Bullish Bull Put Spread

What is Bull Put Spread?

For the uninitiated, a Bull Put Spread is one of the option strategies you, as an investor, use. This is done when the underlying asset price is expected to increase at least moderately. Underlying assets are what provide the basis upon which a derivative price rests. To understand Bull Put Spread, you have to understand what an option is. It is also sometimes called a Bull Put Credit Spread strategy when investors expect the instruments to be less uncertain or volatile. The goal of the strategy is to profit from neutral to bullish price action in the underlying stock.

This means one buys a Put Option and sells it at different strike prices, thus keeping in check the risk as also the reward. It is used by the more conservative investors who are risk-averse. This is what is meant by Bullish Bull Put Spread. It is a limited risk to reward strategy. It works if you are not willing to risk too much. Consequently, your rewards might also be limited, but you are willing to face that. It is considered a variation of the writing strategy where an options investor can write a put on stock and purchase the stock at a good price.

When you short-sell a put option while at the same time you buy another put option and they have the same expiration date, but with a lower strike price, you are employing what is a Bull Put Spread. A Bull Put Spread mitigates the risk by buying concurrently, reducing the net premium received but lowering the risk considerably.

A vertical spread has four basic types: one of them is Bull Put Spread. A Bull Put Spread, when involved, has the investor receiving an upfront payment and is also sometimes called a Credit (Put) Spread. So, a vertical spread has

- Bull Put Spread

- Bull Call Spread

- The Bear Call Spread

- The Bear Put Spread

If investors wish to profit from declining stock prices, they use put options as they give the ability - without the obligation - to sell a stock.

What Is an Option?

An option is a financial instrument based on the actual value of any form of underlying securities. They could be stocks. When an options contract is provided to a buyer, the buyer has the chance to sell or buy. The independence of whether they want to buy or sell an asset rests entirely with the holder of the option.

It is important to remember that every contract could have a different expiration date, and the holder has to exercise the option within that date. The entities that normally buy and sell options are online brokers. Any strategy has the option of a high or low strike price. The net credit is the difference between the two options.

Example of a Bull Put Spread

Let us, hypothetically, consider an investor who is bullish on Reliance. Their stock, let's imagine, is currently trading at INR 275 a share. So now, to implement a Bull Put Spread, what does the person do?

He sells a Put Option for INR 8.50 with a strike of INR 280 that will expire in one month and buys one put option for INR 2; this one has a strike of INR 270 that will expire in a month. This investor thus gets a profit of INR 6.50 for both the options - INR 8.50 - INR 2 premium paid. If we consider that one option contract is 100 shares, the total amount received as credit is INR 650.

It is safe to execute a Bull Put Spread when, in place of purchasing naked calls with much higher outflow, traders can sell higher strike calls, which helps fund the outflow, resulting in a fully hedged strategy. You can identify a clear uptick which is essential. It will not cause much damage if a breakout does not materialize. The best time is when you expect an incremental but slow rise in prices.

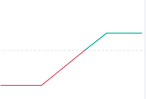

Profit/Loss Diagram and Table: Bull Call Spread

| Long 1 100 call at | (3.30) |

| Short 1 105 calls at | 1.50 |

| Net cost = | (1.80) |

Stock Price at ExpirationLong 100 Call Profit/(Loss) at ExpirationShort 105 Call Profit/(Loss) at ExpirationBull Call Spread Profit/(Loss) at Expiration

| 108 | +4.70 | (1.50) | +3.20 |

| 107 | +3.70 | (0.50) | +3.20 |

| 106 | +2.70 | +0.50 | +3.20 |

| 105 | +1.70 | +1.50 | +3.20 |

| 104 | +0.70 | +1.50 | +2.20 |

| 103 | (3.30) | +1.50 | +1.20 |

| 102 | (3.30) | +1.50 | +0.20 |

| 101 | (3.30) | +1.50 | (0.80) |

| 100 | (3.30) | +1.50 | (1.80) |

| 99 | (3.30) | +1.50 | (1.80) |

| 98 | (3.30) | +1.50 | (1.80) |

| 97 | (3.30) | +1.50 | (1.80) |

| 96 | (3.30) | +1.50 | (1.80) |

How Can You Profit From a Bull Put Spread?

The Bull Put Spread is a great strategy to earn premium income without taking many risks. You can buy stocks at reduced prices - i.e., you can get the stocks you want at a price that is significantly lower than what is currently the price in the market.

The Bull Put Spread can generate income when the going is difficult. Put writing is always quite risky, especially when markets seem on a downward slide. No other bullish strategies work very well at times like these except for this. You can capitalize on marginally higher markets. Buying calls and initiating Bull Call Spreads do not work well when markets go through this churn. The Bull Put Spread strategy works best when you think that the price of a particular underlying will either rise, move laterally, or fall, but not a great deal.

What Are the Advantages of a Bull Put Spread?

With the Bull Put Spread, an investor's risk is limited, and the investor does not incur heavy losses. Typically, options either expire or die out, and the Bull Put Spread takes advantage of this time decay.

Moreover, you can customize a Bull Put Spread and tailor it to suit your risk profile. For instance, if you are a conservative investor, you can choose to have the strike prices close together, which will bring down the maximum risk and the maximum potential gain. If you choose to be aggressive, you could prefer a wider spread and maximize gains. However, this also has the potential of you facing a huge loss if the stock declines. The Bull Put Spread strategy makes it easy to correct loss-making Long Put.

What Are the Disadvantages of Bull Put Spread?

As one can expect, the one disadvantage is the limited profit one gets from this. Also, the time decay can work against you in loss situations. It is important to identify clear areas of support as well as resistance. In the event of the stock closing below the lower strike put, there is a significant possibility of one losing money.

Key Takeaways

- The scenario where you can make the maximum profit when employing the Bull Put Spread is when both the options remain unexercised. Inversely, maximum loss happens when both the options are exercised.

- A Bull Put Spread is an options strategy employed by the investor, especially for situations where he expects a mild increase in the value of the underlying asset.

- A Bull Put Spread primarily has one short put with a higher strike price and one long put with a lower strike price.

- An investor executes a Bull Put Spread by buying a put option on security and selling another put option for the same date but at a higher strike price.

- It is possible to exit from the Bull Put Spread plan. You have to wait for options to expire to keep the premiums you got and buy back the Short Put options and sell the Put options you bought. This way, you get to exit from the Bull Put Spread strategy you used, but you also get maximum profits from your strategy.

- The maximum profit in a Bull Put Spread is the difference in the premium costs of the two put options. When the stock's price closes somewhat above the higher strike price at expiry, this is what occurs. You should wait for options to expire to retain the premiums you have got, and only then will you be in a position to buy back the short put options.

- Both puts have the same underlying stock and the same expiration date. A Bull Put Spread is established to get a net credit (or net amount received) and profits from a rising stock price, time erosion, etc. Potential profit is limited to the net premium received fewer commissions, and potential loss is limited if the stock price falls below the long put's strike price.

Conclusion

The Bull Put Spread is a suitable option for generating premium income or buying stocks at effective below-market prices. However, while the risks when using this strategy are limited, the chances of heavy gains are also similarly limited. The more savvy and sophisticated investors might not find this a very attractive strategy.