The Superstar Portfolio: A Look into LIC's Investment Strategy

What is LIC?

Life Insurance Corporation of India (LIC), often hailed as the country's biggest Domestic Institutional Investor (DII), is a financial juggernaut that manages equity assets worth a staggering Rs. 11.16 lakh crore. LIC is not just an insurance giant; it's a financial powerhouse that plays a significant role in shaping India's investment landscape.

Holdings and Portfolio of LIC

With stakes in a whopping 273 listed firms, LIC's influence in the stock market is undeniable. As of March 31, 2023, LIC's publicly held stocks were worth a jaw-dropping ₹ 57,357.7 crore. However, a few months later, as of June 30, 2023, the insurer held shares in 4 stocks valued at ₹ 11,442.1 crore, signalling some interesting changes in its investment strategy.

Recent Stock Picks by LIC

LIC made waves in the June quarter with a strategic move into several high-value stocks. Among these were IDBI Bank, Bharti Airtel, State Bank of India, Larsen & Toubro, and Tata Consultancy Services, each worth billions in LIC's growing portfolio. Additionally, the insurer raised its stake significantly in Tata Chemicals by a remarkable 301 basis points, showcasing its confidence in the company's future prospects.

Performance and Outlook of LIC's Recent Picks

LIC's equity assets surged by an impressive 10.97 percent during the quarter, solidifying its position as a financial heavyweight. The insurer held a substantial 3.85 percent share in the value of NSE-listed companies as of June 30, 2023.

One standout performer in LIC's portfolio was ITC Ltd, which witnessed a substantial jump of ₹ 12,918 crore in value terms during the quarter. Reliance Industries (RIL) also saw LIC's holdings rise by ₹ 7,902 crore. These gains were propelled by favorable market conditions, with ITC's stock climbing 17 percent during the quarter.

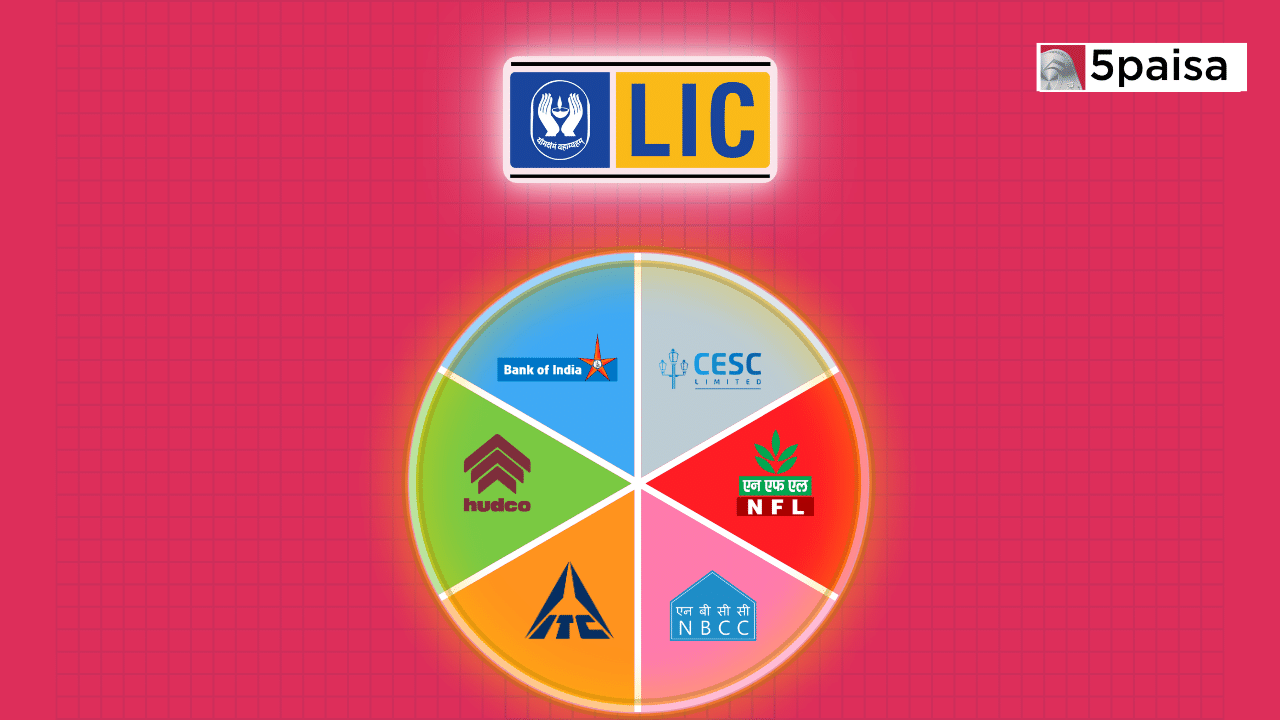

The Stock Picks Upto RS. 100

While LIC's high-value investments are eye-catching, it's equally intriguing to explore some of the stocks in its portfolio that are currently trading below ₹ 100. These stocks, often overlooked by investors, carry their own potential.

1) Union Bank of India

LIC holds a 1.35 percent stake in this banking company, with shares trading at ₹ 100 apiece as of 26 Sep 2023.

| Ratios | (FY23) |

| Capital Adequacy Ratio (%) | 16.04 |

| Net Interest Margin (%) | 3.07 |

| Gross NPA (%) | 7.53 |

| Net NPA (%) | 1.7 |

| CASA Ratio (%) | 35.62 |

Union Bank Of India Share Price

2-CESC

Engaged in electricity generation and distribution, CESC has LIC as a significant shareholder with a 3.41 percent stake. Its shares were trading at ₹ 90.2 apiece as of 26-Sep-23.

| Ratios | (FY23) |

| Stock P/E (x) | 8.47 |

| Dividend Yield (%) | 4.98 |

| ROCE % | 11.4 |

| ROE % | 12.2 |

| Debt to equity (x) | 1.31 |

| Return on assets % | 3.61 |

| PEG Ratio (x) | 1.14 |

| Int Coverage (x) | 2.57 |

CESC Share Price

3) National Fertilizers

LIC holds a hefty 9.60 percent stake in this company, which manufactures neem-coated urea and bio-fertilizers. Shares were trading at ₹ 72.4 apiece as of 26-Sep-23.

| Ratios | (FY23) |

| Stock P/E (x) | 17.7 |

| Dividend Yield (%) | 3.85 |

| ROCE % | 15 |

| ROE % | 17.9 |

| Debt to equity (x) | 1.44 |

| Return on assets % | 3.88 |

| PEG Ratio (x) | 0.91 |

| Int Coverage (x) | 1.76 |

National Fertilizers Share Price

4) Housing And Urban Development Corporation

With a 5.78 percent stake, LIC believes in HUDCO's role in financing housing and urban development. Shares were trading at ₹ 90 apiece as of 26-Sep-23.

| Ratios | Q3FY22 |

| Yield on Loans (%) | 9.4 |

| Cost of Funds (%) | 7.5 |

| Net Interest Margin (%) | 3.1 |

| Gross NPA (%) | 5 |

| Net NPA (%) | 1 |

Housing And Urban Development Corporation Share Price

5) NBCC

LIC holds a 6.55 percent stake in NBCC, a company involved in project management consultancy, engineering procurement, construction, and real estate. Shares were trading at INR 57.7 apiece as of 26-Sep-23.

| Ratios | (FY23) |

| Stock P/E (x) | 30.3 |

| Dividend Yield (%) | 0.95 |

| ROCE % | 26.4 |

| ROE % | 19 |

| Debt to equity (x) | 0 |

| Return on assets % | 4.18 |

| PEG Ratio (x) | 30 |

NBCC (India) Share Price

Potential of Those Stocks and Performance of Those Stocks

While these stocks may have relatively lower market prices, they offer intriguing investment opportunities. LIC's presence as a major shareholder speaks to its confidence in their potential. As investors, it's essential to keep an eye on these stocks, as they have the potential to grow and become valuable assets in LIC's already impressive portfolio.

Conclusion

LIC's investment strategy is a fascinating saga of astute financial decisions and calculated risks. The insurer's ability to adapt to market conditions, whether by making strategic investments in high-performing stocks or nurturing promising underdogs, showcases its prowess as a financial powerhouse in India's dynamic economic landscape. As investors, there's much to learn and gain from the LIC's superstar portfolio.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advanced Charting

- Actionable Ideas

Trending on 5paisa

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Capital Ltd

5paisa Capital Ltd