is not great news for LIC and that has badly impacted the number of LIC revenues and sales in the last few months.

Here are some other factors that had an impact on the LIC IPO performance

• The last year was not great for insurers. However, month on month numbers of LIC have seen a deterioration in the last one year although it still dominates the life business in India. All insurers had a tough time in the markets, but in the case of LIC it just got magnified due to the aggressive pricing in the IPO.

• While size of the IPO was an issue, people expected better subscription numbers. The general expectation was around 5-6 times subscription what actually came in was just about 3 times. Even here, many of the MF investors just had to join the bandwagon. A below par listing was not great news and the digital IPO implosion had its impact on LIC stock too.

• Ironically, the Adani Hindenburg case has had a deep impact on the fortunes of Adani group. LIC was under strict media trials as the insurance major owned stakes in a few Adani Group. LIC exposure to Adani group was pegged at close to Rs56,000 crore and that did not go down too well with the market.

But the biggest problem has been performance vis-a vis private sector peers.

How LIC is struggling to grow

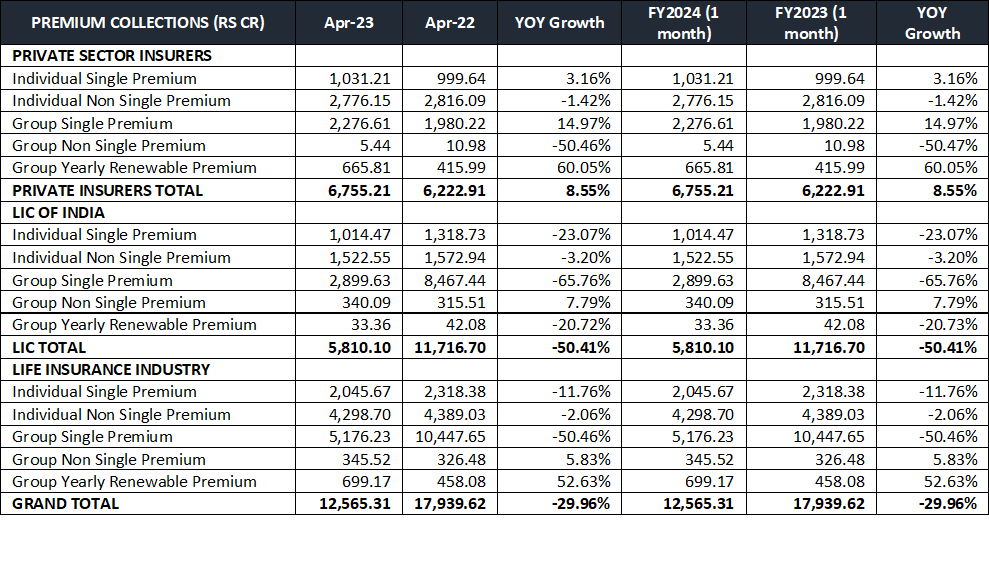

That is the real fundamental issue here and that is evident if you look at the table. We first look at the new business premium collection of LIC and private players for the month of April 2023 as per data put out by the Life Insurance Council.

We look at the new business premium (NBP) collections for the month of April 2023.

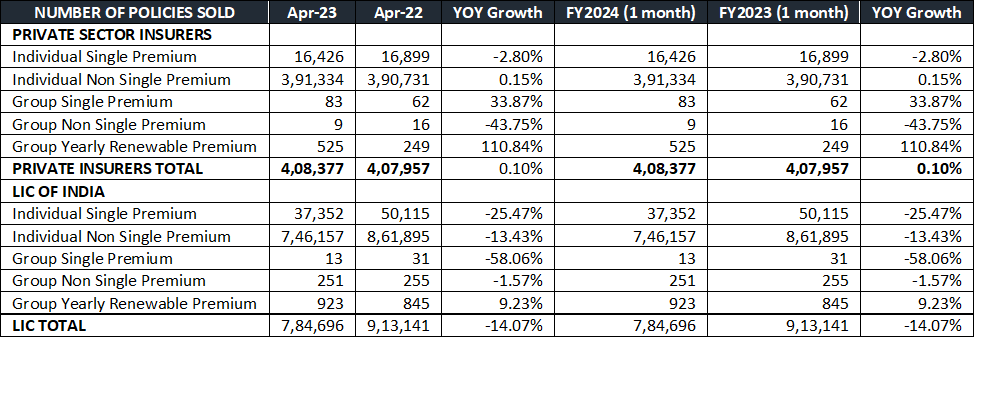

In fact, LIC has not only seen a sharp fall in NBP but also pulled the overall life insurance industry down with it. For a more retail view, let us also look at the policies sold by LIC in the month of April 2023. That is also a clear picture.

Clearly, LIC is seeing pressure on growth in NBP and growth in policies sold. Above all, the company has hardly paid any dividends to shareholders. Clearly, the problems don’t seem to be going away in a hurry.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

01

5paisa Research Team

5paisa Research Team

02

5paisa Research Team

5paisa Research Team

Indian Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.