Top BESS Stocks in India 2026: Battery Energy Storage Leaders to Watch

Will the PSU Bank Stock Rally Continue?

Last Updated: 16th December 2022 - 04:47 pm

PSU bank stocks have been making headlines recently due to their impressive performance in the market.

The performance of PSB stocks last month has been spectacular.The NIFTY PSU bank index has rallied 93% in the past year, while the NIFTY bank index has only gained 33% in the same period. Some individual PSU bank stocks have even seen significant increases in their share prices. For instance, In the last one month, Punjab and Sind Bank's stock is up nearly 71%, while UCO Bank's stock has increased by 55%. Union Bank of India has seen a 51% price increase, while Bank of India has seen a 42% increase and Central Bank of India has seen a 39.5% increase. On a year-to-date (YTD) basis, Bank of Baroda, Indian Bank, and Union Bank of India have more than doubled in value for investors.. While, SBI and Canara Bank have hit their all time highs.

The rally in the PSU bank stocks is unusual and perplexing. Because, you see PSU bank stocks have never been investor favorites. Most of them traded below their book value the longest time.

Why?

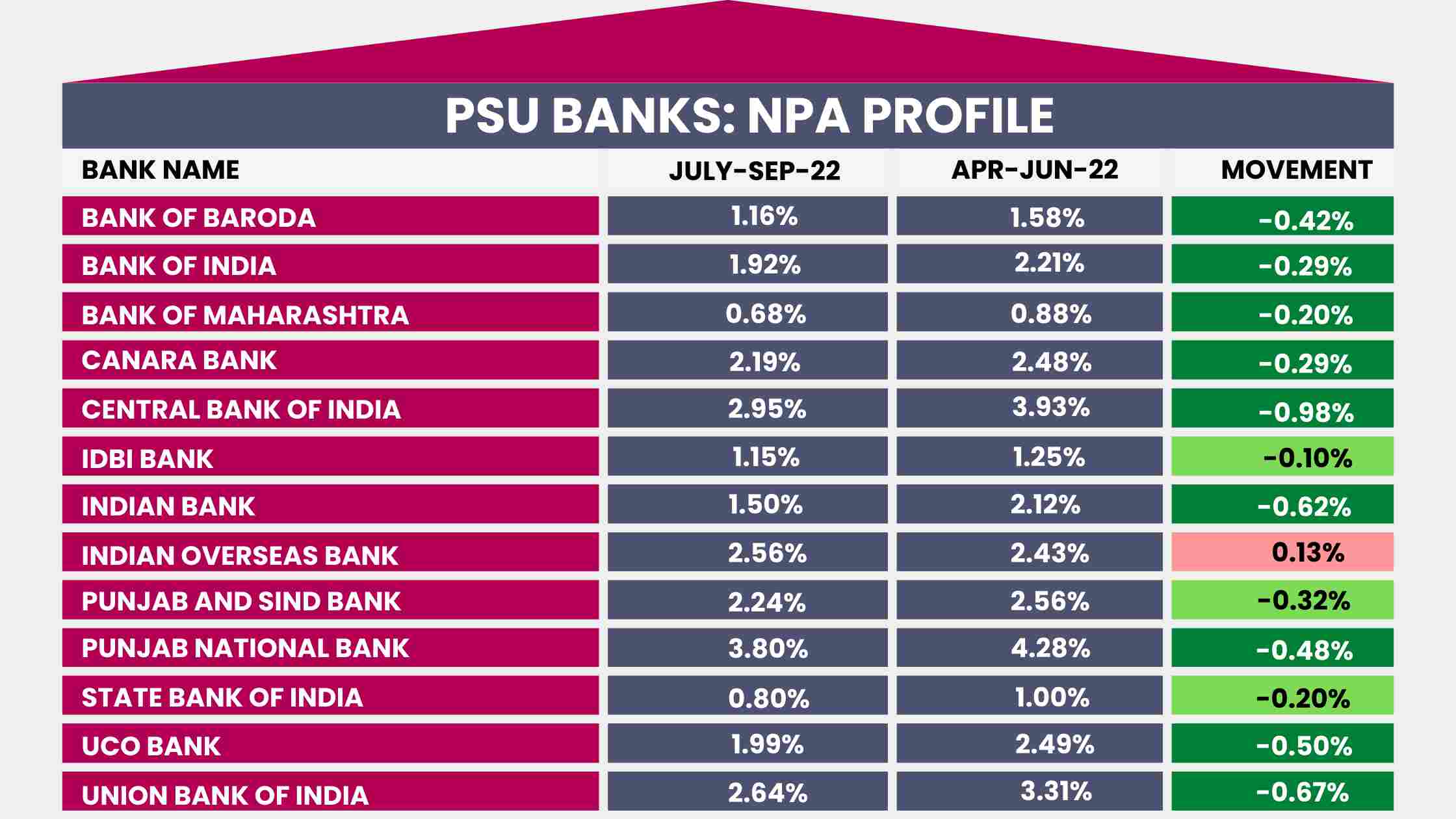

Well, these banks have been at the forefront when it comes to loan frauds and high NPAs. Due to their reckless lending and poor operational efficiencies they had high NPAs and poor capital adequacy.

In 2015, when Reserve Bank of India introduced new rules under then-Governor Raghuram Rajan to address the recognition of bad loans by banks. The bad loans of these PSU banks skyrocketed. Bad loans, which were around 3.1 lakh crore rupees in the fiscal year 2015, rose to nearly 10.4 lakh crore rupees by the end of the fiscal year 2018, and a majority of them appeared on the balance sheets of public sector banks.

The situation was so grim that the government had to step in to ensure their survival. Govt infused a total of 3.10 lakh crore rupees through new capital over a five-year period and also merged 10 of the banks into four larger ones in an effort to reduce operational costs.

Once frowned upon by investors because of low asset quality and laggard management. These stocks have now suddenly become investor favorites.

What has changed now?

Well, it is because most of these banks reported better-than-expected results in the recent quarter.

Together, PSU banks saw a 50% increase in net profit, totaling a whopping Rs 25,685 crore. And leading the charge was none other than the State Bank of India, which contributed more than half of the combined profit with its own highest-ever profit of Rs 13,265 crore – a staggering 74% increase from the previous year.

Other banks also saw impressive growth, with Bank of Baroda's net profit jumping 52.8% to Rs 3,313 crore and Canara Bank's net profit rising 25% to Rs 2,525 crore. Even Punjab National Bank, which has struggled in the past, saw a 33% increase in net profit to Rs 411 crore.

Overall, ten of the public sector banks saw profits ranging from 13-145% during the second quarter of the fiscal year, with UCO Bank and Bank of Maharashtra recording the highest percentage growth at 145% and 103%, respectively. It's clear that these state-owned banks are on the rise and continuing to perform strong in the market."

Not only did they see impressive earnings, but they also reported improvements in the quality of their assets and a boost in credit growth.

As you can see in the image, the net NPA of most PSBs have improved in the recent quarter.

Analysts are also bullish on the PSBs. Analysts believe that the banks were able to report good numbers because of the rise in deposits, which increased due to change in lending rates.

PSU banks are expected to see a boost in their return ratios thanks to improving asset quality, a surge in loan growth, stronger capital adequacy, and lower provisions. The market has already begun to factor in these positives, leading to an improvement in PSU bank valuations.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advanced Charting

- Actionable Ideas

Trending on 5paisa

03

5paisa Capital Ltd

5paisa Capital Ltd

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Capital Ltd

5paisa Capital Ltd