Bear Bull Put Ladder Strategy - Detailed Guide and Explanation - 5Paisa

In a bearish market, stock prices tend to decrease or stay stable at a particular position. The Bull Put Ladder is an excellent strategy for traders to reap the benefits in such a market. The Bull Put Ladder combines a Bull Put Spread and an Extra Long Put with a lower strike price. If the stock price of the selected share keeps plummeting, the potential profit one can make using this strategy is unlimited. It can be used when the trader is not sure about the decreasing direction of the market and wants to make a profit while limiting their losses.

So let's look at what Bull Put Ladder strategy is all about and how you can execute it for your investment.

What is Bull Put Ladder Strategy?

The Bull Put Ladder is a Bearish Strategy that can offer unlimited returns to traders if the stock continues to fall and provides defined returns if the stock price rises with limited risk. The market expectation for this strategy should be extremely bearish with high volatility. The strategy is a 3-leg strategy where:

- The trader sells one ATM put.

- Buys one OTM put.

- Again Buys one OTM put with an even lower strike price.

This strategy aims to reduce the overall cost of the strategy and lower the upper breakeven point and lower breakeven point, ensuring that the underlying risk is low. The upper breakeven point in this strategy is below the stock's underlying price will have to fall for the trader's net cost to become nil and for the position to start making a profit. Meanwhile, the lower breakeven point is when the trader would not want the underlying price to fall, which would mean incurring heavy losses.

In this strategy, there are two breakeven points: upper and lower. The ideal scenario for the trader is to ensure that the stock price is above the upper breakeven point, making it profitable as the trader can retain the entire or portion of the net premium received. Similarly, with the lower breakeven point, the trader has the potential to earn unlimited profits, as in between these two breakeven points is the loss zone. The maximum loss under the strategy is limited and occurs when the underlying price is between the lower and middle strike price.

Benefits and Drawbacks of Bull Put Ladder

Since the Bearish Bull Put Ladder strategy has an OTM put option with a higher strike price, and a buy call with the same number of OTM Put options having a middle strike price along with the same number of OTM put options, at a lower strike price, there are several advantages. These are:

- As long as the underlying price keeps going down, the potential for unlimited profits is below the lower breakeven point.

- Potential to retain the entire net premium if the underlying price is above the strike price

However, this strategy also has its negatives. Some of these are:

- Uncertainty as the approach involves a net debit strategy.

- The underlying price can get stuck between the two breakeven points when the trader can suffer huge losses.

- Time decay is harmful when the price is near the higher strike PUT.

Characteristics of Bull Put Ladder

- Maximum Loss: Unlimited, as the loss can be (Middle Strike Price - Higher Strike Price) + Net Debit. This high risk involved is why traders should invest using this strategy only when they are sure about the market situation.

- Maximum Profit:Unlimited. This makes it ideal in the Bearish market to make huge profits.

- Time Decay [Theta]:Time decay can positively impact the higher strike PUT and have a harmful impact on the lower strike PUT.

- Volatility Impact [Vega]: Increase in volatility is helpful when the price is near the lower strike PUT, but volatility can also be harmful if the price is near the higher strike PUT.

- Lower breakeven point:Lower strike price - Maximum loss.

- Upper breakeven point:Higher strike + Net debit (or - Net credit)

Example of Bull Put Ladder In Action

To illustrate how this strategy works, let us consider an investment in NIFTY50, wherein a trader sells 1 ATM 20,000 PUT at Rs. 1500, buys 1 OTM 19,000 Put at Rs. 700 and another OTM 18,5000 PUT at Rs. 600. Here are the details of the strategy:

- Strike Price at shortPut = 20,000

- Strike Price at middle longPut = 19,000

- Strike Price of lowerlongPut = 18,500

- ShortPut Premium (Higher Strike) = INR 1500

- LongPut Premium (Middle Strike) = INR 700

- LongPut Premium (Lower Strike) = INR 600

- Net Credit = Rs. 200; calculated as (Higher Strike - Middle Strike - Lower Strike) i.e. (1500-700-600)

- Net Credit Value = INR 4,000 (200*20)

- Upper Breakeven Point = 19,800

- Lower Breakeven Point = 17,700

- Maximum upside = INR 4000

- Maximum downside = unlimited

- Maximum Risk = INR 16,000 [(20000-19000-200)*20]

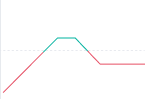

Here's what the premium pricing chart will look like:

| Underlying Price | Net Profit / Loss |

|---|---|

| 25,000 | INR 4000 (Profit) |

| 22,000 | INR 4000 (Profit) |

| 20,000 | INR 4000 (Profit) |

| 19,900 | INR 2000 (Profit) |

| 19,800 | NIL (No Profit, No Loss) |

| 19,500 | INR 6000 (Loss) |

| 19,000 | INR 16,000 (Loss) |

| 18,500 | INR 16,000 (Loss) |

| 18,000 | INR 6000 (Loss) |

| 17,700 | NIL (No Profit, No Loss) |

As can be seen in this table, the maximum the trader gains when the NIFTY50 figure moves upward is INR 4000, which is the net premium that the trader received upfront. On the other hand, there is a potentially unlimited profit-making option if the market plummets below the lower breakeven point. The deeper the fall, the more the trader has to gain in this strategy.

However, also see the risk if the NIFTY50 is stuck between the breakeven points. In this scenario, the trader can suffer losses of up to INR 16,000. The only good side here is that the losses are limited.

Recommendations for Bearish Bull Put Ladder

In Summary, the Bull Put Ladder can be executed in two phases. In the first phase, you will Sell a PUT at a higher strike and instantly buy a put at a slightly higher strike. Next, when you have set up your Bull Put Spread, you will Buy another PUT at a lower strike price to adjust the Bull Put Spread and make it a Bull Put Ladder. If the underlying price declines, you want it to fall below the lower breakeven point, so carefully choose the long Put strike.

This strategy can be executed when market conditions are slightly volatile but rising. To exit, there are two options in front of traders. First, they can book profits when the price stays above the support zone. Traders can also book profits as the difference between the spreads keep coming down. Upon receiving 50% of the net premium, you can close the position or manage it with a stop loss once you receive your target premium.

The other option is to buy a PUT to adjust the position. If the prices plummet significantly, make sure to manage the lowest strike PUT with a stop loss as there is a chance for the price to come back and reset the support zone. Traders can then book profits at the lower strike OTM Put and continue holding the spread.