SIF vs Mutual Funds: How Do They Differ Strategy, Flexibility, and Risk?

Top 5 Flexi cap funds in India

Last Updated: 25th March 2022 - 10:37 am

Flexi-cap funds are dynamic and open-ended mutual funds whose fund managers invest in equity funds of different market capitalizations. These can be small, mid, or large caps. The funds are ideal for those investors who want to appreciate their money over a period of five years or more. These funds yield returns that trump inflation and are better than the interest from fixed income instruments. Flexi caps also shield the investor from market jitters.

The Best Flexi-Cap Funds in India

Let's now look at the top five funds that have given consistently attractive returns over a prolonged period. You may consciously decide to invest in any of these after going through their details.

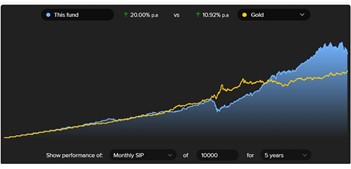

1. PGIM India Flexi Cap Fund - Direct Plan-Growth

This fund enjoys a Crisil Rating of 5. This is indicative of its excellent performance among peer funds. The expense ratio is 0.39% which is comparatively lower than prominent multi-cap funds. Fund managers have shown peerless dexterity in controlling losses even during market crashes.

In the last year, the fund has returned 25.46% on invested capital. Since its inception, the average annual return has been 16.04%.

If you had invested Rs.10,000 on 14th February 2021, the present value would have been Rs. 12,562.

Other key facts:

1) Launch Date: 11th February 2015

2) NAV: Rs.28.15 as of 14th February 2022.

3) Fund size (AUM): Rs.3521.63 crores.

4) Investment Pattern: 93.98% in Indian stocks; 48.27% in large-cap stocks, 13.8% in mid-cap stocks, and 19.49% in small-cap stocks.

5) Top Holdings: ICICI Bank, Infosys, HDFC Bank, Larsen & Toubro Limited, Axis Bank

6) Majority Investment in: Technology, Healthcare, Financial, Engineering, and Construction segments

Performance Graph (Source)

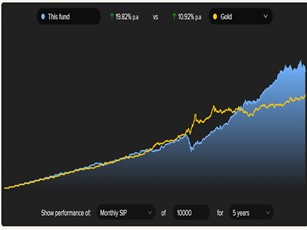

2. UTI Flexi Cap Fund - Direct Plan-Growth

This fund’s Crisil Rating is 5. The expense ratio is 0.92%.

During the last year, the fund has returned 12.97% on invested capital. Since its inception, the average annual return has been 16.33%.

If you had invested Rs.10,000 on 14th February 2021, the present value would have been Rs.11,305.

Other key facts:

1) Launch Date: 1st January 2013

2) NAV: Rs.251.83 as of 14th February 2022.

3) Fund size (AUM): Rs.24638.43 crores.

4) Investment Pattern: 97.69% in Indian stocks; 41.65% in large-cap, 29.2% in mid-cap, and 11.62% in small-cap stocks.

5) Top Holdings: Bajaj Finance, ICICI Bank, Infosys, HDFC Bank, Larsen & Toubro Infotech Limited, Kotak Mahindra Bank

6) Majority Investment in: Technology, Healthcare, Financial, Chemicals and Services segments

Performance Graph (Source)

3. Union Flexi Cap Fund - Direct Plan-Growth

This fund’s Crisil Rating is 4. The expense ratio is 1.32%.

During the last year, the fund has returned 19.65% on invested capital. Since its inception, the average annual return has been 13.39%.

If you had invested Rs.10,000 on 14th February 2021, the present value would have been Rs.11,976.

Other key facts:

1) Launch Date: 1st January 2013

2) NAV: Rs. 34.48 as of 14th February 2022.

3) Fund size (AUM): Rs. 924.37 crores.

4) Investment Pattern: 92.82% in Indian stocks; 62.5% in large-cap, 11.4% in mid-cap, 3.28% in small-cap stocks, and 0.06% in debt funds.

5) Top Holdings: Reliance Industries, ICICI Bank, Infosys, HDFC Bank, Tata Consultancy Services

6) Majority Investment in: Energy, Finance, Technology, and Software segments

Performance Graph (Source)

4. Canara Robeco Flexi Cap Fund - Direct Plan-Growth

This fund’s Crisil Rating is 4. The expense ratio is 0.55%.

During the last year, the fund has returned 17.76% on invested capital. Since its inception, the average annual return has been 15.27%.

If you had invested Rs.10,000 on 14th February 2021, the present value would have been Rs.11,787.

Other key facts:

1) Launch Date: 1st January 2013

2) NAV: Rs. 235.43 as of 14th February 2022.

3) Fund size (AUM): Rs. 6777.71 crores.

4) Investment Pattern: 95.48% in Indian stocks; 61.22% in large-cap, 13.08% in mid-cap, and 5.44% in small-cap stocks.

5) Top Holdings: ICICI Bank, Infosys, HDFC Bank, Reliance Industries, State Bank of India

6) Majority Investment in: Automobile, Finance, Technology, Construction, and Healthcare segments.

Performance Graph (Source)

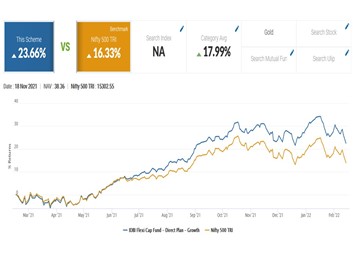

5. IDBI Flexi Cap Fund - Direct Plan-Growth

This fund’s Crisil Rating is 4. The expense ratio is 1.17%.

During the last year, the fund has returned 23.66% on invested capital. Since its inception, the average annual return has been 18.13%. (Source)

If you had invested Rs.10,000 on 14th February 2021, the present value would have been Rs.12,380.

Other key facts:

1) Launch Date: 1st January 2013

2) NAV: Rs.37.24 as of 14th February 2022.

3) Fund size (AUM): Rs.390.06 crores.

4) Investment Pattern: 99.05% in Indian stocks; 62.5% in large-cap, 9.55% in mid-cap, and 11.64% in small-cap stocks.

5) Top Holdings: ICICI Bank, Infosys, HDFC Bank, Reliance Industries, Grindwell Norton Limited

6) Majority Investment in: Software, Finance, Refinery, Abrasives, and Chemical segments

Performance Graph (Source)

To Wrap up

These top 5 Flexi funds are operated with the prime objective of generating long-term capital gains from a portfolio that is significantly made up of equity and related securities based in India.

- ZERO Commission

- Curated Fund Lists

- 1,300+ Direct Funds

- Start SIP with Ease

Trending on 5paisa

Mutual Funds and ETFs Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Capital Ltd

5paisa Capital Ltd

5paisa Capital Ltd

5paisa Capital Ltd