Iron Condor with Weekly Expiries: Is It Worth the Risk?

Rupee weakens beyond 76/$ as dollar demand spikes

After a long gap, the Indian rupee weakened beyond the 76/$ mark on sustained FPI selling as well as the worsening situation in Ukraine. On 24-February, the rupee fell beyond 76 before RBI intervention helped the INR to close at 75.63/$, still a loss of over 102 paisa over the previous day. The rupee gained some ground on 25-February with the Nifty rallying by more than 400 points, but the structural pressure on the rupee seems here to stay.

In the few of forex traders, sustained foreign fund outflows, heavy selling in domestic equities and elevated crude oil prices were the major reasons. Let us look at crude first. The price of crude had crossed the $100/bbl level briefly on 24-February and that led to banks indulging in panic buying of the dollar on behalf of the oil marketing companies like HPCL, BPCL and IOCL. However, things improved after RBI intervened, but oil remains a worry.

Check - Why is crude beyond $100/bbl and what does it really mean

FPI flows have been another big area of concern. February marks the fifth successive month of consistent FPI outflows. In Feb-22 so far, FPIs have sold over $4 billion in equities. If you look at the first 2 months of 2022, then FPI selling has been close to $9 billion, while FPIs sold a total of $22 billion since the start of October. Historically, this is the longest and deepest FPI outflow story seen since the global financial crisis of 2009.

In a way, the dollar index tells you the complete story of dollar strength. It is not just about whether the US economy strong or not. What is holding up the US dollar is a combination of a hawkish US Fed and rising demand for the US Dollar as a safe haven currency. This resulted in the dollar index (DXY) touch a recent high of 96.90. The DXY is a dollar valuer against a basket of global currencies of countries with strong trade links with the US.

Incidentally, the Indian Rupee has now became the worst performing currency among Asian currencies on for the calendar year 2022 due to month-end dollar demand from oil importers. In addition, in the light of the fluid situation in Russia and Ukraine, there is a lot of safe haven dollar demand that has also led to a surge in dollar demand. Most countries with dollar payables or dollar debt are rushing to buy dollars in the open market.

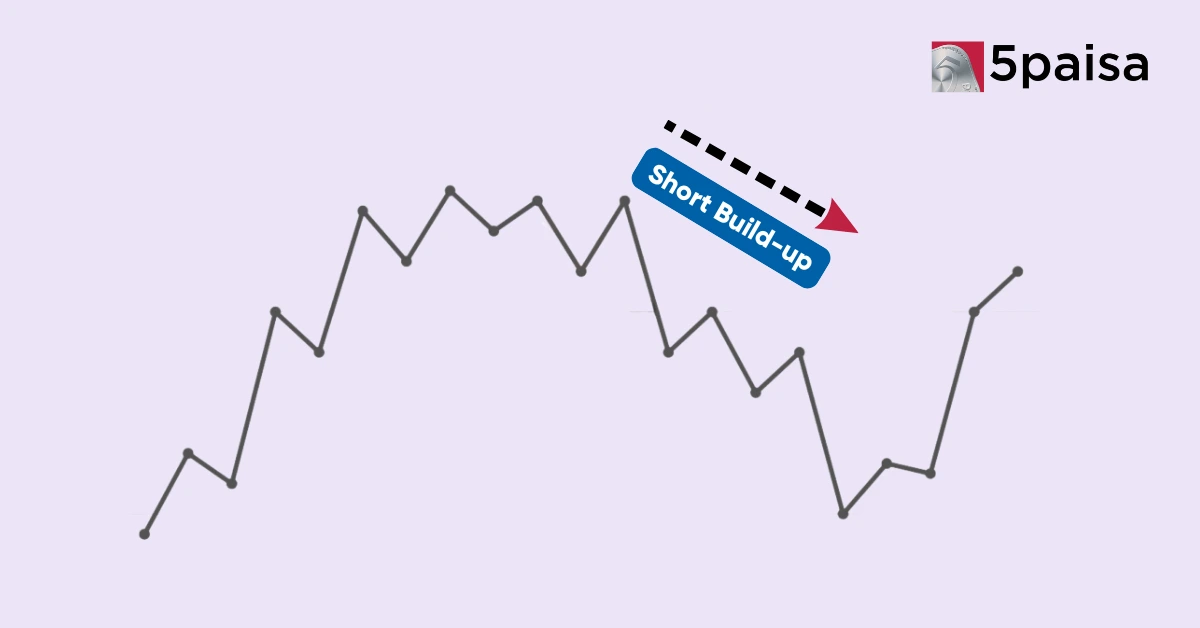

One of the better ways to gauge the trend of the dollar is to look at the simple moving average (SMA) of the Spot USD-INR. The SMA of the USD INR spot has taken support at around the 74.30 levels while the 200 day SMA has now scaled to 75.72, clearly showing the underlying trend moving towards the 76/$ mark. The sharp fall in the Nifty and the Sensex has not helped matters and that has sustained pressure on the rupee.

One though process is that the Indian inflation is still lower than the inflation in the US, so there is justification for the Indian rupee to structural strengthen against the dollar. However, that argument may not really work when the safe have currency flows are all rushing towards the US dollar. For now, it looks like the rupee could remain under pressure for more time as long as the uncertainty in Ukraine favours dollar assets over EMs.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

03

5paisa Research Team

5paisa Research Team

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team