SIF vs Mutual Funds: How Do They Differ Strategy, Flexibility, and Risk?

Are Small-Cap funds overvalued?

Last Updated: 9th May 2025 - 03:15 pm

What's sizzling hot in the Indian Stock Market these days? IPOs? Nope! Value stocks? Give it another shot! Well, it's none other than Small-cap Funds!

Yes, you heard it right! Small-cap funds have suddenly become the apple of the Indian investor's eye. Money is flowing into these schemes at an unprecedented rate, breaking records left and right.

Small-cap funds have become very popular among Indian investors recently. A lot of money is pouring into these funds, and it's hitting record levels.

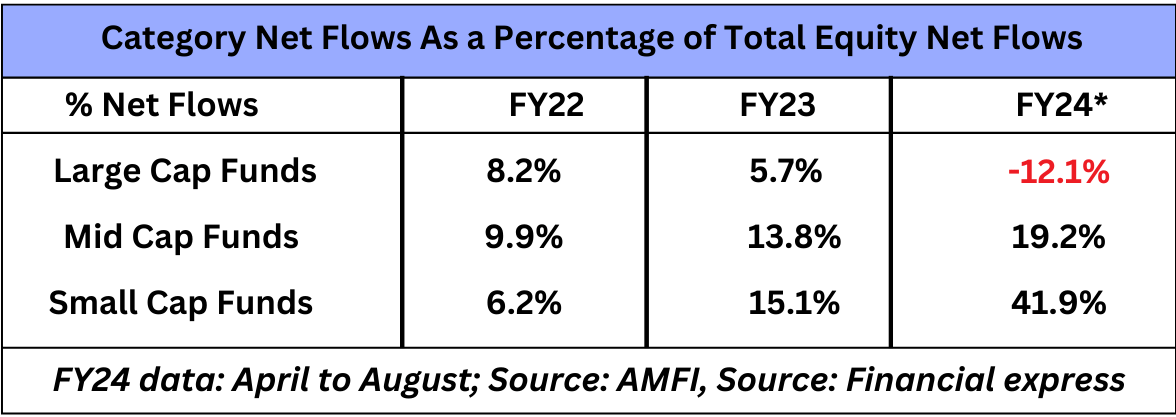

To understand why this is a big deal, let's look at some numbers. The money going into large-cap mutual funds has been decreasing since the last financial year (FY22). It used to be 8.2% of all the money invested in stocks, but now it's down to 5.7%. And in the first few months of FY24, it dropped even more, by 12.1%.

But here's where it gets interesting. While large-cap funds were going down, mid-cap and small-cap funds were going up. Mid-cap funds saw their money go from 9.9% to 19.2%, and small-cap funds went from 6.2% to a whopping 41.9% in FY24.

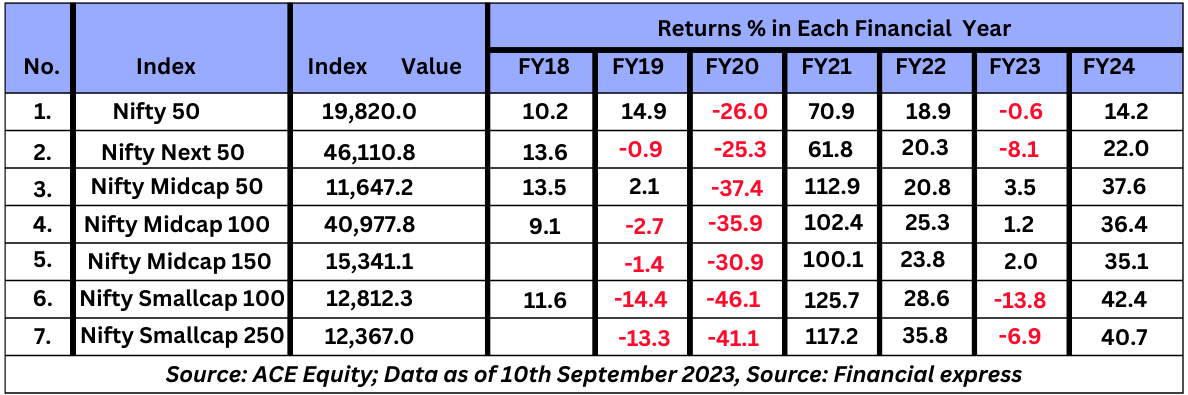

The small-cap funds really started turning heads in March when they dazzled existing investors with eye-popping returns. Over the past year, Nifty small-cap stocks have delivered a handsome 36% return on investment, outshining Nifty MidCap 100 at 28% and Nifty 100 at a mere 13%.

Soon, these small-cap gems found themselves in the trending sections of fintech platforms like IndMoney, Groww, Kuvera, and Paytm Money. FOMO kicked in, and investors began pouring their hard-earned savings into this small-cap phenomenon.

Aftermath?

The prices of Small-cap stocks touched the roof.

The Nifty 250 Smallcap index hit an all-time high, with a trailing twelve-month price-to-earnings ratio soaring over 24.

Now, here's the twist with smaller market cap companies: they tend to have lower liquidity compared to their larger counterparts. This means that when too much money floods into them, it can drive up their prices and make them less attractive from a valuation perspective. Plus, the massive influx into small and micro-cap stocks can come back to bite investors when market conditions shift, and redemption pressures mount.

So, when the flood of funds showed no sign of stopping, fund managers had to take a step back. Two fund houses, Nippon India MF and Tata MF, decided to halt lump-sum investments in their small-cap funds.

Chandraprakash Padiyar, the fund manager at Tata Small Cap Mutual Fund, explained that the surge in inflows had made it challenging to deploy additional funds without pushing stock prices to the moon. Consequently, Tata's small-cap fund found itself sitting on a 15% cash cushion, compared to the usual 10%.

Padiyar emphasized the importance of gradual stock accumulation, saying, "Any stock that we buy, we want to add to it gradually. But when you're suddenly hit with five times the daily inflow you're used to, your cash level keeps rising, and that can eventually impact the fund's performance." He added that a flood of money chasing stocks can lead to inflated valuations and reduced future returns, so it's wise to let things settle down.

They plan to deploy the excess cash in the next 1-2 months, but only when they feel the time is right.

Let’s get back to the main question - Are Small-Cap funds really overvalued?

You see, when stocks become too pricey, it becomes difficult for fund managers to deploy funds. They have a few options to weigh before closing the doors to new investors.

First, they can increase the percentage of cash and cash equivalents in the fund. To put it another way, they retain more money on the sidelines, ready to be used when the perfect possibilities present themselves.

Second, they can increase the quantity of equities they have in their portfolio. They can spread their investments and lower the risk involved with maintaining a concentrated portfolio by diversifying across many different stocks.

Finally, fund managers may decide to allocate funds to mid and large cap stocks. These companies can accept greater investments without having a substantial impact on their values and are frequently more liquid.

If any of this is happening, it's most likely a sign that these funds are overpriced!

Here’s the thing - Investing in small cap stocks can be risky because the liquidity in these stocks is low and hence there are chances of stock price manipulation.

That's why many advisors suggest going through mutual funds rather than trying to time the market with lump-sum investments, small cap ETFs, or direct stock purchases.

Small caps are known for their wild volatility, but some offer juicy returns to those brave enough to venture into this territory, especially when small cap indices are breaking records. If you're thinking about stepping into the small cap space, it's a smart move to consult your advisor first because small caps aren't for the faint of heart. Happy investing!

- ZERO Commission

- Curated Fund Lists

- 1,300+ Direct Funds

- Start SIP with Ease

Trending on 5paisa

01

5paisa Capital Ltd

5paisa Capital Ltd

Mutual Funds and ETFs Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Capital Ltd

5paisa Capital Ltd