Bond yields cross 7.5% after 39 months; what does it mean?

Last Updated: 9th December 2022 - 12:31 pm

After a gap of nearly 39 months, the bond yields on the benchmark 10 year bonds crossed above the 7.5% mark. The rally has been rapid since the last repo rate hike by the RBI in May 2022. Since then the bond yields have spiked more than 70 bps from 6.80% to 7.50%.

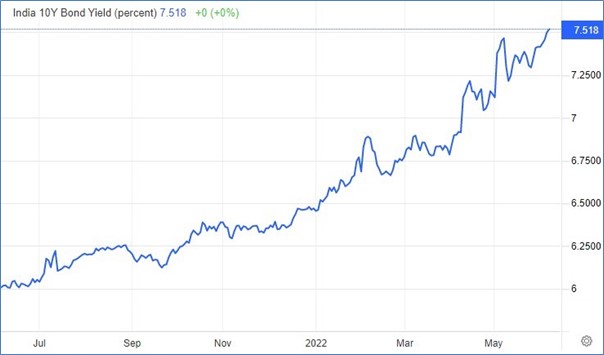

The last time we saw these high yields was in March 2019. What has triggered these high yields and what does it mean. First a look at the chart of the 10 year benchmark yield.

The bond yields have rallied from just under 6% last year to 7.518% in June 2022 with most of the action seen in the last 2 months since April 2022. What were the triggers for this sharp spike in bond yields?

a) The first trigger is the hawkishness of the RBI. Like the US Fed, the RBI has also shown a keen hawkishness and shown intentions to raise the repo rates rapidly. They hiked rates by 40 bps in May 2022 and plan to hike another 40-50 bps in June 2022. Higher repo rates obviously would increase the cost of funds and spike the bond yields.

Start Investing in 5 mins*

Get Benefits worth 5100* | Rs.20 Flat Per Order | 0% Brokerage

b) The second reason for the spike is inflation. In the month of April 2022, India reported CPI inflation at 7.79% and WPI inflation at 15.08%. Both are very high numbers and the CPI inflation is worsened by the fact that core inflation is also above 7% now. This has led to a rise in inflation expectations, setting the tone for higher bond yields.

c) This related to the previous point. The RBI normally gives out its full year inflation estimates in each monetary policy. In April it had raised the inflation target for FY23 by 120 bps from 4.5% to 5.7%. In the June policy, the RBI is expected to hike the inflation target for FY23 further by 80 bps to 6.50%. This type of signal from the RBI has also led to a spike in bond yields.

d) One reason is also that most of the RBI efforts are focused at the short end of the rate curve. Hence the long end continues to remain at higher levels. Macros and the global uncertainty is just adding to the higher yields.

e) Finally, an important factor in this rising rate scenario is the total borrowings of the government. For FY23, the borrowing target is already at a record level of Rs14.31 trillion. However, now the government has raised it by another Rs1 trillion to fund the fight against inflation.

In addition, the government has also hinted at the full year fiscal deficit slipping back from 6.4% to 6.9%. Both these factors have resulted in a spike in the 10 year bond yields.

What does bond yields at 7.518% mean?

It means several things and rising rates are never a very good sign. Firstly, rising rates increases the cost of borrowing for corporates. This can be a lot more painful for the mid-cap and the small cap companies which do not have easy access to credit like the larger names.

Secondly, for many of the companies with high leverage and low coverage ratios, higher bond yields can also increase the risk of solvency.

Another important implication is on the cost of capital. Companies are valued in the market based on future cash flows which hare discounted at the cost of capital. One component of cost of capital is the debt cost and if the cost of debt goes up then the WACC also goes up.

That means, future cash flows tend to get valued at lower current values. That normally impacts the valuation of companies in a negative way. Lastly, for a government that relies heavily on borrowing domestically to bridge its fiscal deficit, high interest rates would mean more devolvement on the RBI and hence higher inflation risk. That is hardly an encouraging scenario.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team