Multibaggers Penny Stocks For 2025

Stock in Action - Va Tech Wabag Ltd

Last Updated: 22nd November 2023 - 05:41 pm

About

The company Va Tech Wabag Ltd works in the water treatment industry. Designing, supplying, installing, building, and managing the operations of drinking water, waste water treatment, industrial water treatment, and desalination facilities are among its main tasks.

Estimated Rationale Behind the Surge:

This surge is attributed to the company's strategic collaboration with Pani Energy Inc., signalling a new era in water treatment through the application of Artificial Intelligence (AI).

Operational Intelligence in Water Treatment:

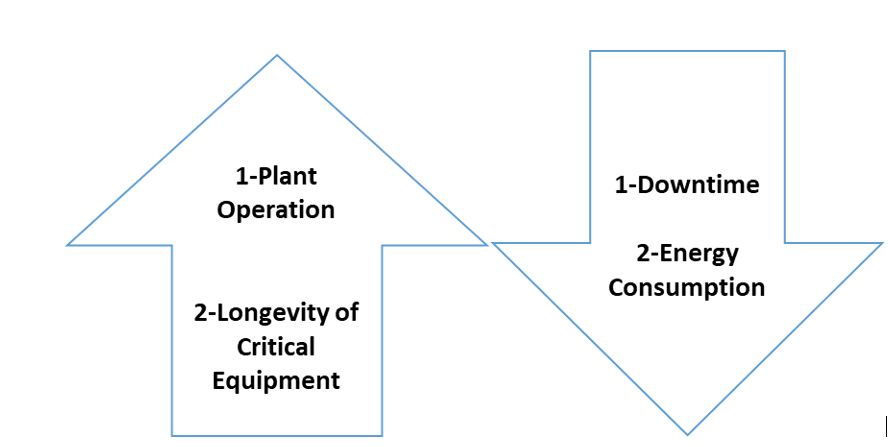

The water treatment firm has joined forces with Pani Energy Inc. to implement Operational Intelligence (OI) through their product, Pani ZEDTM.

Technical Analysis:

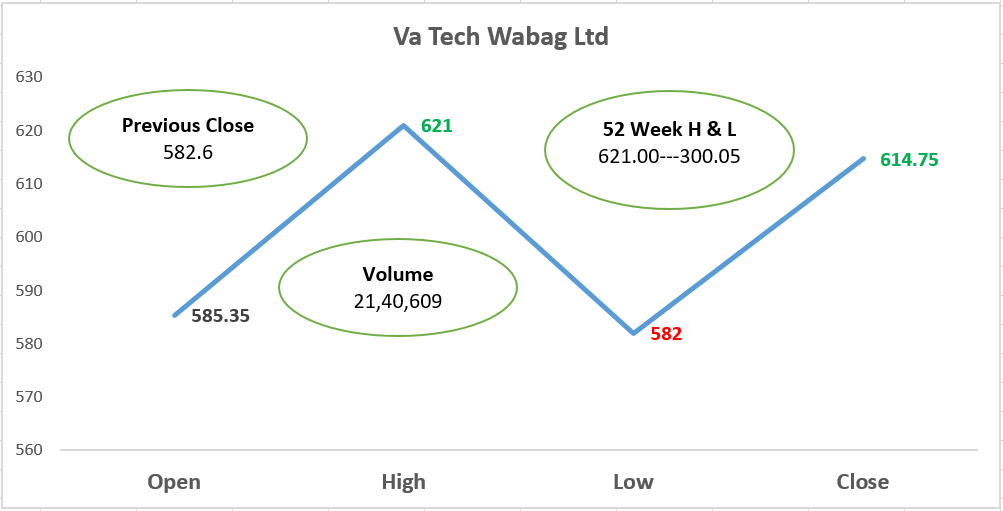

VA Tech Wabag stock, currently closed at ₹ 614.75, reflects an upward trajectory. The Relative Strength Index (RSI) stands at 39.4, indicating balanced trading conditions. Notably, the stock is trading higher than various moving averages, including the 5-day, 10-day, 20-day, 50-day, 100-day, 150-day, and 200-day averages.

Market Capitalization:

The market capitalization of VA Tech Wabag has climbed to ₹ 3,823 crore, reflecting the market's positive reception of the company's strategic initiatives and advancements in water treatment technology.

Key Financial Highlights:

1. In the quarter ending June 2023, VA Tech Wabag reported a substantial 65.33% rise in net profit, reaching ₹ 49.6 crore.

2. The company showcased resilience, rebounding from a net loss of ₹ 111.9 crore in the previous quarter.

3. Revenue from operations in Q1 FY24 was ₹ 552.8 crore, compared to ₹ 631.7 crore in the year-ago quarter.

4. Profit before tax (PBT) rose to ₹ 64 crore in Q1 FY24 from ₹ 39.20 crore in Q1 FY23.

Stakeholder Insights:

Renowned investor Rakesh Jhunjhunwala's wife, Rekha Jhunjhunwala, held an 8.04% stake or 50 lakh shares as of June 2023. Additionally, two promoters held a 19.13% stake, while 94,017 public shareholders owned 80.87% of the firm.

Strategic Outlook:

CEO-India Cluster at WABAG, Shailesh Kumar, expressed excitement about the collaboration, stating that the integration of operational intelligence into their water treatment processes aligns perfectly with their digitalization initiative. This move reinforces VA Tech Wabag's commitment to providing sustainable solutions for a better life.

The surge in VA Tech Wabag shares can be attributed to the forward-looking partnership with Pani Energy Inc. and the adoption of cutting-edge AI technology in water treatment. As the company continues to innovate and optimize its operations, investors are responding positively to the potential for improved efficiency, reduced costs, and a commitment to sustainable solutions.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta