Nifty Outlook For - 26 December 2024

Market Outlook for 16 September 2024

Last Updated: 17th September 2024 - 07:29 pm

Nifty Prediction for 16 September

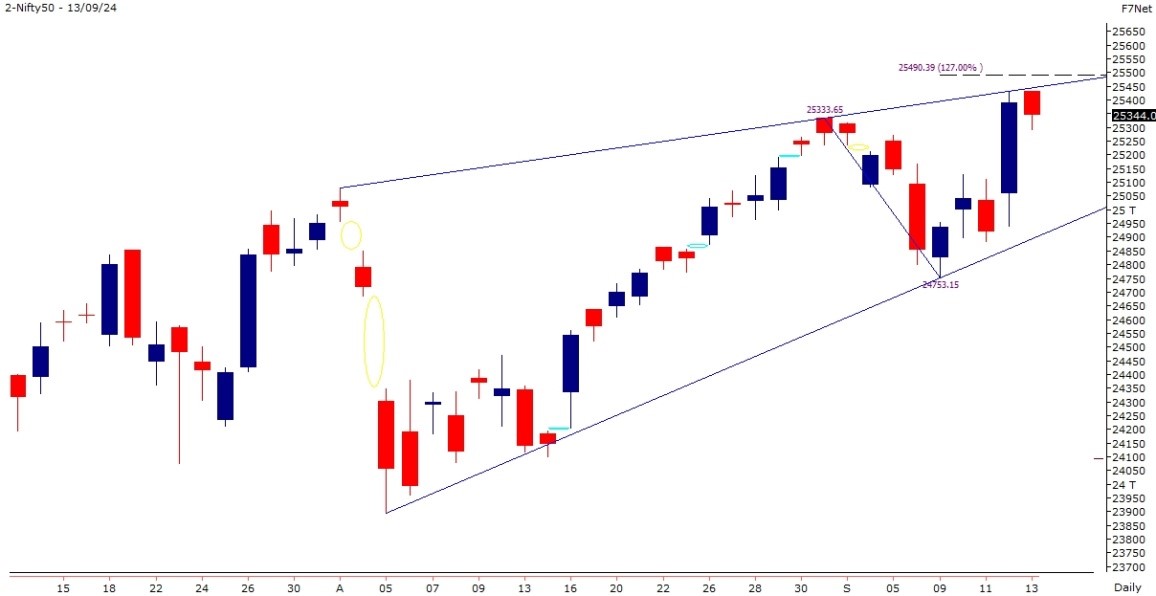

In the week gone by, Nifty witnessed a breakout on weekly expiry day and it registered a new record high of 25433. The index consolidated in a range on Friday, but it managed to end the week around 25350 with weekly gains of a couple of percent.

iJoin the club of lakhs of tech savvy investors!

Post a small corrective phase, Nifty managed to form a higher bottom near 24750 during last week and the index resumed its uptrend. The upmove was mainly led by FIIs where they bought equities in the cash segment and also formed fresh longs in the index futures segment on Thursday. Now on the daily chart, the recent price action has led to formation of a ‘Rising Wedge’ pattern and index has ended near the resistance end.

Hence, the follow up move will be important for the near term trend. The immediate resistance for Nifty is seen around 25500 which if broken, then we could see a continuation of the upmove towards 25700. On the flipside, 25150 followed by 25000 will be seen as immediate supports.

Considering the strong market breadth and the positive trend in key sectoral indices, it is advisable to trade with the

trend and look for buying opportunities. However, the U.S. Fed event in the coming week will be crucial and markets reaction to the policy will be important as the markets have already run up before the event. In case of any reversal signs post the event, short term traders can prefer to book profits and take some money off the table.

Fed event in coming week key to determine near term momentum

Bank Nifty Prediction for 16 September

During last week, the Nifty Bank index gave a breakout from a ‘Symmetrical Triangle’ pattern which is a positive sign. The RSI oscillator on the daily charts too has given a positive crossover indicating bullish momentum. The immediate hurdle for the banking index is seen around 52350 which if surpassed, then the index could rally towards 52800-53000. On the flipside, 51000-50900 is seen as the immediate support which should be seen as the stop loss level on long positions.

Nifty, Bank Nifty Levels and FINNIFTY Levels:

| NIFTY Levels | SENSEX Levels | BANKNIFTY Levels | FINNIFTY Levels | |

| Support 1 | 25290 | 82660 | 51700 | 23880 |

| Support 2 | 25220 | 82440 | 51500 | 23780 |

| Resistance 1 | 25430 | 83100 | 52070 | 24050 |

| Resistance 2 | 25500 | 83320 | 52200 | 24120 |

- Performance Analysis

- Nifty Predictions

- Market Trends

- Insights on Market

Trending on 5paisa

Market Outlook Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta