Are PSU Banks on the cusp of change?

Last Updated: 4th April 2022 - 12:03 pm

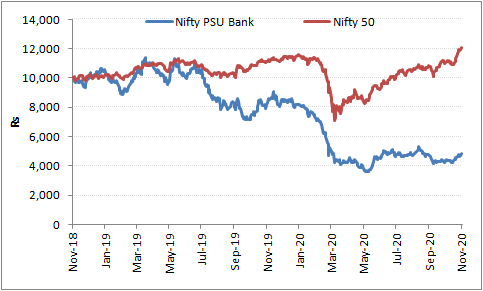

PSU Banks are up by 20% in the last thirty days. They have outperformed Nifty Bank by a huge margin. Are they going to sustain this outperformance?

One of the trends that is quite visible in the last few days of trading is that banking stocks are outperforming the overall market. Even within banks, state-owned banks are showing better resilience. Banks like Indian Bank and Union Bank are up by 40% in the last thirty days. In the same period, the best performing bank from the private sector has been Federal Bank, whose share price is up by 20%. This better performance in the last one month has helped the PSB stocks to lift last one-year performance also. They are up by 114% in the last year compared to 63.5% by Bank Nifty.

Performance of PSU Banks in last one year and one month.

|

Symbol |

52week High |

52week Low |

365 day % Change |

30 day % Change |

|

NIFTY PSU BANK |

2,860.75 |

1,244.85 |

114.37 |

19.26 |

|

INDIAN Bank |

185.75 |

57.35 |

202.32 |

40.51 |

|

J&K BANK |

44.3 |

14.05 |

173.54 |

7.57 |

|

CENTRAL Bank |

29.65 |

10.65 |

113.95 |

7.48 |

|

SBI |

508.7 |

185.9 |

145.89 |

14.18 |

|

Punjab & Sind Bank |

23.75 |

10.4 |

68.04 |

7.6 |

|

UCO BANK |

16.35 |

10.75 |

15.08 |

7.81 |

|

BANK of BARODA |

99.85 |

41.05 |

121.97 |

20.09 |

|

PNB |

48.2 |

26.3 |

62.32 |

15.88 |

|

CANARA Bank |

204.25 |

84.35 |

122.07 |

27.27 |

|

BANK of INDIA |

101.4 |

38.2 |

50.37 |

10.51 |

|

MAHA BANK |

32 |

10.85 |

85.84 |

17.98 |

|

IOB |

29 |

9.05 |

132.43 |

3.37 |

|

UNION BANK |

51.7 |

23.45 |

101.23 |

40.49 |

What is driving the banking sector as a whole is their underperformance for a while and good quarterly results. For example, the Bank of Maharashtra saw its profit double in the latest quarter on yearly basis. Besides its asset quality has also improved significantly. There are many cases that are not being resolved such as DHFL, which is helping such bank. Hence, PSBs are likely to continue their superior performance.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team