Iron Condor with Weekly Expiries: Is It Worth the Risk?

Stock In Action: JSW Steel

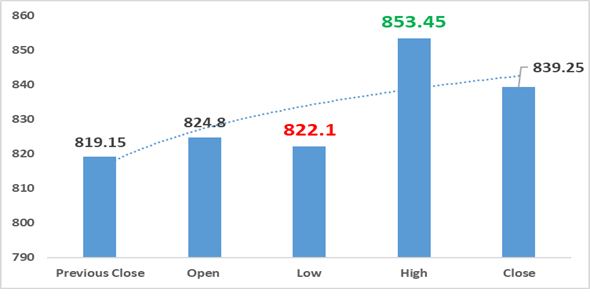

Movement of the Day

Analysis

1. Strengths: Strong Momentum: Price above short, medium and long term from 5 days to 200 days respectively.

2. Positive break-out.

Key Highlights

Consistent Growth: The stock has shown consistent growth throughout the day, with incremental increases in value. The most recent trade at Rs 844.0 indicates a 3.03% surge, and it has reached a 52-week high at Rs 840.35, registering a gain of 2.59%.

Technical Indicators: Technical indicators such as the Simple Moving Averages (SMA7 and SMA5) showcase positive trends, with SMA5 standing at Rs 826.46, supporting the upward momentum.

Market Sensitivity: The stock's beta of 1.6872 over the past 6 months suggests its sensitivity to market movements, indicating that it has the potential to outperform in bullish market conditions.

Trading Volume: The stock's trading volume has exceeded the average volume of the past 7 days, reaching 4,102,129 shares compared to the average of 1,890,849 shares. This surge in volume aligns with the positive price movement.

Recent Developments: An announcement regarding the raising of long-term funds by JSW Steel USA Ohio, Inc, a wholly-owned indirect subsidiary of JSW Steel Limited, may have positively influenced investor sentiment.

Rationale Behind the Surge

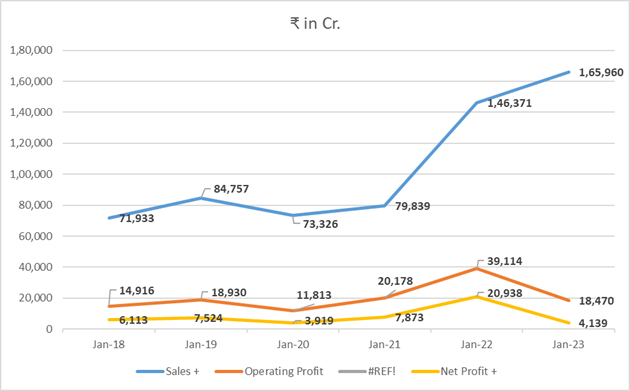

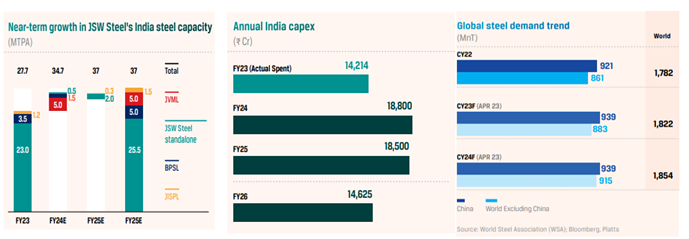

Strong Financial Performance: JSW Steel's robust financial performance, as evidenced by consistent quarterly results, revenue growth, and profitability, is likely contributing to investor confidence.

Industry Trends: Positive trends in the steel industry, such as increased demand, favorable pricing, or strategic expansions, could be influencing JSW Steel's stock performance.

(Source: AR’23)

Strategic Announcements: The announcement of raising long-term funds may be perceived positively by investors, indicating financial stability and potential growth opportunities.

Market Confidence: The overall bullish sentiment in the market, as indicated by the stock's beta and positive technical indicators, suggests that investors are confident in JSW Steel's outlook.

Conclusion

JSW Steel's stock has exhibited a strong upward trend, supported by consistent growth, positive technical indicators, and strategic announcements. While short-term fluctuations are expected, the overall performance indicates a favourable outlook for the stock. Investors should continue monitoring industry trends and company developments for informed decision-making.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta