Top Energy ETFs in India - Best Funds to Invest

Best Metal Stocks

Last Updated: 13th September 2023 - 11:03 am

In 2023, top metal stocks in India are anticipated to grow significantly. This is because of the increased demand and government initiatives for metal stocks. The performance of top metal stocks in India and the metal sector is examined in this article. The effects of national and international economic factors on metal stocks are also discussed.

What are Metal Stocks?

Shares of businesses producing and distributing different metals, such as steel, aluminum, copper, and others, are referred to as having metal stocks. Investors can gain exposure to the metal industry and profit from the sector's expansion by purchasing these best metal stocks in India.

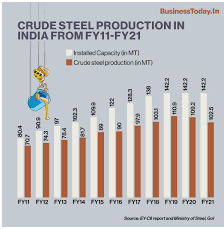

Overview of Metal Industry

Steel, aluminum, copper, and other best metal stocks are produced and distributed in the metal industry. The demand for the product comes from sectors including manufacturing, construction, and the automobile industry, all of which play a significant part in the global economy. Technological breakthroughs and shifting market trends have an ongoing impact on the industry's development and performance.

Why Invest in Metal Stocks?

Investing in metal stocks may provide investors with several advantages. Here are some explanations as to why an investor might think about buying metal stocks:

● Portfolio Diversification: Investing in top metal stocks can expose investors to a different asset class not associated with other common investments like equities and bonds.

● World Demand: The metal business is a vital part of the world economy, with demand coming from industries like manufacturing, construction, and transportation. As a result, metal stocks may be appealing as investments since they may gain from the expansion of the world economy.

● Spending on Infrastructure: Governments worldwide are investing in infrastructure projects, which may increase demand for metals like copper and steel.

● Technical Developments: New materials and technologies are continually being created in the metal business, which has the potential to spur expansion and open up new investment opportunities.

Investing in top metal stocks may benefit investors through possible long-term growth and diversification.

Top 10 Metal Stocks to Invest in India

Here is a list of metal company stocks in India:

|

Company Name |

Industry |

|

Tata Steel Ltd |

Steel |

|

Hindalco Industries Ltd |

Aluminum |

|

JSW Steel Ltd |

Steel |

|

Vedanta Ltd |

Copper, Zinc, Aluminium, and Iron Ore |

|

Coal India Ltd |

Coal |

|

NMDC Ltd |

Iron Ore |

|

National Aluminium Company Ltd |

Aluminum |

|

Jindal Steel & Power Ltd |

Steel |

|

Hindustan Zinc Ltd |

Zinc |

|

SAIL (Steel Authority of India Ltd) |

Steel |

Factors to Consider Before Investing in Metal Related Stocks in India

It is vital to consider several elements that may affect the performance of an investment before considering metal stocks to buy in India. These are some important things to consider:

● Industry Trends and Performance: One of the most crucial aspects to consider is the performance of the companies involved in the metal industry, as well as the past, present, and projected trends in that sector. Understanding consumer demand for various metals, the production capacities of multiple businesses, and the market factors affecting the industry are crucial.

● Regulatory Environment: Environmental, labor, and safety requirements are only a few regulations that apply to the metal business. Understanding how these regulations will affect the companies you wish to invest in is crucial because failure to comply might result in fines.

● Company Financials: Research the Company's financials, including its sales, profitability, debt levels, and cash flow, before investing in a stock connected to metals. It's also critical to comprehend the capital structure of the business, especially its interest coverage and debt-to-equity ratios.

● Management and Governance: A company's management and governance structure impacts its performance. The management team and their prior accomplishments and the organization's corporate governance principles and practices should be thoroughly investigated.

● World Economic Conditions: Factors like inflation, interest rates, and political unrest can impact the performance of equities associated with the metals industry. Monitoring these variables and how they could affect businesses and the industry is critical.

Therefore, investing in companies that are associated with the metal industry might offer the possibility of long-term growth. Still, it is crucial to consider the above considerations and conduct extensive research and analysis before making any investment decisions. Also, it is essential to continuously analyze your investments and modify your portfolio as necessary in light of shifting market conditions.

Performance Overview of Metal Stocks List

One of India's largest and most prestigious business conglomerates, the Tata Group, is the parent company of Tata Steel Ltd., a leading steel manufacturer in the country. The business was established in 1907, headquartered in Mumbai, and has activities in Southeast Asia, Europe, and India.

Key Financial Ratios:

● Market Cap: INR 1,38,787 crore

● Face Value: INR 10

● EPS (Earnings Per Share): INR 106.96

● Book Value: INR 954.53

● ROCE (Return on Capital Employed): 18.33%

● ROE (Return on Equity): 19.53%

● Debt to Equity: 0.60

● Stock PE (Price to Earnings Ratio): 8.57

● Dividend Yield: 1.18%

● Promoter's Holdings (%): 33.04%

Hindalco Industries Ltd is an affiliate of the Aditya Birla Group and a multinational firm based in India. The Company's main business is the manufacture of copper and aluminum products. Its copper products include cathodes, rods, and cakes, while its aluminum products comprise extrusions, sheets, coils, foil, and wire rods.

Key Financial Ratios:

● Market Cap: INR 79,711 crore

● Face Value: INR 1

● EPS (Earnings Per Share): INR 20.95

● Book Value: INR 225.53

● ROCE (Return on Capital Employed): 10.08%

● ROE (Return on Equity): 7.31%

● Debt to Equity: 0.88

● Stock PE (Price to Earnings Ratio): 7.92

● Dividend Yield: 0.99%

● Promoter's Holdings (%): 36.65%

The JSW Group includes the Indian steel firm JSW Steel Ltd. Steel and associated products, such as hot-rolled coils, plates, cold-rolled coils, galvanized good metal stock, and color-coated goods, which are produced and distributed by the business. It is also active in the mining and energy industries.

Key Financial Ratios:

● Market Cap: INR 152,404 crore

● Face Value: INR 10

● EPS (Earnings Per Share): INR 77.89

● Book Value: INR 524.85

● ROCE (Return on Capital Employed): 22.10%

● ROE (Return on Equity): 24.43%

● Debt to Equity: 1.32

● Stock PE (Price to Earnings Ratio): 9.79

● Dividend Yield: 0.49%

● Promoter's Holdings (%): 55.98%

A diversified natural resources corporation with oil and gas, power, and mining operations, Vedanta Ltd. is based in India. The Company is well-represented throughout the Middle East, Australia, Africa, and India.

Key Financial Ratios:

● Market Cap: INR 77,639 crore

● Face Value: INR 1

● EPS (Earnings Per Share): INR 17.89

● Book Value: INR 120.64

● ROCE (Return on Capital Employed): 7.63%

● ROE (Return on Equity): 11.20%

● Debt to Equity: 0.81

● Stock PE (Price to Earnings Ratio): 4.59

● Dividend Yield: 7.68%

● Promoter's Holdings (%): 50.14%

An Indian state-owned coal mining corporation called Coal India Ltd. With activities spread over eight Indian states, it is one of the biggest producers of coal in the entire globe. Coking coal, non-coking coal, and coal bed methane are among the several coal products that the company produces.

Key Financial Ratios:

● Market Cap: INR 124,011 crore

● Face Value: INR 10

● EPS (Earnings Per Share): INR 29.55

● Book Value: INR 178.23

● ROCE (Return on Capital Employed): 33.57%

● ROE (Return on Equity): 21.04%

● Debt to Equity: 0.04

● Stock PE (Price to Earnings Ratio): 5.61

● Dividend Yield: 7.26%

● Promoter's Holdings (%): 66.14%

The National Mineral Development Company, also known as NMDC Ltd, is an Indian state-owned mining producer. The Company's main activities include exploring copper, iron ore, and other metals.

Key Financial Ratios:

● Market Cap: INR 60,952 crore

● Face Value: INR 1

● EPS (Earnings Per Share): INR 21.21

● Book Value: INR 104.11

● ROCE (Return on Capital Employed): 28.16%

● ROE (Return on Equity): 25.32%

● Debt to Equity: 0.05

● Stock PE (Price to Earnings Ratio): 6.15

● Dividend Yield: 5.04%

● Promoter's Holdings (%): 68.29%

7. National Aluminium Company Ltd

Alumina and aluminum products are produced and marketed by National Aluminium Company Ltd, also known as NALCO, a public sector entity. The entity also generates wind energy, then sells it to the national grid.

Key Financial Ratios:

● Market Cap: INR 22,364 crore

● Face Value: INR 5

● EPS (Earnings Per Share): INR 6.77

● Book Value: INR 77.24

● ROCE (Return on Capital Employed): 15.73%

● ROE (Return on Equity): 12.03%

● Debt to Equity: 0.03

● Stock PE (Price to Earnings Ratio): 13.98

● Dividend Yield: 4.12%

● Promoter's Holdings (%): 51.50%

An important player in the mining, power, steel, and infrastructure sectors, Jindal Steel & Power Ltd. (JSPL) is a well-known Indian steel and power corporation. The Company's extensive product line includes sponge iron, pig iron, coal, steel plates, hot-rolled coils, and wire rods.

Key Financial Ratios:

● Market Cap: INR 47,370 crore

● Face Value: INR 1

● EPS (Earnings Per Share): INR 7.77

● Book Value: INR 134.31

● ROCE (Return on Capital Employed): 7.82%

● ROE (Return on Equity): 6.05%

● Debt to Equity: 1.36

● Stock PE (Price to Earnings Ratio): 11.56

● Dividend Yield: 0.78%

An Indian mining business called Hindustan Zinc Ltd specializes in producing zinc and lead. It is a division of one of the nation's biggest mining and metal corporations, Vedanta Limited.

Key Financial Ratios:

● Market Cap: INR 1,20,120 crore

● Face Value: INR 2

● EPS (Earnings Per Share): INR 27.97

● Book Value: INR 173.25

● ROCE (Return on Capital Employed): 25.91%

● ROE (Return on Equity): 27.08%

● Debt to Equity: 0.00

● Stock PE (Price to Earnings Ratio): 13.15

● Dividend Yield: 5.68%

● Promoter's Holdings (%): 65.19%

10. SAIL (Steel Authority of India Ltd)

Steel Authority of India Limited is a government-owned steel production company in New Delhi, India. One of India's biggest steel producers, it creates various steel goods such as hot and cold rolled coils, galvanized sheets, and rails.

Key Financial Ratios:

● Market Cap: INR 34,876 crore

● Face Value: INR 10

● EPS (Earnings Per Share): INR 6.87

● Book Value: INR 59.67

● ROCE (Return on Capital Employed): 7.29%

● ROE (Return on Equity): 10.48%

● Debt to Equity: 1.44

● Stock PE (Price to Earnings Ratio): 8.80

● Dividend Yield: 2.63%

● Promoter's Holdings (%): 75.00%

Here is a list of best metal stocks to buy in India 2023 with their statistics.

|

Company Name |

Net Sales (FY21) |

EBITDA (FY21) |

Net Profit (FY21) |

EBITDA Margins (FY21) |

Net Profit Margin (FY21) |

|

Tata Steel Ltd |

INR 179,458 Cr |

INR 38,477 Cr |

INR 21,205 Cr |

21.5% |

11.8% |

|

Hindalco Industries Ltd |

INR 136,902 Cr |

INR 20,596 Cr |

INR 8,443 Cr |

15.0% |

6.2% |

|

JSW Steel Ltd |

INR 98,641 Cr |

INR 23,920 Cr |

INR 9,936 Cr |

24.3% |

10.1% |

|

Vedanta Ltd |

INR 88,600 Cr |

INR 31,536 Cr |

INR 13,677 Cr |

35.6% |

15.4% |

|

Coal India Ltd |

INR 78,050 Cr |

INR 26,207 Cr |

INR 15,223 Cr |

33.5% |

19.5% |

|

NMDC Ltd |

INR 11,764 Cr |

INR 6,529 Cr |

INR 4,540 Cr |

55.5% |

38.6% |

|

National Aluminium Company Ltd |

INR 10,404 Cr |

INR 2,895 Cr |

INR 1,931 Cr |

27.8% |

18.6% |

|

Jindal Steel & Power Ltd |

INR 34,453 Cr |

INR 7,245 Cr |

INR 2,630 Cr |

21.0% |

7.6% |

|

Hindustan Zinc Ltd |

INR 22,466 Cr |

INR 11,699 Cr |

INR 7,529 Cr |

52.0% |

33.5% |

|

Steel Authority of India Ltd (SAIL) |

INR 75,021 Cr |

INR 20,338 Cr |

INR 8,047 Cr |

27.1% |

10.7% |

Conclusion

With the growth of infrastructure and government efforts, demand for metal stocks are anticipated to increase. The leading metal businesses in India have consistently increased their revenue and profitability. Before selecting the best metal stock to buy, investors must take into account several variables, including financial performance, market trends, and governmental laws. In conclusion, investing in metal stocks can be smart for those wishing to diversify their holdings and profit from India's expanding metal industry.

FAQs

Which Indian Company is investing in the Metal Sector?

Tata Steel, along with other Indian companies such as Hindalco and JSW Steel, are investing in the metal sector to capitalize on India's growing demand for metal stocks.

What is the future of Metal in India?

The future of metal in India looks promising with the increasing demand for metal stocks due to infrastructure development and government initiatives, offering opportunities for growth and investment.

Who is the largest manufacturer of Metal in India?

Tata Steel is one of India's largest metal manufacturers, producing a wide range of products, including steel, aluminum, and copper.

What are Nifty Metal stocks?

Nifty metal stocks refer to a group of metal-related companies listed on the National Stock Exchange (NSE) of India, representing the performance of the metal sector in the Indian stock market.

How can I invest in Metal stocks using the 5paisa App?

To invest in metal stocks using the 5paisa app, you must open a Demat account, transfer funds, search for the desired metal stock, and place an order. The app provides real-time market news, data, and analysis to aid investment decisions.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

03

5paisa Research Team

5paisa Research Team

04

5paisa Research Team

5paisa Research Team

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Sachin Gupta

Sachin Gupta