Stock in Action – EID Parry 18 December 2024

Stock in Action - Cholamandalam Investment & Finance Company

Last Updated: 16th May 2024 - 04:10 pm

Why Cholamandalam Stock is in Buzz?

Cholamandalam Investment & Finance Company Limited (NSE:CHOLAFIN) has recently garnered attention due to its dividend announcement & subsequent discussions about its financial health & investment potential. company's decision to pay dividend of ₹0.70 per share on 24th of August has sparked discussions about its dividend yield, earnings, & future outlook among investors & analysts.

Fundamental Analysis of Cholamandalam Investment & Finance

▪ Cholamandalam Investment & Finance's dividend yield of 0.2% may seem modest, but its earnings easily cover distributions, indicating stability in dividend payments.

▪ However, weak cash flows raise concerns about sustainability of dividends in long term. company's projected EPS growth of 94.1% for next year is promising, with estimated payout ratio of 2.8%, which falls within sustainable range.

▪ Moreover, Cholamandalam Investment & Finance has demonstrated solid track record of paying stable dividends, with annual distributions growing at rate of about 11% since 2014.

▪ This consistent growth in dividends reflects company's financial stability & commitment to rewarding shareholders.

▪ Furthermore, company's earnings per share have grown at impressive rate of 22% per year over past five years, indicating strong underlying performance.

▪ low payout ratio coupled with robust earnings growth suggests that Cholamandalam Investment & Finance has potential to further increase dividends in future.

Highlights – Q4FY24 & FY24

| Particular | Q4FY24 Vs Q4FY23 | FY24 Vs FY23 |

| Disbursement | Disbursement at Rs.24,784 Cr, a growth of 18%. | Disbursement at Rs.88,725 Cr, a growth of 33%. |

| Business AUM | Rs. 1,45,572 Cr in Q4 FY24 registering a growth of 37%. | |

| NIM | Maintained at 7.8% | 7.5% as compared to 7.7% |

| PBT | Rs.1,437 Cr, a growth of 24% | Rs.4,582 Cr, a growth of 27% |

| PBT – ROTA | 3.9% as compared to 4.4% | 3.4% as compared to 3.8% |

| Return on Equity | 22.3% as compared to 24.9% | Maintained at 20.6% |

| Stage 3 (90DPD) | 2.48% in Mar24 from 3.01% in Mar23. | |

| GNPA (RBI) | 3.54% in Mar24 as against 4.63% in Mar23 and NNPA at 2.32% in Mar24 against 3.11% in Mar23. | |

| CAR | 18.57%. Tier I at 15.10%. | |

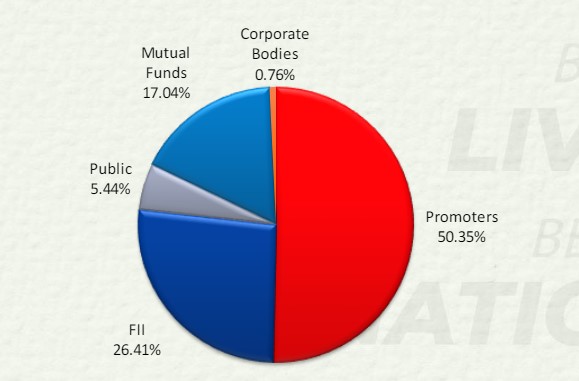

Cholamandalam’s Shareholding

Institutional Holders (More than 1%)

• Axis Mutual Fund

• SBI Mutual Fund

• HDFC Mutual Fund

• Aditya Birla Sun Life Mutual Fund

• Canara Robecco Mutual Fund

Top Foreign Institutional Holding

• Capital Group

• Vanguard

• Blackrock

• Norges Bank Investment Management

Promoters’ shareholding of 50.35% includes:

• Cholamandalam Financial Holdings Limited – 44.39%,

• Ambadi Investments Limited – 4.01%

• Others – 1.95%

Cholafin Profitability

CholaMandalam Asset Ratios

Cholamandalam Shareholders’ Returns Ratios

Cholamandalam’s Outlook

Despite positive aspects, there are concerns about sustainability of current dividend level due to weak cash flows. While company has been able to cover dividends with earnings, ongoing monitoring of cash flows is essential to ensure long-term stability in dividend payments.

Additionally, Cholamandalam Investment & Finance's ownership structure, with significant control by public companies & institutions, may influence management & governance decisions. Company's top three shareholders collectively own 53% of company, indicating their influence on strategic matters.

Chola’s Position

▪ Copnay will continue their focus in this segment in line with macro-economic environment & industry growth.

▪ Chola’s financing in this segment will be based on vehicle earning capacity & rural cash flows.

▪ Chola’s exposure in this segment is 7% at portfolio level. We will closely watch this segment in coming quarters based on government outlay for infrastructure & mining

Conclusion

Overall, while Cholamandalam Investment & Finance has shown strong fundamentals & solid track record of dividend growth, investors should carefully evaluate company's cash flows & ownership structure before making investment decisions. Conducting thorough research beyond broker forecasts & considering various factors affecting company's share price are crucial for informed investment choices.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Sachin Gupta

Sachin Gupta

5paisa Research Team

5paisa Research Team