Trump’s reciprocal tariff could hurt India’s Gems and Jewellery Sector

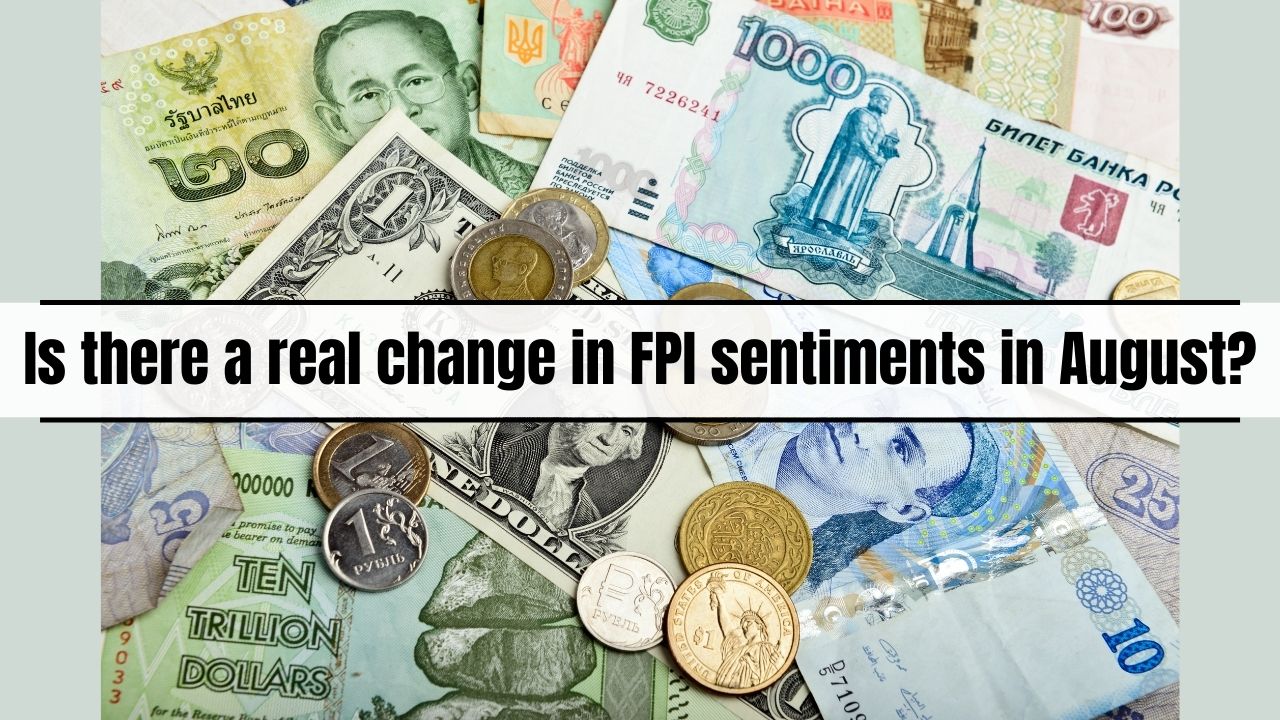

Is the turnaround in FPI sentiments for real?

The good news is that the foreign portfolio investors have turned net buyers in equities since July 2022. FPI had sold close to $35 billion of equities between October 2021 and June 2022. However, in the month of July, the FPIs net infused $634 million, with bulk of the buying coming in the second half of the month. In the month of August, the FPIs have infused more than $2 billion in the first few days and there are still 3 weeks to go. That brings us to a basic question; have FPI sentiments finally turned around for the better.

FPIs buy in July after 9 months, continue in August 2022

The table below captures monthly FPI flows since October 2021 with a break up of equity and debt flows. The equity flows includes secondary market and IPO flows too.

|

Month |

FPI – Equity |

FPI – Debt |

Net Flow |

Cumulative Flow |

|

Oct-21 |

-13,549.67 |

1,272.16 |

-12,277.51 |

-12,277.51 |

|

Nov-21 |

-5,945.10 |

3,448.49 |

-2,496.61 |

-14,774.12 |

|

Dec-21 |

-19,026.06 |

-10,407.62 |

-29,433.68 |

-44,207.80 |

|

Jan-22 |

-33,303.45 |

3,080.26 |

-30,223.19 |

-74,430.99 |

|

Feb-22 |

-35,591.98 |

-2,586.30 |

-38,178.28 |

-1,12,609.27 |

|

Mar-22 |

-41,123.14 |

-8,876.35 |

-49,999.49 |

-1,62,608.76 |

|

Apr-22 |

-17,143.75 |

-5,613.91 |

-22,757.66 |

-1,85,366.42 |

|

May-22 |

-39,993.22 |

3,537.04 |

-36,456.18 |

-2,21,822.60 |

|

Jun-22 |

-50,202.81 |

-1,327.34 |

-51,530.15 |

-2,73,352.75 |

|

Jul-22 |

+4,988.79 |

-2,840.97 |

+2,147.82 |

-2,71,204.93 |

|

Aug-22 * |

+16,175.20 |

+235.06 |

+16,410.26 |

-2,54,794.67 |

|

Grand Total |

-2,34,715.19 |

-20,079.48 |

-2,54,794.67 |

|

Data Source: NSDL (all figures are Rupees in crore) * Aug data up to 08th

In the above table, the FPI data for the month of August is only till 08th August. However, as can be seen from the above table, the sharp positive flow in August is in sharp contrast to the heavy outflows from October 2021 to June 2026. What exactly has led to the sharp turnaround in FPI flows in the last one month and few days?

Drivers for a turnaround in FPI flows

It has been a combination of factors driving up the FPI flows into India.

a) The US Fed, while staying hawkish, has indicated in its last FOMC policy statement that if the growth levers were to slow down then the Fed would be open to the idea of reducing interest rates and reducing the hawkishness. This has reduced the extent of risk flows and funds are again flowing into emerging markets like India.

b) There are some positives on the domestic front too. For instance, the latest IMF report ahs clearly underlined that India should be able to maintain its growth momentum even as consumer inflation in India is tapering faster than in the US or even in Europe. That is creating prospects of higher real growth in the months to come.

c) Global commodity prices are coming down and oil has fallen sharply in the Brent Crude market from a high of $139/bbl to the current level of $95/bbl. For an economy that is heavily dependent on imported crude to the tune of 85% of its daily needs, this is a welcome shift and would be less of a macro pressure point.

d) Last, but not the least, the rupee has taken support around 80/$. While it may be too early to call a bottom, one thing is evident that FPIs are seeing the risk-reward of buying Indian stocks at around 80/$ favourable. That will most likely ensure that their dollar returns are protected or even enhanced. The outcome of this is visible in the daily flows of FPIs into Indian equity as shown in the table below.

|

Date |

Secondary Flows |

Primary Flows |

Total Flows |

|

August 01st |

$184.87 million |

$0.24 million |

$185.11 million |

|

August 02nd |

$375.46 million |

$299.92 million |

$675.38 million |

|

August 03rd |

$211.51 million |

$(0.02) million |

$211.49 million |

|

August 04th |

$503.27 million |

$(0.04) million |

$503.23 million |

|

August 05th |

$217.26 million |

$0.00 million |

$217.26 million |

|

August 08th |

$253.10 million |

$(0.31) million |

$252.79 million |

|

Total for August |

$1,745.47 million |

$299.79 million |

$2,045.26 million |

Data Source: NSDL

As can be seen, there are clear signs of FPI buying interest in August in Indian equities. For now, the turnaround looks real. The only risk factor is the way the current account deficit pans out. That could be a pain point for the rupee and hence to FPI flows.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

02

5paisa Research Team

5paisa Research Team

Global Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.