Top Energy ETFs in India - Best Funds to Invest

Aditya Birla’s foray into the paints industry is a death sentence for paint companies?| Asian Paints | Berger Paints

Last Updated: 12th December 2022 - 01:02 pm

Asian paints, the sweetheart stock of most Indian Investors was down 7% yesterday after Grasim Industries, the flagship company of the giant Aditya Birla group announced that the company would double their CAPEX.

A mammoth company like Aditya Birla wants to set its foot into the paints industry, surely it's not going to be just another player. Not just that, a lot of people found it reminiscent of Reliance Jio’s disruption in the telecom industry. A company with deep pockets that disrupted the industry.

If it's going to be that big, surely we have to dig deeper to find out how the story is going to unfold.

Deep Pockets, Vast networks, A recipe for success?

So, Grasim Industries is a part of Aditya Birla group, which has two subsidiaries Aditya Birla Capital and Ultratech cement.

Initially the company plans to create a synergy between its existing products and the paints segment. It is going to use the distribution network of Birla white, Ultratech both of which are market leaders in white cement and putty and cement respectively. Since, their distribution network is similar to that of paints, it would give them access to the market without any additional costs.

Here is a snippet of their con call, mentioning this.

Okay, this is cool! Existing distribution network and everything! But what about Asian paints, can they dethrone it?

Asian Paints: The Undisputed king

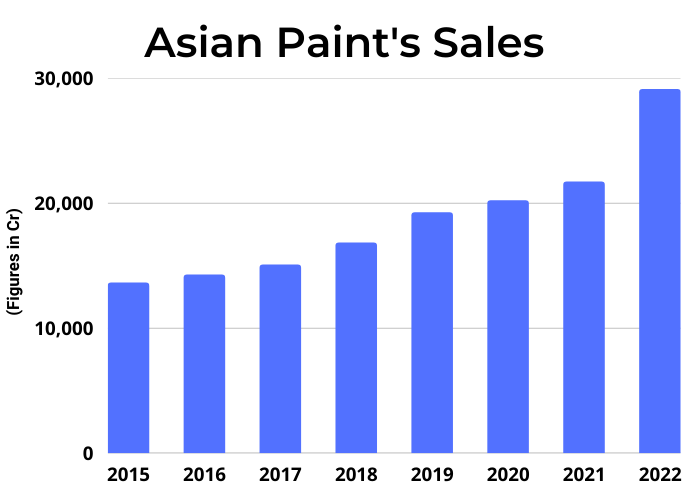

So, you don’t have to look at the numbers or an excel sheet to know that Asian Paints is the market leader in the industry. Paints are synonymous in India to Asian Paints. That’s the kind of brand value it has. The company has a spectacular record, even amidst the pandemic it has grown its topline and even after being the largest player in the industry, it has consistently gained market share.

But have you ever wondered, why is it the market leader with more than 50% share ?

Well, the first reason is its distribution network, you can find an Asian paints dealer in even the remotest location in India.

Further, the company has figured a way to the hearts of Indian customers that are quite choosy with their colors. So, one problem that paint companies face is to make all colors available with the dealer, so whenever any customers walks into a hardware shop they have to select from a palette and the dealer would then place the order for that color with the distributor, and the whole process would take around 10 to 20 days, Asian paints solved this problem by installing a tinting machine, which is machine, where the dealer can mix match colors to create a desired color. So, now it's easy for customers to get their desired color.

This process requires having a good network of dealers, also the company needs to have a personal connection with them and have to train them for the usage of machines, so you see it's not as easy as it sounds.

But Asian paints has pioneered this process and has become the king in Industry. It's not like other players aren’t trying to catch up, but Asian paints definitely has the largest network of more than 50,000 machines, while Nerolac and Berger together have 46000 machines.

To have a personal connection with dealers, and a good distribution network with a strategy is definitely going to be a challenge for Grasim, but they have taken notes of it as they mentioned in their concall.

ABG group has a history of being the leader in whatever they do. Will they be able to lead the paints industry, which is ever growing and has a high ROCE?

Paints industry is oligopolistic in nature because there are high entry barriers, like technology, distribution network and its difficult to break that entry barrier and it seems like ABG knows it well as they clearly mentioned that they plan to be the number 2 in the industry.

Clearly, they still are yet to figure out their strategy to beat Asian Paints, but if ABG is doing it, they are clearly here for a long haul and it seems like a threat for small players in the Industry.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

03

5paisa Research Team

5paisa Research Team

04

5paisa Research Team

5paisa Research Team

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Sachin Gupta

Sachin Gupta