Long Build Up vs. Short Covering: How to Profit from Each?

Understanding the Effects of Inflation on Stock Market Performance

Have you ever noticed how the same amount of money buys you less and less over time? That's inflation at work. And it doesn't just affect your grocery bill - it can greatly impact your investments, especially in the stock market. Let's dive into what inflation means for investors and how it can shake things up in the world of stocks.

What is Inflation?

Simply put, inflation is when prices go up over time. It's like everything in the store is slowly getting more expensive. For example, a cup of coffee cost ₹50 last year. If there's 5% inflation, that same cup might cost ₹52.50 this year. It doesn't sound like much but adds up over time and across everything we buy.

In India, we measure inflation using the Consumer Price Index (CPI). This index looks at the prices of common goods and services that people buy regularly. The Reserve Bank of India (RBI) tries to keep inflation around 4%, give or take 2%. When it goes higher than that, it can start causing problems.

Why does inflation happen? There are a few reasons:

● Too much money chasing too few goods: If a lot of money is floating around but not enough stuff to buy, prices go up.

● Rising costs for businesses: If it costs more to make things (like higher raw materials or labour costs), companies often raise their prices to keep making a profit.

● People expecting prices to rise: If everyone thinks prices will go up, they might start spending more now, which can cause inflation to happen.

Inflation isn't always bad in small doses. A little bit can encourage spending and investment, which is good for the economy. But when it gets too high, it can cause all sorts of issues, including for the stock market.

How Inflation Works

To understand how inflation affects the stock market, we need to know more about how it works in practice. Let's break it down:

● Purchasing Power: This is probably the most obvious effect of inflation. As prices go up, each rupee you have buys less. If you had ₹1000 saved up to buy something, but its price increases due to inflation, you might not be able to afford it anymore.

● Interest Rates: When inflation starts climbing, the RBI often raises interest rates to try and slow it down. Higher interest rates make borrowing more expensive, which can cool down spending and investment.

● Wages and Salaries: In theory, wages should go up with inflation to keep pace with rising costs. But this doesn't always happen evenly or quickly, leaving people feeling the pinch.

● Business Costs: Companies also have to deal with rising costs. They might pay more for raw materials, energy, or wages, which can eat into their profits unless they raise their own prices.

● Investments: Inflation can be tricky for investors. If your investments aren't growing faster than the inflation rate, you're losing purchasing power over time.

Here's a simple example to illustrate:

Let's say you invest ₹10,000 in a savings account that gives you 3% annual interest. After a year, you'd have ₹10,300. Sounds good, right? But if inflation that year was 5%, your money's real value has decreased. You'd need ₹10,500 just to have the same purchasing power as when you started.

This is why many people turn to the stock market during inflationary times. Historically, stocks have often (but not always) provided returns that beat inflation over the long term. But as we'll see, inflation can shake things up in the stock market, too.

Effect of Inflation on Stock Market

Now that we understand inflation and how it works, let's examine how it can impact the stock market. It's not always straightforward, and different market parts can react differently.

Impact on the Stock Market Overall

When inflation rises, the whole stock market jumps. Here's why:

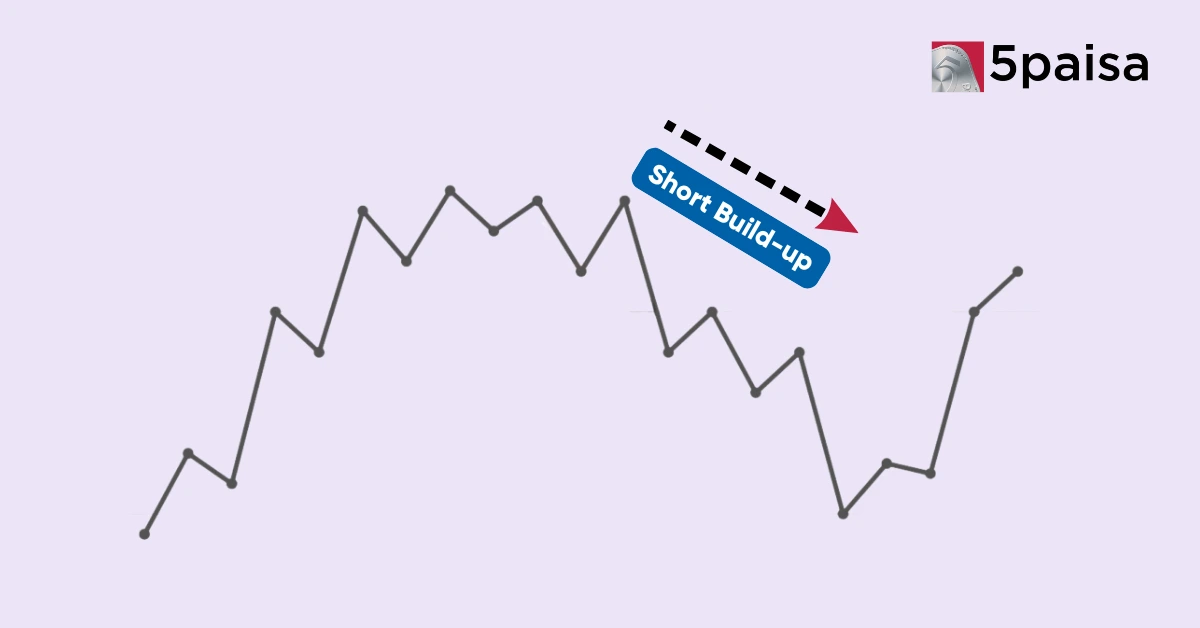

● Uncertainty: Inflation introduces many unknowns. Will the RBI raise interest rates? How will consumers react? This uncertainty can make investors nervous, leading to more ups and downs in stock prices.

● Changing Valuations: As we mentioned earlier, higher inflation often leads to higher interest rates. This can make stocks less attractive compared to safer investments like bonds, and as a result, stock prices might fall across the board.

● Sector Shifts: Some parts of the market might do better than others during inflationary times. For example, companies that can easily pass higher costs to customers (like consumer staples) might fare better than those that can't.

● Foreign Investment: If inflation in India is higher than in other countries, foreign investors might withdraw their money, looking for better opportunities elsewhere. This can put downward pressure on the whole market.

Let's look at a real-world example. In 2022, when inflation in India started climbing above 6%, the stock market became more volatile. The Sensex, steadily climbing, started to see more big swings up and down.

Impact on Companies

Inflation doesn't just affect the market as a whole - it can have big impacts on individual companies, too. Here's how:

● Rising Costs: As inflation pushes the price of raw materials, energy, and wages, companies face higher costs. Their profits can shrink if they can't pass these on to customers.

● Pricing Power: Some companies have an easier time raising their prices than others. For example, a company selling luxury goods might find it easier to raise prices than one selling basic necessities.

● Debt: Companies with a lot of debt might benefit from inflation in the short term. As the value of money decreases, so does the real value of their debt. But if interest rates rise, new loans become more expensive.

● Investment Decisions: High inflation can make it harder for companies to plan for the future. They might hold off on big investments if they're unsure about future costs and revenues.

For example, during periods of high inflation, we often see companies in the Fast-Moving Consumer Goods (FMCG) sector doing relatively well. Companies like Hindustan Unilever or ITC can often pass on higher costs to consumers without losing too many sales, as people still need their products.

Conversely, companies in sectors like automobiles or real estate might struggle more. These big-ticket items are easier for consumers to put off buying when times are tough.

Impact on Equities

When we talk about equities, we're referring to stocks - company ownership shares. Inflation can affect different types of stocks in different ways:

● Value Stocks: These are stocks of companies that are seen as undervalued. They often do better during inflationary times because they're already priced lower and might have more room to grow.

● Growth Stocks: These are stocks of companies expected to grow faster than average. They can struggle during high inflation because their future earnings are worth less when discounted back to present value at higher interest rates.

● Dividend Stocks: Companies that pay regular dividends can be attractive during inflation because they provide a steady income stream. However, if inflation outpaces dividend growth, these stocks can lose appeal.

● Cyclical Stocks: These are stocks of companies that do well when the economy is strong. However, if inflation leads to an economic slowdown, they can be hit hard by it.

Let's look at a concrete example. During the inflationary period in 2022, many technology stocks (often considered growth stocks) took a hit. Companies like Zomato or Paytm, which were very popular in 2021, saw their stock prices fall significantly as inflation rose and interest rates increased.

On the other hand, some value stocks in sectors like energy or materials did relatively well. For instance, Coal India saw its stock price rise as energy prices increased globally.

Impact on Stocks in the Long Run

While inflation can cause a lot of short-term turbulence in the stock market, its long-term effects can differ. Here's what investors should keep in mind:

● Historical Performance: Over very long periods, stocks have generally provided returns that beat inflation. This is why many financial advisors recommend stocks for long-term wealth building.

● Company Adaptation: Given enough time, many companies find ways to adapt to higher inflation. They might develop new products, find efficiencies, or successfully raise prices.

● Economic Growth: Moderate inflation often goes hand in hand with economic growth. As the economy grows, many companies see their profits grow, too, which can lead to higher stock prices over time.

● Compounding Returns: Even if inflation eats away at some of your returns, the power of compounding over many years can still lead to significant wealth accumulation through stocks.

For example, if we look at the performance of the Sensex over the past 20 years (from 2003 to 2023), we see that it has provided an annualized return of about 13%. During this same period, inflation in India averaged around 6-7%. So, even accounting for inflation, long-term stock market investors have seen real growth in their wealth.

It's important to note that this is an average over a long period. There were certainly years within this timeframe where inflation outpaced stock market returns.

Impact on Stocks in the Short Run

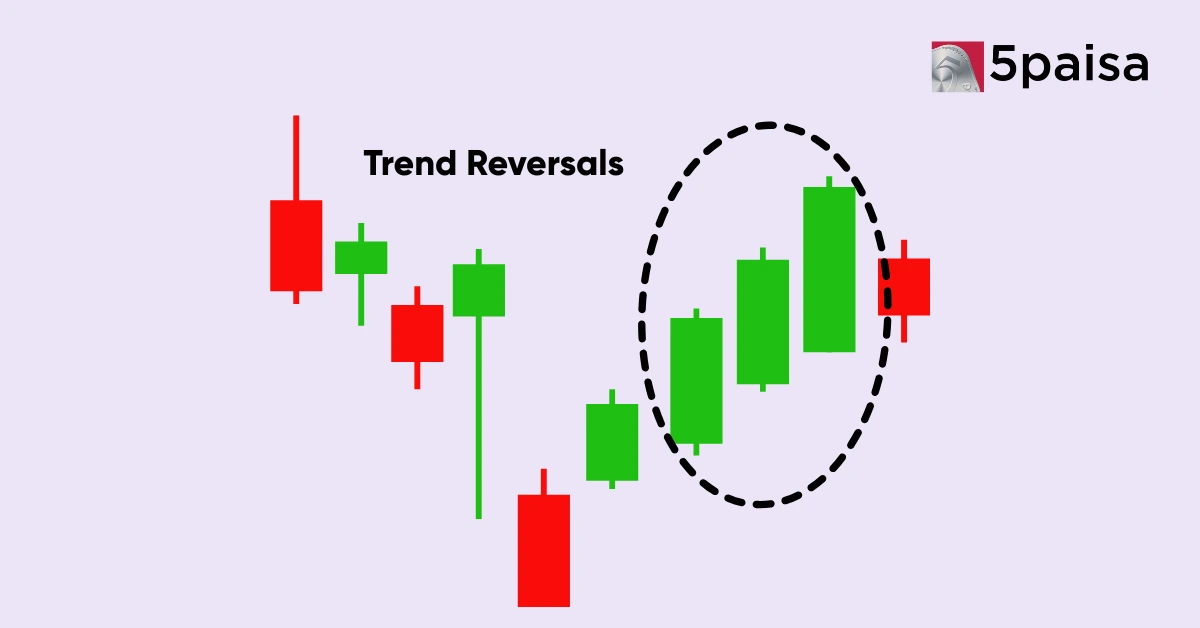

In the short term, inflation can cause a lot of volatility in the stock market. Here's what often happens:

● Immediate Reaction: When inflation numbers come out higher than expected, we often see an immediate dip in the stock market as investors worry about potential interest rate hikes.

● Sector Rotation: Some investors might quickly move their money from growth stocks to value stocks or dividend-paying stocks that might do better in an inflationary environment.

● Earnings Impact: As companies report how inflation affects their bottom line, we might see big swings in individual stock prices. Companies that are managing well might see their stocks rise, while those struggling might see sharp declines.

● Market Sentiment: Inflation can make investors nervous, leading to more emotional decision-making. This can cause bigger and more frequent swings in stock prices.

Let's look at a real example from recent history. In April 2022, when India's inflation rate hit a high of 7.79%, we saw immediate reactions in the stock market. The Sensex fell by over 1,000 points in a single day as investors worried about how this high inflation would impact companies and potential RBI actions.

In the following weeks, we saw a lot of volatility as different sectors reacted differently to the inflationary environment. Banks, for instance, initially did well, as higher interest rates were expected to boost their profits. On the other hand, sectors like automobiles and real estate saw their stocks fall as investors worried about reduced consumer spending on big-ticket items.

Conclusion

Inflation and its impact on the stock market are complex topics. While high inflation can certainly cause turbulence in the short term, stocks have historically been a good hedge against inflation over the long run.

For Indian investors, it's important to keep a few key points in mind:

● Diversification is crucial. Different sectors and types of stocks react differently to inflation, so spreading your investments can help manage risk.

● A long-term perspective is key. While inflation can cause short-term volatility, stocks generally have good returns over long periods.

● Regular review is important. As inflation impacts different sectors differently, periodically review your portfolio to ensure it aligns with your goals and the current economic environment.

● Consider your personal situation. Your age, financial goals, and risk tolerance should all affect how you approach investing during inflationary periods.

Remember, while understanding the impact of inflation on the stock market is important, it's just one of many factors to consider when investing. Always research, seek advice from a financial professional, and make investment decisions based on your circumstances and goals.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta