Fonebox Retail PO Financial Analysis

Last Updated: 24th January 2024 - 05:59 pm

Fonebox Retail, established on 5 February 2021, specializes in multi-brand retail of smartphones (Vivo, Apple, Samsung, Oppo, Realme, Nokia, Narzo, Redmi, Motorola, LG, Micromax) and consumer electronics (laptops, washing machines, smart TVs, air conditioners, fridges) from brands such as TCL, Haier, Lloyd, Daikin, Voltas, Mi, Realme, and OnePlus is set to launch its IPO on 23 January 2024. Here's a summary of the company's business model, strengths, weaknesses, and growth prospects to assist investors in making informed decisions.

Fonebox Retail IPO Overview

Fonebox Retail Ltd is a multi-brand retailer with 153 stores in Gujarat, offering smartphones from Apple, Samsung, Vivo, Oppo, Realme, Redmi, LG, Micromax, and Motorola. It operates under Fonebook and Fonebox brands. The company also sells electronic products from TCL, Haier, Lloyd, Daikin, Voltas, Realme, and OnePlus. They partner with financial institutions like Bajaj Finance, HDB, HDFC Bank, and IDFC for credit/EMI options. As of late 2023, 40 stores follow the COCO model, and 113 are franchise-operated under the FOCO model. The company has a workforce of over 130 people

Fonebox Retail IPO Strengths

1- Experienced Promoters and a skilled management team.

2- Extensive network for widespread distribution.

3- Diverse range of products.

4- Offering a wide range of smartphones and accessories from reputable brands

Fonebox Retail IPO Risk

1. The company consistently faced negative cash flow from operating activities in recent fiscal years. Prolonged negative cash flow may impact business, financial health, and operational results.

2. operates in a business with high sales but low-profit margins.

3. Fonebox's success heavily relies on the reputation and recognition of its product brands. Any failure to maintain or improve this image could impact its business, financial condition, and operational results.

4. The company relies on a small number of key suppliers. Losing any of them could impact its business operations.

Fonebox Retail IPO Details

Fonebox Retail IPO is scheduled from 25 to 30 January 2024. It has a face value of ₹10 per share, and the IPO's price range is ₹66-70 per share

Financial Performance of Fonebox Retail

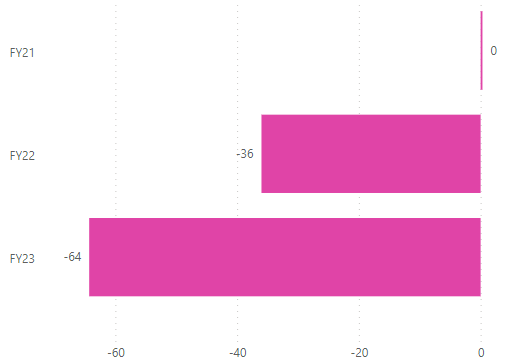

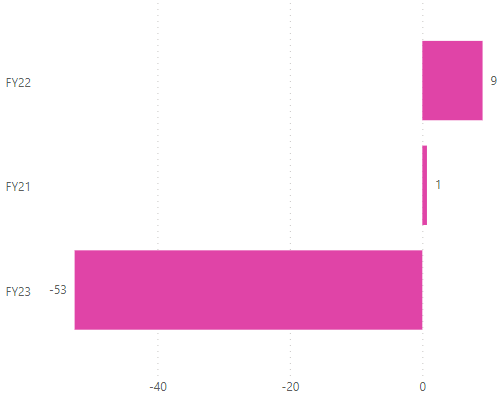

Fonebox Retail faced a positive Free Cash Flow of 0.30 million in FY21, but it turned negative in subsequent years, reaching -36.00 million in FY22 and -64.30 million in FY23. This trend raises concerns about the company's financial health and ability to meet obligations. Free Cash Flow reflects the cash available for distribution, debt reduction, or reinvestment. Positive values indicate surplus cash, while negative values suggest a cash deficit

Net Profit (Rs in millions)

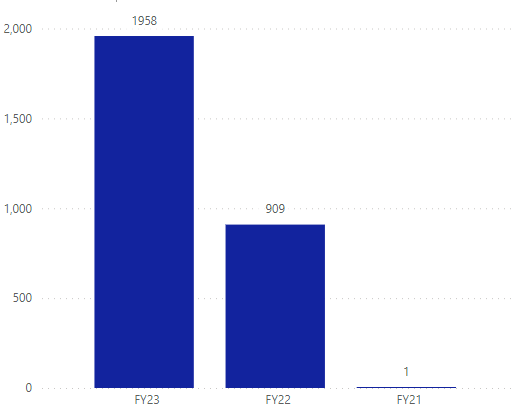

Revenue from Operations (Rs in millions)

Free Cash Flow (Rs in millions)

Cash Flow from Operations (Rs in millions)

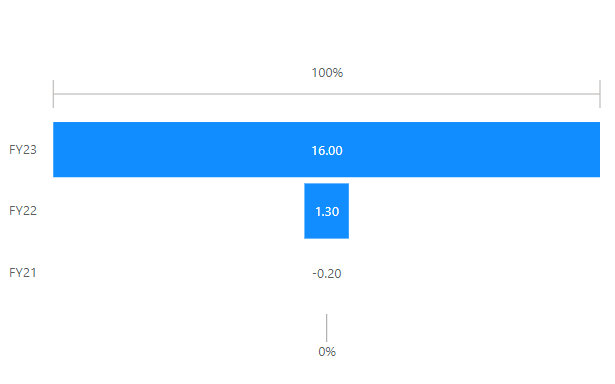

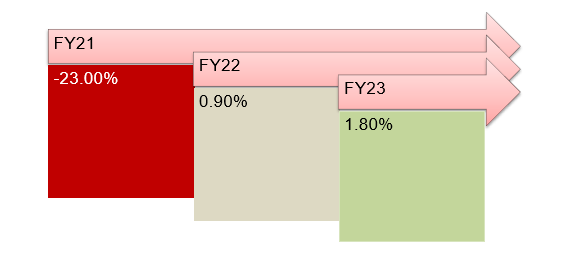

Margins

Key Ratios

Fonebox Retail's Return on Equity shows how well it's using shareholders' money for profits. In FY21, it was -16.67% rose to 21.67% in FY22, and then surged to 76.19% in FY23. These percentages indicate the efficiency of the company in generating returns for shareholders from their investments

| Particulars | FY23 | FY22 | FY21 |

| PAT Margins (%) | 0.82% | 0.14% | -20.00% |

| Return on Equity (%) | 76.19% | 21.67% | -16.67% |

| Return on Assets (%) | 4.14% | 0.62% | -2.82% |

| Asset Turnover Ratio (X) | 5.08 | 4.31 | 0.14 |

| Earnings per share (₹) | 2.35 | 0.19 | -0.04 |

Promoters of Fonebox Retail IPO

1. Mr. Manishbhai Girishbhai Patel.

2. Mr. Jigar Lallubhai Desai.

3. Mr. Jigneshkumar Dashrathlal Parekh.

4. Mr. Amitkumar Gopalbhai Patel.

5. Mr. Parth Lallubhai Desai.

The company was promoted by Manishbhai Girishbhai Patel, Jigar Lallubhai Desai, Parth Lallubhai Desai, Jigneshkumar Dashrathlal Parekh, and Mr. Amitkumar Gopalbhai Patel. Currently, promoters collectively hold 100.00% of the company. However, with the introduction of new shares in the IPO, promoter equity holding is expected to be diluted to 71.64%.

Fonebox Retail IPO Vs. Peers

Jay Jalaram Technologies has the highest P/E ratio at 71.73x, while Bhatia Communications & Retail (India) has the lowest at 25.10x. The industry average P/E ratio is 48.41x. The proposed IPO price range, with a P/E ratio between 30.43x and 56.92x, seems reasonable compared to the industry average of 48.41x

| Company | Face Value (Rs. per Share) | P/ E | EPS (Basic) (Rs.) |

| Fonebox Retail Limited | 10 | 30.43 | 2.17 |

| Jay Jalaram Technologies Limited | 10 | 71.73 | 2.55 |

| Bhatia Communications & Retail (india) | 1 | 25.1 | 0.68 |

Final Words

This article takes a closer look into Fonebox Retail IPO, scheduled for subscription from 25 January 2024. It suggests that potential investors thoroughly review the company's details, financials, subscription status and GMP. Grey Market Premium indicates the anticipated listing performance, providing valuable insights for investors to make well informed decisions. On 24 January 2024, Fonebox Retail GMP is ₹50 up from the issue price reflecting 71.43% increase

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Sachin Gupta

Sachin Gupta

5paisa Research Team

5paisa Research Team