Bullish Bull Call Ladder

What Is A Bull Call Ladder Strategy?

A Bull Call Ladder is nothing but an extension of a Bull Call Spread. There is a primary difference between the two. Unlike in a Bull Call Spread (where the trader buys an ATM (At-The-Money) call and sells an OTM (Out-of-the-Money) call), in a Bull Call Ladder, the trader buys an ATM call and sells two OTM calls having different strike prices. Hence, this leads to three created legs following this strategy: a lower, a middle, and a higher leg. The lower leg represents a long ATM Call, the middle leg represents a short OTM Call, and the higher leg represents the other short OTM Call.

An Overview

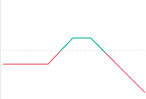

Before delving deeper into the policy, it is imperative to understand the breakeven point of this strategy. A Bull Call Ladder offers two breakeven points, an upper and a lower. The point above which the underlying price has to rise for the trader to reap a profit is the lower breakeven point. Until the lower breakeven point, the strategy remains an unprofitable one. On the other hand, the limit below which the underlying price has to stay to enable the policy to continue to be profitable is the upper breakeven point. The strategy will turn unprofitable if the underlying price goes beyond the upper breakeven point.

Thus, one can note that the strategy offers to be profitable when the underlying price is between the upper and the lower breakeven points. Movement of the underlying price beyond these points (i.e. below the lower breakeven point and above the upper breakeven point) results in the strategy becoming an unprofitable one.

Risk Profile

The Bull Call Ladder offers some pros like a reduced cost and a lower breakeven point of the strategy. However, these benefits do not come for free. The Bull Call Ladder has an amplified risk involvement. Unlike in a Bull Call Spread, where the maximum risk is limited to the magnitude of the net premium paid, the Bull Call Ladder has maximum risk: a maximum upside risk and a maximum downside risk.

The trader loses the entire net premium amount when a maximum downside risk occurs wherein the underlying price falls to or even below the lower strike price. A maximum upside risk occurs when the underlying price rises above the upper breakeven price. In such a scenario, the trader could face potentially unlimited losses as he has two short-call positions open against just one long call.

Thus, a trader must pay special attention to rising underlying prices when adopting this strategy. When the underlying price touches and sustains above the higher strike price, the trader must modify the strategy to make it further bullish or exit the position altogether if the need arises.

How Is It A Net Debit And Not A Net Credit Strategy?

Although a Bull Call Ladder is a net debit strategy, one may wonder how it is a net debit strategy when two options are sold in place of one. The strategy can be a net credit since the trader buys one ATM call and sells two OTM calls. This is possible when the two calls chosen for selling are close to the strike chosen to buy a Call.

However, such a strategy imposes high risks to the options trader as the upper breakeven point will be too close. Such closeness to the above breakeven point can make the position lose money quickly in case of a rise in underlying prices. Thus, a Bull Call Ladder is generally a net debit strategy and not a net credit one.

How Do You Trade To Create A Bull Call Ladder?

Let Us Take A Look At An Example

Let us say that Mr X, based on his observations on Nifty, has decided to initiate a Bull Call Ladder strategy, wherein he will buy one ATM 8100 Call at Rs.470 and sell one OTM 8600 Call at Rs.230 and another OTM 8800 Call at Rs.170.

To Summarize:

- Strike price of long Call = 8100

- Strike price of middle short Call = 8600

- Strike price of higher short Call = 8800

- Long Call premium (lower strike) = Rs.470

- Short Call premium (middle strike) = Rs.230

- Short Call premium (higher strike) = Rs.170

- Net Debit = Rs.70 (470-230-170)

- Net Debit (in value terms) = Rs.5,250 (70*75)

- Lower breakeven point = 8170 (8100+70)

- Upper breakeven point = 9230 (8800+8600-8100-70)

- Maximum downside risk = Rs.5,250

- Maximum upside risk = unlimited

- Maximum Potential Profit = Rs32,250 ((8600-8100-70)*75)

Now, let us assume a few scenarios in terms of where Nifty would be on the expiration date and the impact this would have on the profitability of the trade.

| Underlying Price at Expiration | Profit/(Loss) from Buying @ 8100 | Profit/(Loss) from Selling @ 8600 | Profit/(Loss) from Selling @ 8800 | Total Profit/(Loss) |

|---|---|---|---|---|

| 8000 | (35250) | 17250 | 12750 | (5250) |

| 8100 | (35250) | 17250 | 12750 | (5250) |

| 8170 | (30000) | 17250 | 12760 | No Profit No Loss |

| 8300 | (20250) | 17250 | 12750 | 9750 |

| 8600 | 2250 | 17250 | 12750 | 32250 |

| 8800 | 17250 | 2250 | 12750 | 32250 |

| 9000 | 32250 | (12750) | (2250) | 17250 |

| 9230 | 49500 | (30000) | (19500) | No Profit No Loss |

The table above clearly shows that the trader continues to incur losses until the underlying price is below the lower breakeven price. The incurred loss is limited to the extent of the net debit of the strategy. One can also observe that the trader begins gaining once the underlying price rises above the lower breakeven price.

The profit potential stretches to its maximum when the underlying price is between the middle and the higher strike price. Once the underlying price rises above the higher strike price, the profitability of the trade starts reducing until the price reaches the upper breakeven point. You can also observe that, beyond this point, the trader begins suffering losses again at a catastrophic rate as these losses are uncapped and thus, have no limit.

When To Use This Trading Strategy?

A Bull Call Ladder strategy is best-suited for intermediary and advanced options traders in a moderately bullish market. Options traders must execute this strategy if they expect the market conditions to be less volatile upon detailed study. The market should remain between the strike price for traders to benefit from this strategy.

Advantages Of A Bull Call Ladder Strategy

- The overall cost of the strategy is reduced even more than in a Bull Call Spread.

- The lower breakeven point of the strategy is also reduced much more than in a Bull Call Spread.

- The options trader can exercise his preference over choosing the two strikes for shorting the Calls.

Drawbacks Of A Bull Call Ladder Strategy

- The losses know no bounds once the underlying price goes beyond the upper breakeven price.

- This strategy requires a considerable margin in your trading account as the Bull Call Ladder involves selling two options.

- Theta will function against the trader till the underlying price is below the lower breakeven point.

Conclusion

A Bull Call Ladder strategy is a limited profit, unlimited loss type of options strategy. It is highly suitable for intermediate or advanced options traders, and beginners must not deploy it. It is a moderately bullish strategy where the trader benefits when the underlying price goes up to the middle strike allowing him to maximise the profit potential of the Bull Call Ladder.

The underlying price movement beyond the middle strike will lead to profits for the trader. The profits will continue till it does not rise above the higher strike price. The strategy turns bearish once the underlying price begins to go beyond the higher strike price. And the profit potential of the trader sees a downfall. Thus, the Bull Call Ladder is moderately bullish till the underlying price is below the higher strike price. It becomes bearish once the underlying price moves beyond the higher strike price.