Marcellus to Launch Global AIF in February for Diversification

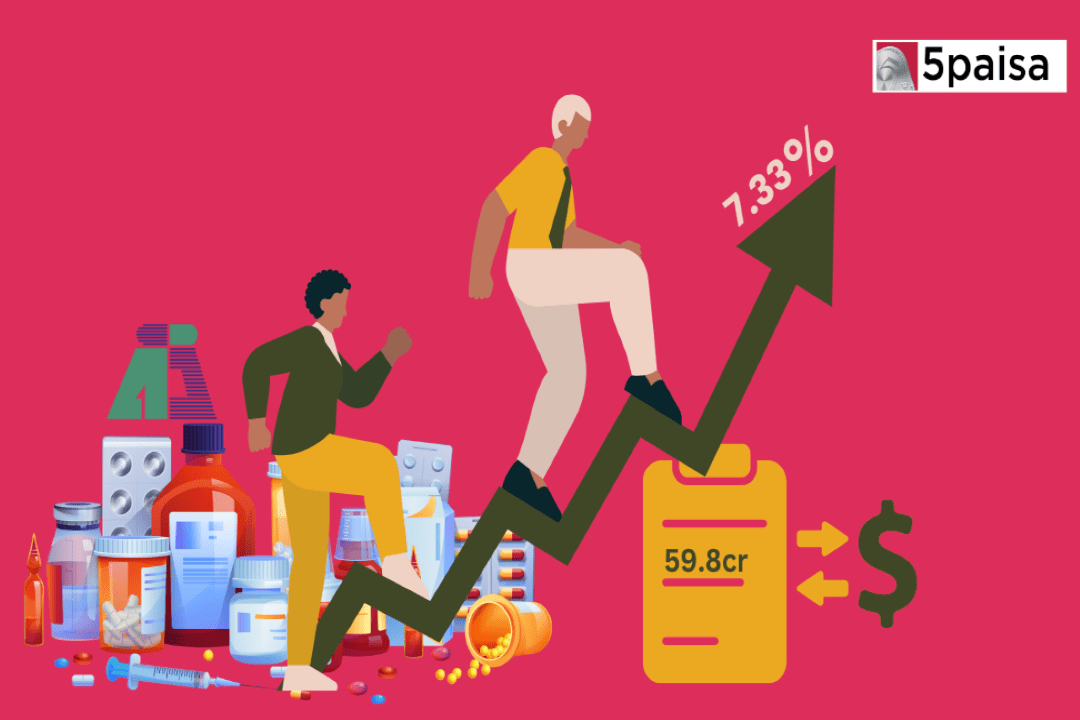

Aarti Drugs Q1 Net Sale Surges up 7.33% YoY, Approves Rs 59.8 crore Buyback

Last Updated: 24th July 2023 - 08:00 pm

Aarti Drugs Limited, a leading domestic pharmaceutical company, has revealed its decision to initiate a share buyback program after reporting an impressive performance in the first quarter of the fiscal year 2023-2024 (Q1FY24).

The company's stock surged 16%, hitting a 52-week high of ₹607.90 on July 24.

The share buyback plan entails repurchasing 665,000 shares at a price of ₹900 per share, totaling a buyback amount of ₹59.85 crore. This buyback is equivalent to 0.72% of the company's total issued shares. The move aims to reward shareholders and instill confidence in the company's future growth prospects.

During Q1FY24, Aarti Drugs witnessed a remarkable 38% year-on-year increase in its consolidated profit after tax (PAT), reaching an impressive figure of ₹47.97 crore. The company's total revenue for the quarter also saw a notable 6% year-on-year growth, amounting to ₹661.11 crore. The change was primarily attributed to an 18% increase in the volume of Active Pharmaceutical Ingredients (API), one of the company's key business segments.

The buyback process is set to begin once the company's board approves the plan. Shareholders who hold Aarti Drugs' shares on the record date, fixed as August 4, 2023, will be eligible to participate in the buyback.

Those shareholders opting to participate will have the opportunity to sell their shares back to the company at the buyback price of ₹900 per share.

In the previous buyback, which occurred in 2021, the company repurchased its shares at a rate of ₹1,000 per share. The company's stock was trading for 680 per share at the time. The company's decision to repurchase its shares at a higher price than the market price could indicate its confidence in the future growth and value of its business.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team