What is the Renko Chart?

Last Updated: 3rd June 2024 - 12:08 pm

Understanding price movements is crucial in trading and investing. While traditional charts like candlesticks and bar charts are widely used, a unique charting technique offers a refreshing perspective: the Renko chart. Originating from Japan centuries ago, Renko charts provide a simplified view of price action, making it easier for traders to spot trends and make informed decisions.

What is a Renko Chart?

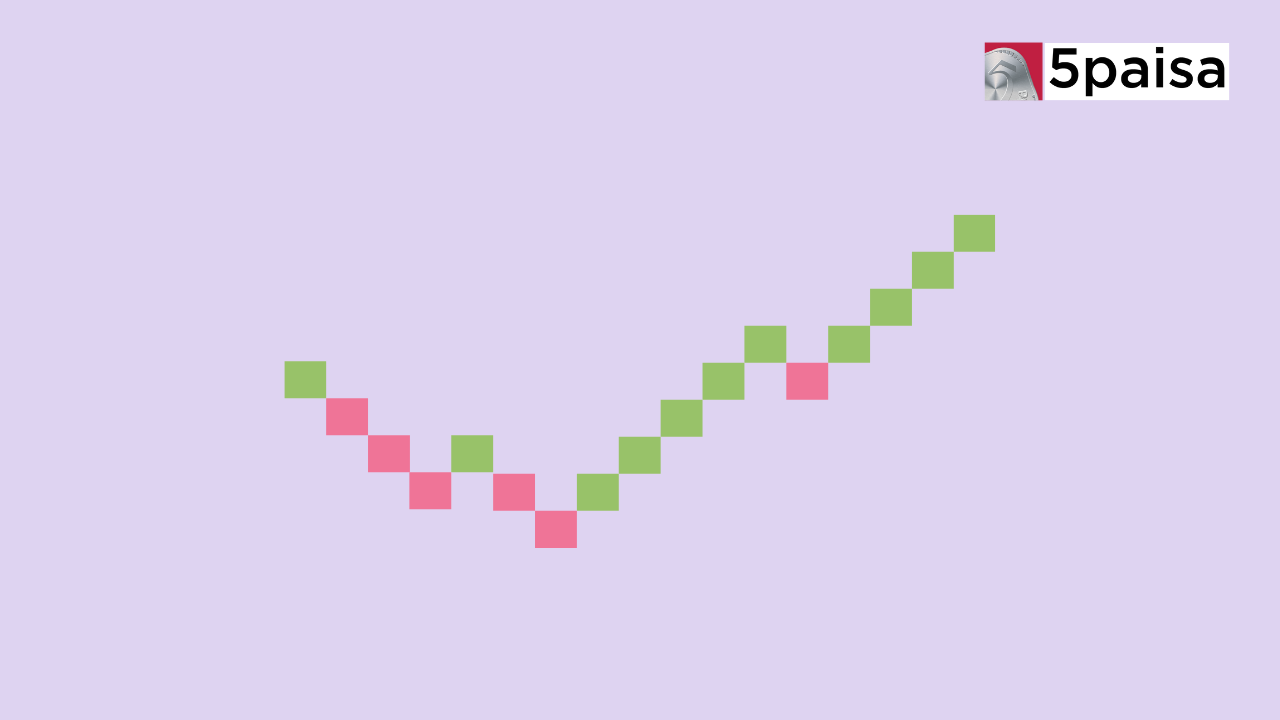

A Renko chart displays price movements without considering the passage of time. Unlike candlesticks or bar charts plotting price data against a time axis, Renko charts are built using bricks or blocks representing specific price changes. Each brick is formed based on a predetermined price movement, known as the "brick size," which can be set to any desired value, such as one point, rupee, or dollar.

The Renko chart filters out minor fluctuations, focusing solely on significant price movements. This helps traders identify trends and key support and resistance levels more easily.

How Does a Renko Chart Work?

Let's understand Renko charts with an example. Imagine you're analysing a stock's price and setting the brick size to one rupee. If the stock's price is currently at ₹50 and moves up to ₹52, a green brick will be drawn on the chart to indicate the price increase. If the price drops to ₹49, a red brick will be added to the chart, signalling a downward movement.

The formation of new bricks continues in this manner, with green bricks representing upward price movements and red bricks representing downward price movements. No new brick will be drawn if the price movement is less than the specified brick size. This filtering out of minor price fluctuations gives Renko charts their distinctive appearance and reduces market noise.

Benefits of Renko Charts

Renko charts offer several advantages over traditional charting methods, making them a valuable tool for traders and investors. Here are some key benefits in simple terms:

● Simplicity: Renko charts are known for their simplicity, displaying only price movements without the clutter of time intervals or other extraneous data. This makes them easy to read and understand, even for beginner traders.

● Trend Identification: One of the biggest advantages of Renko charts is their ability to clearly identify trends. By removing market noise and focusing solely on significant price movements, Renko charts make it easier to spot prevailing trends and potential reversals.

● Clarity: Since Renko charts eliminate the time factor, they provide a clearer picture of price action. This is particularly useful when comparing data from different periods, as it removes the impact of time and allows traders to focus solely on price patterns and trends.

● Reduced Noise: Renko charts filter out minor price movements, reducing market noise and displaying only the most relevant price data. This helps traders focus on the trends and patterns that matter without being distracted by insignificant price fluctuations.

● Forecasting Potential: Renko charts can be used to forecast future price movements. They display patterns and trends in an easy-to-read format, enabling traders to identify potential trading opportunities.

How to Use Renko Charts (with Examples)

Using Renko charts effectively requires an understanding of their unique features and the strategies employed by traders. Here are some key aspects to consider when using Renko charts, explained in simple terms:

● Setting Brick Size: Brick size is an important parameter in Renko charts, as it determines how sensitive the chart is to price movements. A larger brick will filter out more noise, while a smaller brick will make the chart more sensitive to price movements. Traders often experiment with different brick sizes to find the one that best suits their trading style and market conditions.

● Entry and Exit Signals: Renko charts can provide valuable signals for when to enter or exit a trade. Some common signals include the formation of new upward or downward-trending bricks after a period of consolidation, price breaking out from a trading range, and divergences between price action and momentum indicators.

● Chart Patterns: Like candlestick charts, Renko charts can also exhibit recognisable patterns that may signal potential trend reversals or continuations. Examples include Renko rectangles (consolidation patterns), Renko triangles, Renko wedges, and Renko triple tops/bottoms. Traders can use these patterns and other technical indicators and analysis techniques to make informed trading decisions.

Example: Let's say you're analysing the price of a stock using a Renko chart with a brick size of ₹2. The current price is ₹100, and the chart shows a series of green bricks, indicating an upward trend. Suddenly, you notice a red brick forming, suggesting a potential reversal. You can use this signal and other technical indicators and chart patterns to decide whether to exit your long position or wait for further reversal confirmation.

Renko Charts vs. Heikin Ashi Charts

While Renko charts are unique in their approach, they share some similarities with another Japanese charting technique called Heikin Ashi charts. Both charts aim to highlight trends and filter out market noise, but they differ in their construction methods.

Heikin Ashi charts create their bars or candles by averaging the open, high, low, and close prices for the current and previous time periods. This means that the size of each bar or candle is different, reflecting the average price. Heikin Ashi charts are useful for highlighting trends, similar to Renko charts. However, they still incorporate the time factor, which Renko charts eliminate.

Conclusion

Renko charts offer a unique and simplified perspective on price action, giving traders a clearer view of market trends and significant price movements. By filtering out market noise and focusing solely on price, Renko charts help traders identify trends, support and resistance levels, and potential trading opportunities with greater clarity. While they have limitations, such as the lack of detailed price data and the potential for false signals, Renko charts remain valuable to any trader's toolkit when used with other technical analysis techniques.

Frequently Asked Questions

Are There Any Limitations to Using Renko Charts?

Can Renko Charts Provide False Signals?

What Are Common Trading Strategies with Renko Charts?

- Flat ₹20 Brokerage

- Next-gen Trading

- Advanced Charting

- Actionable Ideas

Trending on 5paisa

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Capital Ltd

5paisa Capital Ltd