Weekly Outlook on Natural Gas - 07 June 2024

Weekly Outlook on Copper- 10 Oct 2022

Copper prices retreated on Thursday after touching their highest in two weeks due to the regained dollar and the president's worries that higher interest rates may dent metals demand. During the week, copper prices rose by 1.8% as the LME exchange imposed conditions on new metal deliveries from Russian mining & Metallurgical Co and a subsidiary.

LME copper slipped 4% after touching a high of 7875 on Thursday, as the outlook for copper remains pressured by slowing economic growth across the globe. However, Chinese government stimulus and hope of easing coronavirus restrictions in Beijing could support the metal market further.

The dollar index also resumed its upward rally on Wednesday after a profit booking from the higher levels. Focus now turns to upcoming U.S nonfarm payrolls data to strengthen the momentum.

In the last two weeks, LME copper witnessed a sharp recovery from the low of 7223 levels and set a weekly high of 7875 levels, but prices failed to sustain highs and corrected more than 4% in recent weeks, trading near 7552 levels in the last trading session. On a weekly chart, the price has reversed after taking a support at 200-weeks Simple Moving Averages that suggest positive strength in the counter. Moreover, the copper price also moved above the Middle Bollinger Band formation, which indicates further support for the near term. On the downside, it may find support around 7223 and 7000 marks, while on the upside, resistance is at 7900 and 8050 levels.

Weekly outlook on Copper

MCX copper witnessed some pullback but is still trading in the Bearish Pennant pattern on the weekly chart that indicates weakness in the counter. Moreover, the price has been trading below 100-week moving averages, which act as an immediate resistance zone. However, indicators like RSI & CCI are witnessing positive strength that could support prices further, but the upside should be capped due to the above formation. On the daily timeframe, it has formed a long bearish candlestick, a kind of Bearish Marubozu that shows bearishness for the near term. Hence, based on the above mixed parameters, the pullback moves may continue till Rs. 670/675 levels. However, on the higher side, it has a resistance at around Rs. 685/693 levels. While, on the downside the crucial support is at Rs. 630. For the coming week, traders can look for a sell-on rise strategy with proper SL & targets.

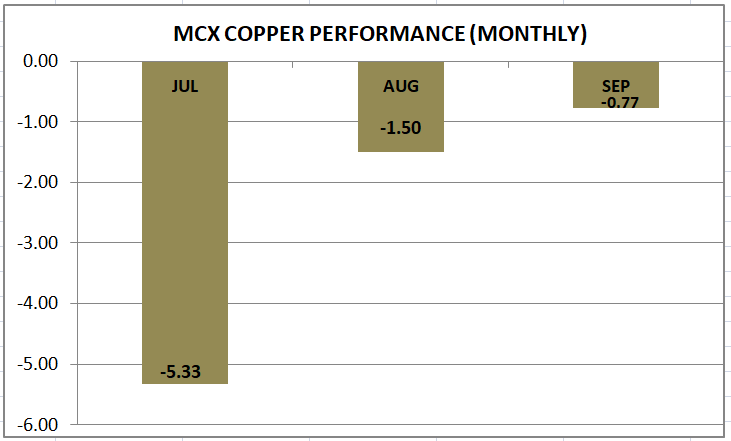

MCX Copper performance of last three months:

Important Key Levels:

|

MCX COPPER (Rs.) |

LME COPPER ($) |

|

|

Support 1 |

630 |

7223 |

|

Support 2 |

615 |

7000 |

|

Resistance 1 |

685 |

7900 |

|

Resistance 2 |

693 |

8050 |

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Commodities Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

5paisa Research Team

5paisa Research Team