Top Pharma Mutual Funds To Invest In 2021

Last Updated: 15th December 2022 - 06:59 am

Ever since the global health crisis has fraught our lives, governments around the world have been increasingly investing in medical infrastructure. The developing nations have been seeing massive inflows of funds from intergovernmental pillar organisations and investors alike.

The Indian government, too, is expected to spend about 2.5% of its GDP on health infrastructure by the end of 2025. As a consequence of this increasing global health awareness, the pharma sector has seen a quick rebound after the 2020 stock market crash due to the pandemic.

This sector is expected to rally in the near future, and if you are bullish on this sector too, we have come up with a comprehensive analysis on our top 3 picks among the Pharma Mutual Fund Schemes in 2021:

1) Nippon India Pharma Fund Growth

2) Tata India Pharma & Health Care Fund Growth

3) UTI Healthcare Fund Growth

Let's take a deep dive into all the factors, parameters and fund specific data that will help you make the best choice for yourself:

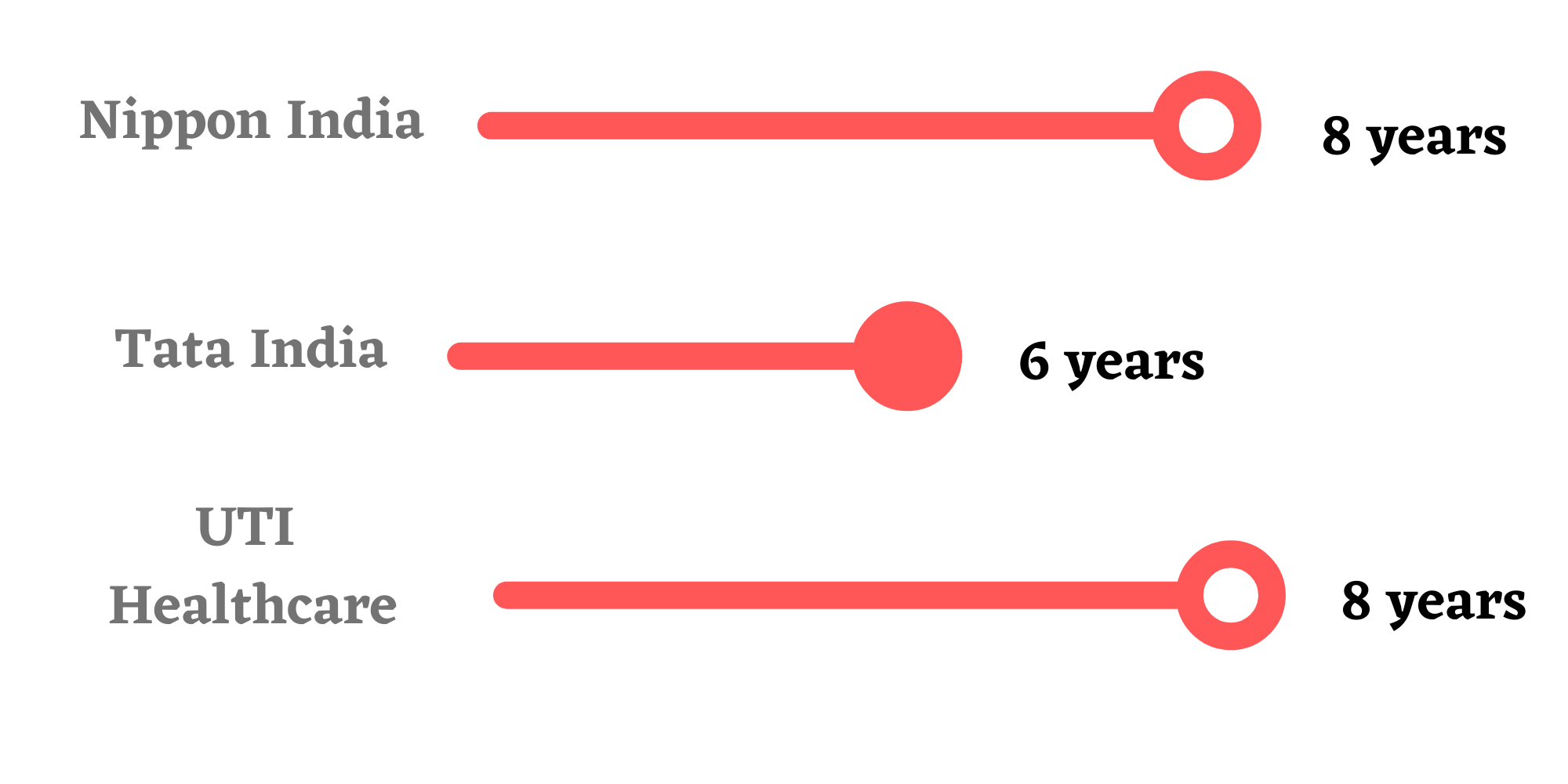

Age

The longer the age of the scheme, and more importantly, the AMC, the surer you can be about its reliability and reputation. A higher age also means a lot of historical data will be available to you for a detailed analysis of its past performance. This doesn't mean you have to steer clear of new schemes as there are a lot of other factors to consider as well.

Asset Under Management

It is the total pool of funds that the fund managers are dealing with, and you could think of it as the fund's current portfolio value. A high AUM signifies that the scheme has amassed a lot of money from the investors and has also grown that amount over the years. It is a telltale sign of investors confidence along with the fund's ability to diversify its holdings.

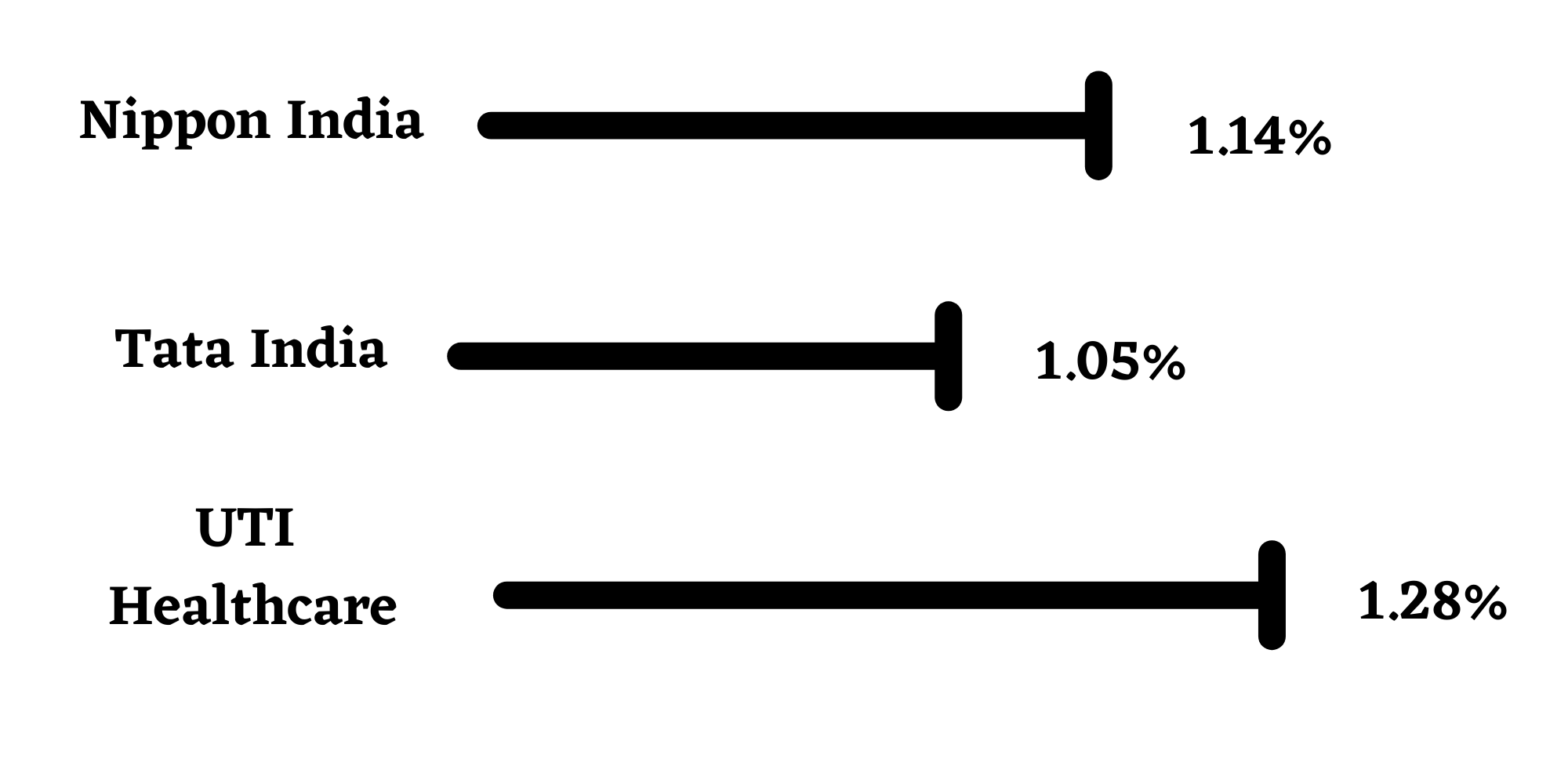

Expense Ratio

Expressed as a percentage of the investment amount, the expense ratio is a measure of how much money would be charged from you as admin expenses. A higher expense ratio will mean your net returns would be lower. Compared to general funds, thematic funds generally charge a high expense ratio, but the overall returns can still be spectacular.

Asset Allocation

A sectoral or thematic fund can allocate its assets among large-cap, small-cap and medium cap shares which indicates the magnitude of the market capitalisation of the companies. Small companies are riskier to invest in, but they can also give you steep positive returns.

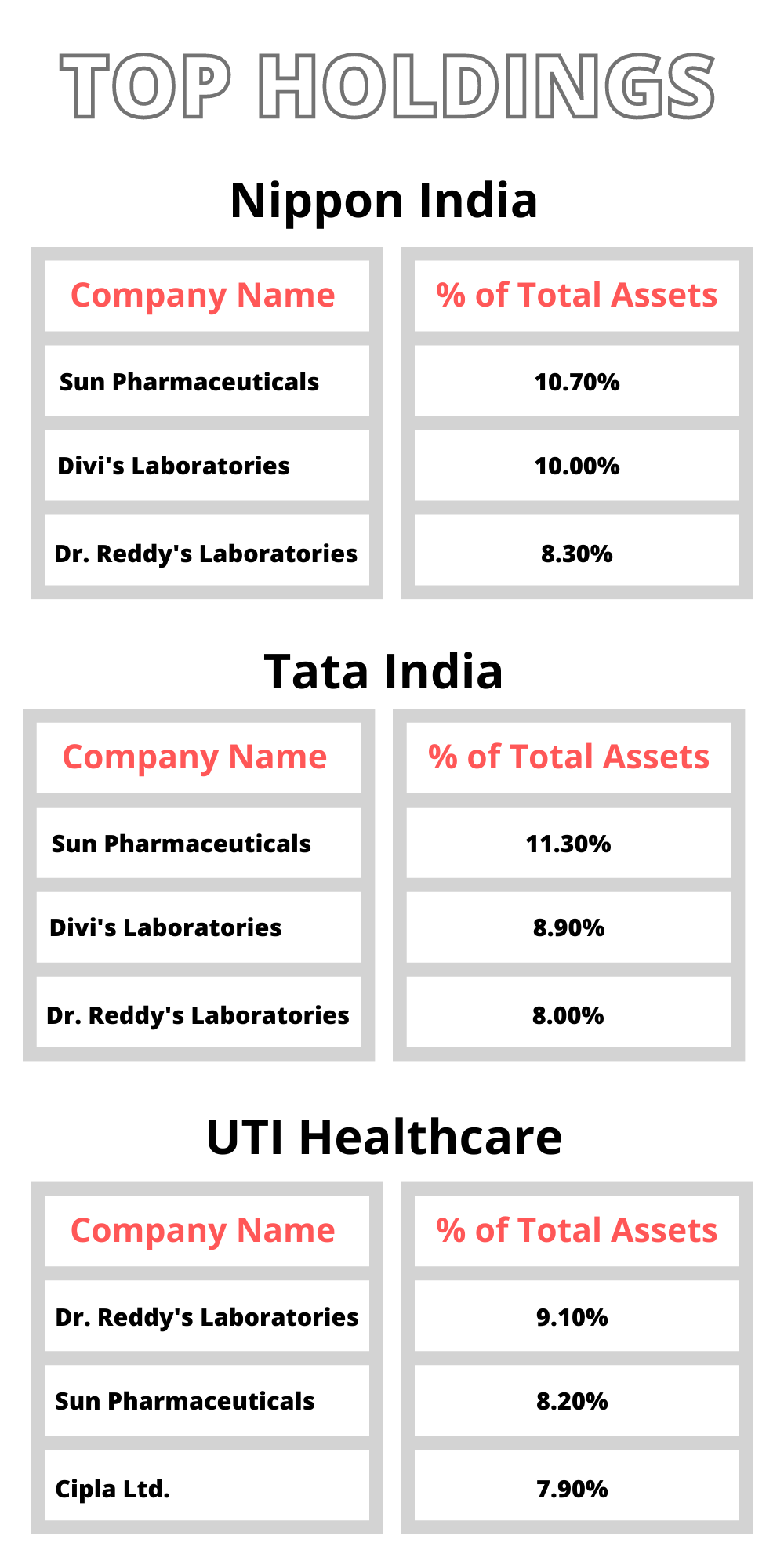

Top Holdings

A closer look into the companies where the funds have concentrated most of their holdings can give you an insight into their future performance. Ideally, a larger holding percentage in fundamentally strong companies means that no matter the transitory ups and downs the returns should have a great average in the long run.

Returns

You must be thinking that this is the concluding factor in choosing the right scheme, but it is crucial to remember that the returns that are available in the records are only indicative of the fund's past performances. You can have a similar projection for the future, but they can always go awry. The smarter way to zero in on the best option is to refrain from giving too much emphasis on returns alone.

You see, there is no clear winner and all 3 of them have given great annualised returns over the life of the funds. Tata India is a comparatively younger fund, which explains why its lifetime returns are lower. In terms of category average returns, all three funds have performed higher than the mean, with the exception of last year, which saw a massive recovery in the markets.

Since the players in the pharma and healthcare industry are not too many in number, all these Pharma Funds have holdings that substantially overlap with each other. So if you are holding units in two or more of these funds, you cannot really enjoy any diversification benefit. It is also not advisable to put all your money in a sectoral or thematic fund to avoid negative returns in case the industry tumbles due to unforeseeable economic consequences.

- 0% Commission*

- Upcoming NFOs

- 4000+ Schemes

- Start SIP with Ease

Trending on 5paisa

Mutual Funds and ETFs Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Sachin Gupta

Sachin Gupta

5paisa Research Team

5paisa Research Team