Swiggy Reports ₹625.5 Cr Net Loss in Q2 Despite Revenue Growth

Bharti Airtel Rights Issue - How to Apply for Rights Issue Online

Last Updated: 5th June 2024 - 11:48 am

The Rs.21,000 crore rights issue of Bharti Airtel opened on 05-Oct and will close on 21-Oct. Effective 05-Oct the Bharti Airtel Rights Entitlement (RE) has also started trading on the stock exchanges under the NSE symbol "AIRTEL-RE". These RE or rights entitlement can be either bought or sold in the exchanges just like you buy stocks.

The company had fixed 28-Sep as the record date for entitlement to the rights issue so investors must have bought the shares of Bharti Airtel at least 2 trading days prior to 28-Sep to be entitled to the rights shares. The rights will be in the ratio of 1:14 i.e. 1 rights share for every 14 shares held. Each RE represents 1 rights share of Bharti.

The rights price was fixed at a steep discount to the market price at Rs.535. The rights is normally priced at a steep discount to make to attractive to existing shareholders. While the rights issue will be open till 21-Oct, the RE trading will only be permitted till 14-Oct after which the RE trading will cease. Hence RE can only be bought or sold till 14-Oct.

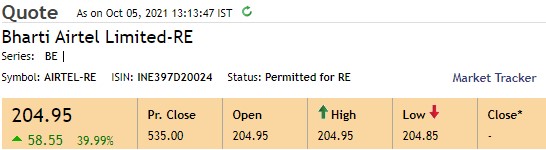

To understand how the RE gets priced, we will look at a real time price snapshot. Remember that RE is a right without an obligation. To that extent, it is more like a call option.

The closing price of Bharti Airtel on 04-Oct was Rs.681.40, which represents a premium of Rs.146.40 over the rights price. The Bharti Airtel RE is locked 40% higher at Rs.204.95 and the Rs.58.55 appreciation that you see in the RE price is over the theoretical price of Rs.146.40. The RE price will keep changing on a real time basis based on the outlook.

Investors can either exercise the right or they can just sell the RE in the market at the current market price. Such REs were already credited to the demat accounts of eligible shareholders as on 04-Oct.

Interestingly, the entire rights price of Rs.535 per share is not payable on application, in case you subscribe to the rights at Rs.535. Only 25% of the total price or Rs.133.75 per share is payable on application, while the balance will be payable in two tranches in the future. The specific deadlines for payment of the remaining instalments will be intimated separately.

Steps to invest in Bharti Rights issue via Registrar & Transfer Agent (RTA)

This can be done by going through the following steps. KFIN Technologies (formerly Karvy Computershare is the registrar to the Bharti Rights issue)

Step 1: You can visit the website page of Bharti rights issue on KFINTECH at the link below.

https://rights.kfintech.com/airtel/

For demat holders in Bharti, click on the "Email & Mobile Registration" link

Step 2: Select the depository NSDL / CDSL or select physical in case you are holding physical shares.

Step 3: Enter important details like DP ID, client ID and Captcha Code and click on Submit.

Step 4: If your email id and mobile is not registered, you can registered them here.

Step 5: As per the terms of the rights offer, an amount equivalent to 25% of the rights amount can be paid online via NEFT online or through the Unified Payment Interface (UPI). Full money will be debited and to the extent not allotted, your money will be refunded.

When the rights shares are allotted around 18-Oct, you will be intimated by email and also by mobile SMS.

Steps to invest in Bharti Rights issue via Internet Banking Account - ASBA Facility

If you have the ASBA facility with a bank, then applying for the Bharti rights is just like applying for any IPO via ASBA. Here are the steps.

Step 1: You must login to your net banking account and click on "Demat & ASBA Services".

Step 2: Click on the Bharti Airtel Rights issue link

Step 3: Fill in details like PAN, Depository Name, DEMAT ID (Depository ID + Client ID)

Step 4: Make ASBA payment. The money is not debited in the case of ASBA but only blocked and the actual debit happens to the extent of allotment on the allotment date.

In both cases, if the shares are not allotted to you, the money gets refunded to your bank account.

Important Note: If your bank does not support ASBA, the RTA would have sent you Composite Application Form (CAF), which you can fill up and submit to the branch of any self-certified syndicate bank (SCSB). You can also pay via cheque / DD.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Corporate Actions Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team