Neutral Long Iron Butterfly - A Complete Guide

Options trading offers several low-risk profit-making strategies specific to the area and not applicable to conventional securities.

One such strategy is the iron butterfly which aims to generate steady income while limiting profits and risks. This strategy belongs to a group of options strategies called as the members are named after flying creatures like condors and butterflies.

In this guide, let us try to learn more about a neutral long iron butterfly strategy and see how and when you can apply it to your options trading to achieve the desired objectives.

What is an Iron Butterfly?

This options strategy is much like a mix of a bullish put spread and a bearish call spread with a similar expiration converging at the middle strike price.

A short put and spread are sold at the middle strike price, forming the butterfly's body, and the wings are formed by buying a put and call below and above the price, respectively.

This strategy is different from the traditional butterfly spread in two ways. The strategy involves four contracts and not three; secondly, it is a credit spread paying the investor a net premium while the butterfly is a debit spread, making it ideal for low-volatility markets and environments.

The strategy should be utilised pre-dominantly during periods of low-price volatility and is both risk and profit-limiting.

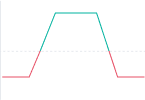

Neutral Long Iron Butterfly upper and lower

- As long as the asset price lies between the two points, the position remains unprofitable. When the underlying asset price is outside the breakeven points, it becomes profitable.

- The Neutral Long Iron Butterfly options strategy limits both gains and losses. Maximum profit is seen when the price falls higher than the upper strike or lower than the lower strike.

- On the other hand, maximum loss happens when the price is right at the middle strike. It is a net debit strategy as long as it involves buying ATM and selling OTM options.

Example

To understand how the options strategy works, consider a trader looking at the Nifty chart and predicting it to move in either direction but expecting that the volatility will increase.

Based on these predictions, he initiates a long iron butterfly where he sells 1 OTM put at $65 with a strike price of 9100, buys 1 ATM put at $105 strike price of 9200, buys 1 ATM call at $70 with a strike price 9200 and sells 1 OTM call at $30 with strike price 9300.

Here are some scenarios where the Nifty could expire and the respective consequences on the trade.

Nifty is trading at 8800 at expiration. If the underlying price is lower than the breakeven point, the trader makes a profit. Even when the price rises to 9000, he makes a profit as the underlying price is below the breakeven point. When the price is the same as the lower breakeven point, 9120, the trade will be neither profitable nor at a loss.

Suppose Nifty rises to 9200 at the expiration date. The trader incurs a loss because the underlying asset price falls between the two critical points. When the price is 9280, it equals the upper breakeven point, and the trader incurs neither a loss nor profit.

Again as the price rises above this price, the trader starts making a profit because the underlying price is above the upper breakeven point. The max profit is $1500 here and occurs when the index is either above the upper strike or below the lower strike. On the other hand, the maximum loss is limited to the net premium, which is $6000. Here, that occurs when the index is at the middle strike.

- It is important to note here that the maximum risk for the strategy is 11.5 times the highest profit. A major limitation of the Long Iron Butterfly is a much higher risk/reward ratio. The strategy is particularly useful to seasoned options traders and doesn you can benefit from a move in an upward or downward direction.

- Maximum loss is limited.

- It can be executed using a small investment.

- Provides more steady income with lesser risk than directional spreads.

- Risk and reward parameters are easy to define.

Downsides

- The risk is much higher than the potential reward.

- There is a chance you could lose all of the invested amounts.

- Time decay hurts the trader, particularly when a position is unprofitable.

- A decline in volatility can hurt the position when the price is near the middle strike.

- Maximum profit is seldom earned.

- Commission costs can be higher as four positions are opened and closed.

Summary

Iron butterflies are intended to provide investors and traders with a steady income stream while limiting risk exposure. However, the neutral long iron butterfly strategy should be used when you are sure that the underlying asset price will move significantly.

Such a strategy usually makes sense before an earnings release or a big impending announcement such as interest rate hikes, jobless claims, and other such events that are likely to be substantial movers and shakers.

It can also prove profitable when there is an increase in volatility. It should only be initiated after carefully understanding the potential risks and rewards recommended for experienced options traders.