Is Bajaj Finance a compounding machine?

In 2022, you don’t have to be rich to afford an Iphone, a Macbook, or a TV, you just need to have a monthly income through which you can pay its EMI.

Today people can have a lifestyle, they could not even afford a few years thanks to the fintech and NBFCs that offer these No cost EMI options to the customers.

One NBFC that has played the most prominent is Bajaj Finance, the company has a lion’s share of 70% in the consumer durable segment.

The company has grown by leaps and bounds in the last decade, it has revolutionised the way people buy consumer durables.

Recently the company swept the investors off their feet with its quarterly results. Some important highlights of its results:

1. Its core Asset under management grew 31% YOY to ₹ 204,018 Cr.

2. Its profit after tax grew 159% YOY to ₹ 2,596 Cr.

3. In Q1, the Company booked 7.42 MM new loans as against 4.63 MM in Q1 FY22.

Since we are comparing the company’s performance to last year when the pandemic was at its peak and there was an overall slowdown in consumer spending, the numbers might seem more attractive due to that as well, but nonetheless, these numbers are too good for a company that is already dominating a space.

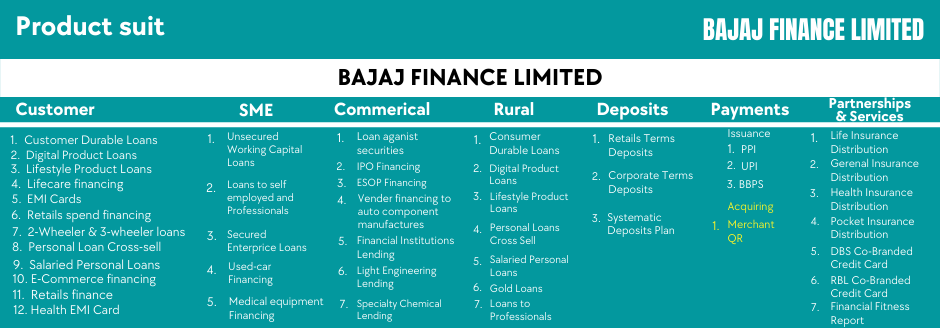

Let’s have a look at its business model. The company is registered as a deposit-taking NBFC with RBI. Also, BFL has two 100% subsidiaries. These are (i) Bajaj Housing Finance Ltd. (‘BHFL’ or ‘Bajaj Housing’) which is registered with National Housing Bank as a Housing Finance Company (HFC); and (ii) Bajaj Financial Securities Ltd. (‘BFinsec’), which is registered with the Securities and Exchange Board of India (SEBI) as a stock broker and depository participant.

It extends personal loans, consumer durable loans, gold loans, SME loans, etc. The company’s mainstay though is the consumer durable loans.

One question that you might have is how the company growing at an eye-popping rate of 29% by offering no-cost EMI to people.

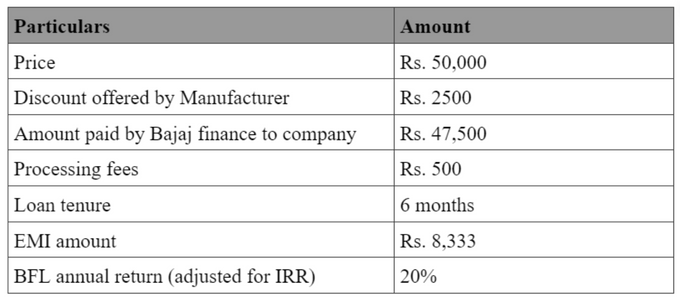

Well, your no-cost EMI, isn’t really no cost. Generally whenever you purchase a product at no-cost EMI, the manufacturer/seller offers a discount to the financier.

Say you bought a TV from Sony which is priced at Rs. 50000, then Sony would offer a 5% discount to Bajaj Finance, and the effective cost of the TV would be Rs. 47,500 for BFL.

Further, BFL would charge you a processing fee of Rs. 500 and would ask you to pay the loan amount in equal installments over a six-month period.

Now, since you are paying monthly Rs. 8333 to the company, the company is getting principal plus the interest. Further, the company is getting the amount in installments every month, therefore the company earns interest on that as well.

This is called IRR, the effective interest would be 1.7% per month and 20% annually.

So, BFL makes around 18%-20% interest on every quote unquote No cost EMI.

Under this arrangement, the seller is happy since he can sell more products from his inventory, and the customer is happy because he believes he got the product at an EMI, without any additional cost.

The finance company is also happy since it is making 18%-20% on the sale.

What makes Bajaj Finance undefeatable?

Early start

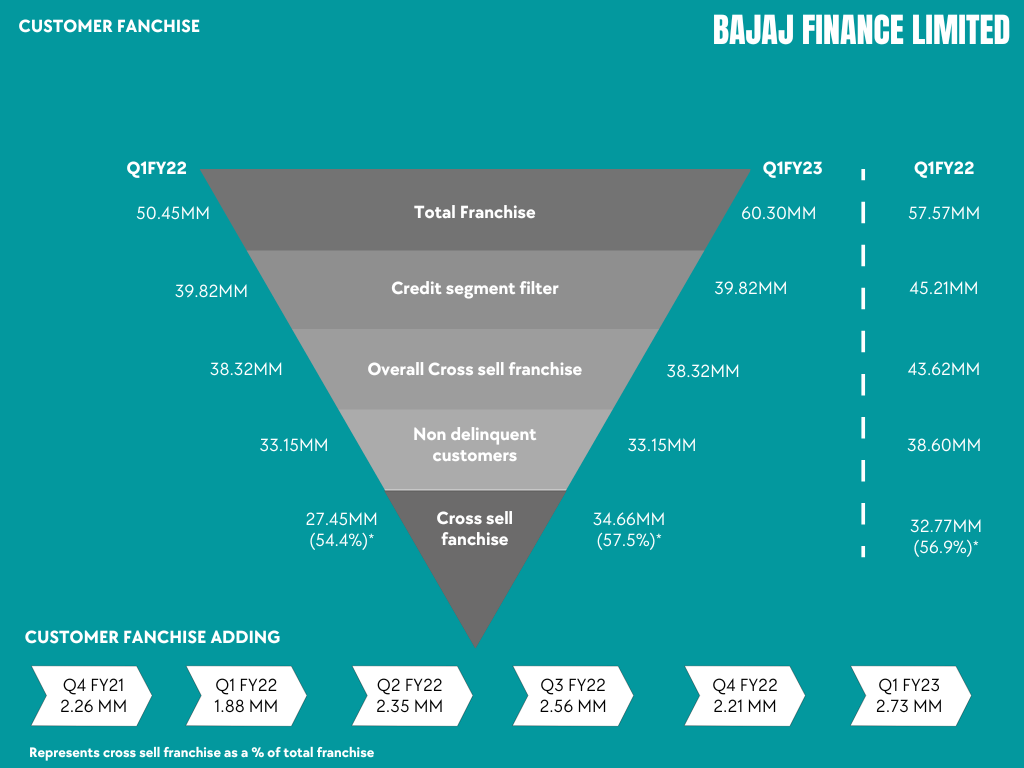

Now, thousands and lakhs of people use these facilities by Bajaj Finance, which provides the NBFC with a lot of data about customers.

Data is like the oil for NBFCs. Bajaj Finance has a market share 30% in electronics, 15% in smartphones, and 10% in organised furniture sold in India.

A huge customer base provides the company with details about the people, like their repayment history, purchase history and credibility and due to this, the company can easily cross-sell its products to the existing customers.

For example, A software engineer bought a phone at EMI with Bajaj Finance, then the company gets a lot of data points about him, like his repayment history, the bank he has an account with,the area where he resides, the company for which he works.

All these details would help the company decide if they could cross-sell or extend new loans to the person or not.

And having this data is crucial to its business because the loans that Bajaj finance gives are generally low ticket loans and conducting a background check which involves visiting the house of the borrower, verifying the income sources, would cost the company a lot and it would not makes sense for it extend the loan.

Huge geographical footprint:

The major difference between a bank and NBFC is you have to visit a bank to get a loan, while in the case of NBFC it is always at the store when you want to make a purchase.

You will find Bajaj Finance executives in offline stores. The company is also ruling the online market with its partnership with the companies like Amazon, Flipkart etc.

Now, why having a geographical footprint is important?

Manufacturers generally partner with companies that can cater to every nook and corner they have a presence in, for example say Apple wants to partner with a company for providing its customers an EMI option, then it would have to select a company that has a presence in most cities in India.

With a presence in 3,586 locations and 1,38,900+ touch points Bajaj Finance can provide the widest geographical footprint to any manufacturer and that's why it is a go-to NBFC for brands.

Infrastructural set-up to support the collection of small ticket loans:

BFL loans are generally low ticket, unsecured loans and therefore it is very important for the company to collect the dues in a way in which the cost of the collection does not eat up the returns from the loan.

It does not make sense for the company to spend Rs. 2500 on collecting EMI for a loan of Rs. 20,000. Therefore, it is important that the company manages the operations at ground level in a way that maximizes profitability.

It is difficult for any company to manage so well at ground level.

Huge balance sheet:

Now whenever a manufacturer or retailer partners with an NBFC, they want the company to offer loans to as many customers as possible and they want that no customer should leave the store because he could not get a loan.

Bajaj Finance because of its huge balance sheet and its data analytics can provide the loan fastest to any consumer.

These were some reasons why Bajaj Finance has created an impenetrable market share for itself. Let’s have a look at its financials to understand its position.

Financials

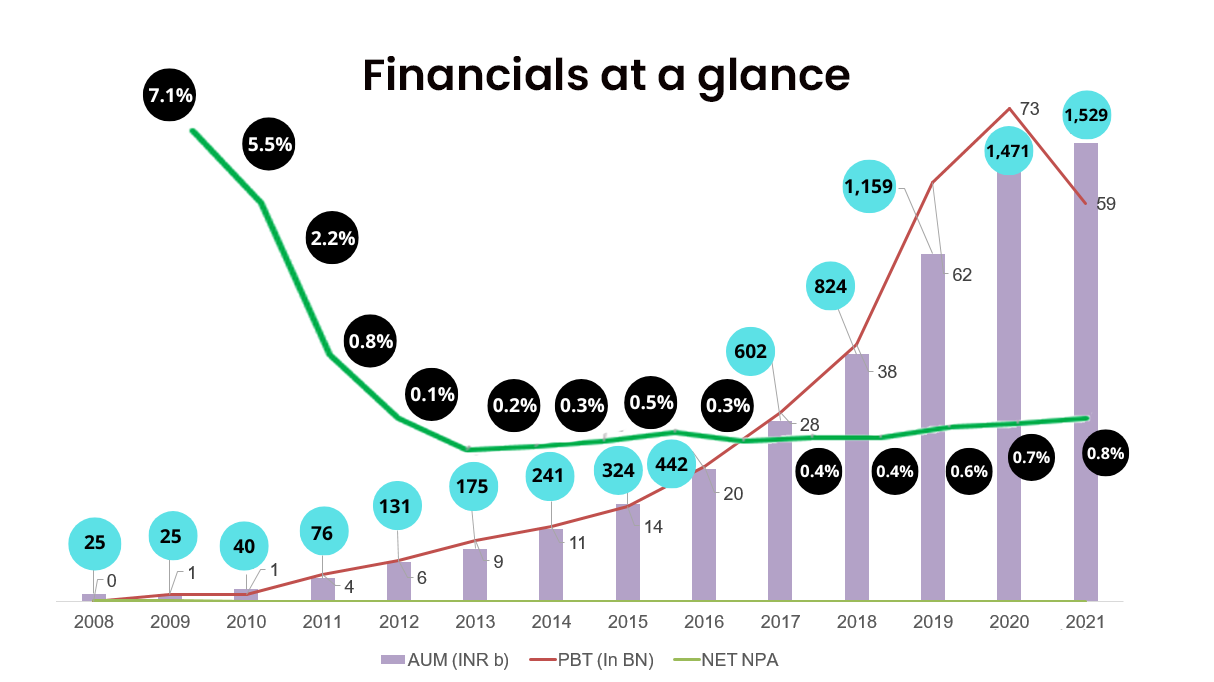

Its total Assets under management (AUM) increased by 29% and stood ₹ 197,452 crores in FY22. The company’s core income (NIM), which is the interest income it receives minus the interest paid rose by 27% and stood at ₹ 21,892 crores in FY22.

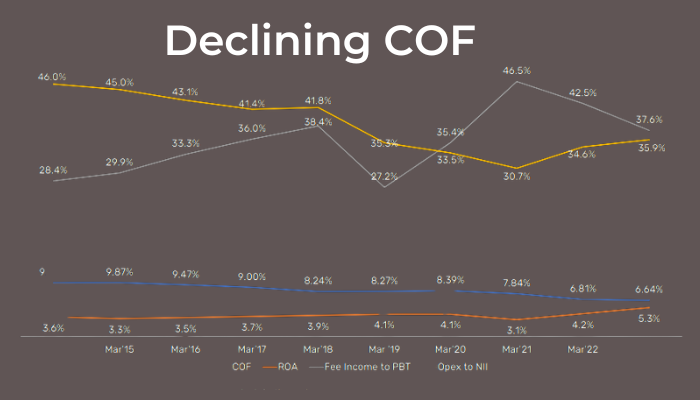

The company’s operating expenses to its Net Interest Income increased and stood at 35.9%. The company has hinted that since they are investing in digital technology and building a super app, the operating expenses would be higher in the coming few months.

Another important ratio for an NBFC is the cost of funds, unlike banks NBFCs don’t have access to low-cost deposits like saving and current account deposits and there have to rely on different borrowing instruments due to which the cost of funds is higher for NBFCs.

The cost of funds for BFL has declined significantly from 8.24% in 2018 to 6.64% in Jun 2022.

The company has an overall diversified borrowing mix which cushions it from any uncertainty.

Asset Quality:

It's GNPA & NNPA stood at 1.25% and 0.51% as of 30 June 2022 as against 1.60% and 0.68% as of 31 March 2022.

Its asset quality has been on par with some of the major banks in India and has improved in recent quarters.

Bajaj Finance is one of the most established NBFCs in India. The company is growing at more than 25%, and at this rate, it can double its business in just three years. It is definitely one of the fastest growing companies in India, the company’s plan to launch a super app, credit growth, and launch of its own credit card are some factors that contribute to its growth.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Tanushree Jaiswal

Tanushree Jaiswal

5paisa Research Team

5paisa Research Team