Open High Open Low (OHOL) Trading Strategy

Last Updated: 7th June 2024 - 11:24 am

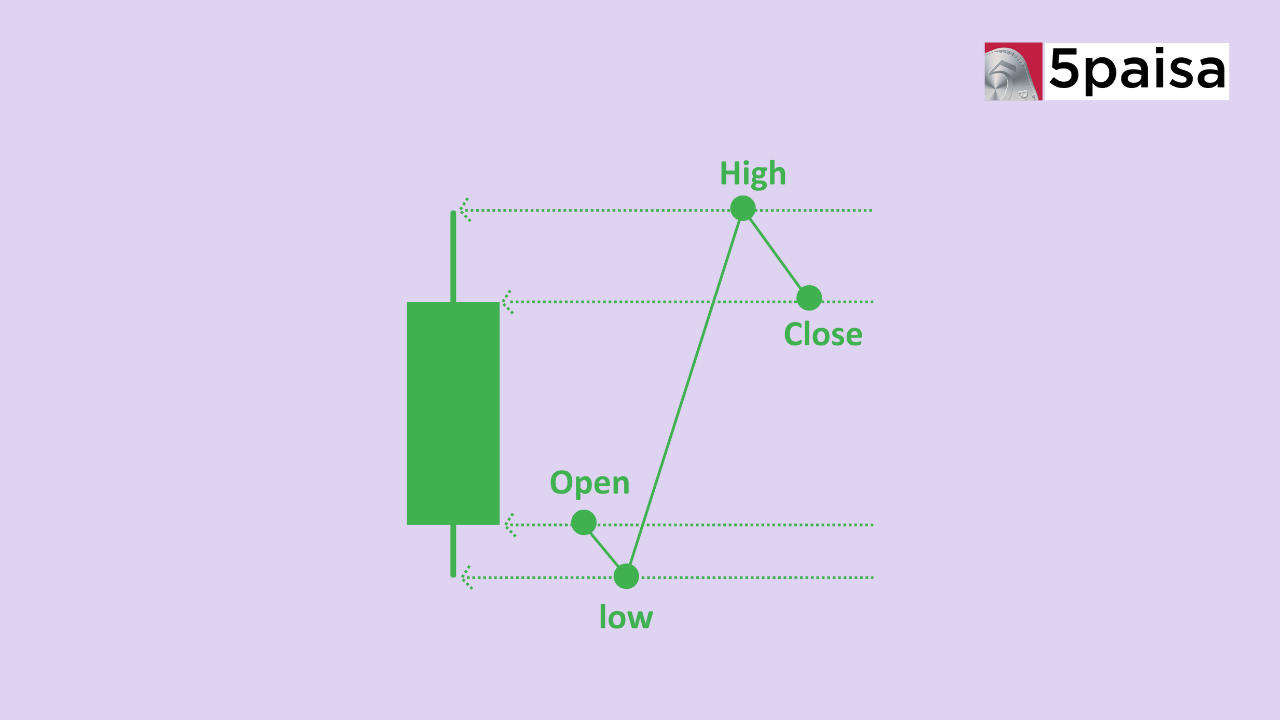

Term "open high low" (OHL) method is intraday trading technique in which precise opening & closing values of any stock or index provide buy signal. This is sign that trader needs to purchase stock. In contrast, when stock or index value is same at open as well as high, selling signal is generated. This indicator suggests that shares should be sold by trader. Open High Open Low trading strategy involves analyzing opening & closing prices of asset

What is Open High Open Low (OHOL) Trading Strategy?

Goal of Open High Open Low (OHOL) intraday stock trading method is to profit from brief intraday price fluctuations. In order to maximize earnings, OHOL entails buying & selling investments (such as stocks, futures, & currencies) on same day. Making most of intraday market chances involves strategic thought, trend analysis, keeping up with relevant news, & fast decision-making. There are risks associated with this method, even though profits could be substantial. open high open low trading strategy strategy is simple yet effective approach for traders.

Here is what you as trader should know about open high open low strategy.

Key Features of open high open low strategy

Swing Trading involves capturing short- to medium-term gains in stock, it relies on Price Action Trading, which emphasizes use of historical price movements, often incorporating Candlestick Patterns as visual indicators of market sentiment. Volatility Analysis is crucial for determining degree of price fluctuation. Breakout Strategy involves identifying key price level, often in conjunction with Support & Resistance Levels, which are areas where price tends to find temporary barriers.

Market Momentum is force behind price movements, indicating strength or weakness of trend, which is analyzed through Technical Analysis techniques such as Trend Following.

1. Long-term stock chart analysis

Analysing long-term stock charts is key component of OHL approach for traders.

Despite fact that this is intraday trading strategy, experts advise against trading against stock's trend. Therefore, it is essential for traders to analyze daily & weekly charts in order to ensure that their decisions to purchase or sell stocks are based on direction of stock.

2. Excessive Return on Risk

Because traders use OHL approach to trade intraday, they typically position their "stop loss" close to strike price, which results in high risk-reward ratio. Typically, traders set their stop loss at low of opening 15-minute candlestick when stock opens at lower price.

3. Using Scanners to Assess Trend of Stock

Traders that use open high low approach are better able to determine trend of stock. They are able to make investment selections more effectively as result.

How to execute OHOL strategy?

goal of OHOL trading strategy is to identify stock market trends & make money by making data-driven trading decisions. When stock's open price & low price are same, buying equity shares of company is known as "OHOL." On other hand, executor of OHOL strategy receives selling signal when stock's opening price matches day's high price. price at which first deal of day is made at stock market is known as stock's open price. Because it represents effect of any information disclosed between last trading of previous day & opening of market following day, open price is important.

As result, executor of OHOL trading technique does not keep track of any stock balances & all positions are terminated by conclusion of trading day.

Risks associated with OHOL trading strategy

There is risk associated with OHOL approach because of its design & intrinsic nature, & traders need to be cautious when using it.

In open high situation, traders lock in price for securities when they sell them. & although if more price increases could result in missed opportunities, losses are avoided. However, if shares are sold short in market using open high trading method, potential losses could be infinite.

Similarly, if security's price continues to drop, losses on such executions could be enormous unless stop-loss order is executed concurrently with open low scenario.

fact that these are short-term trading methods & do not take security's fundamentals into account when making trading decisions adds to dangers involved. In addition, by end of day, positions taken in each security must be closed. This lack of foresight may cause traders needless suffering & deter honest investors.

considerations before opting for open high open low strategy

Brokers should only trade in shares with substantial trading volume.

Trading Volume: High volume stocks typically give traders more confidence.

Closing price of first candle: People should only think about making trade if first candle's closing price is less than second candle's.

Risk to Reward Ratio: It may be concern for traders to ensure that ratio is as low as possible. Experts typically view ratio of 1:2 as ideal. Traders may wish to use immediate support level as stop loss while taking long call. On other hand, experts advise using immediate resistance as stop loss when starting short position.

Range Break-Out: Traders using this method may think about going long or short after breakout in range.

Conclusion

In summary, in choosing assets they trade in, traders should consider long-term trends & examine fundamentals. Although OHOL approach may yield faster returns, investor greed may cause intraday market trading volumes to increase in attempt to maximize earnings. But there are two sides to this, & there could be severe losses. Thus, investment prudence is necessary & justified.

Frequently Asked Questions

What market conditions are suitable for implementing OHOL strategy?

How do traders determine entry & exit points using OHOL strategy?

How do traders adapt OHOL strategy to different asset classes (stocks, forex, futures, etc.)?

What are some common indicators or tools used in conjunction with OHOL strategy?

- Flat ₹20 Brokerage

- Next-gen Trading

- Advanced Charting

- Actionable Ideas

Trending on 5paisa

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Capital Ltd

5paisa Capital Ltd

5paisa Capital Ltd

5paisa Capital Ltd