Finance Minister Nirmala Sitharaman presented her seventh straight Budget on July 23 for the fiscal 2024-25, surpassing the record of former Prime Minister Morarji Desai. This is the first budget by the BJP led NDA government after its re-election in June. The Budget 2024 has laid out nine priority areas with the aim of better future.

The budget focus is on 4 castes namely

The Budget 2024 Theme is

In the interim budget, The Modi Government had promised to present a detailed roadmap for pursuit of ‘Viksit Bharat’. In line with the strategy set out in the interim budget, this budget envisages sustained efforts on the following 9 priorities for generating ample opportunities for all.

These 9 Priorities are

Productivity and resilience in Agriculture

1. Transforming Agriculture Research

Comprehensive review of the agriculture research setup to bring focus on raising productivity and developing climate resilient varieties. Funding will be provided in challenge mode, including to the private sector. Domain experts both from the government and outside will oversee the conduct of such research.

2. National Cooperation Policy

For systematic, orderly and all-round development of the cooperative sector. Fast-tracking growth of rural economy and generation of employment opportunities on a large scale will be the policy goal.

3. Atmanirbharta

For oil seeds such as mustard, groundnut, sesame, soyabean and sunflower. For achieving self-sufficiency in pulses and oilseeds, the government will strengthen their production, storage and marketing.

4. Vegetable production & supply chain

Promotion of FPOs, cooperatives & start-ups for vegetable supply chains for collection, storage, and marketing. Large scale clusters for vegetable production will be developed closer to major consumption center’s.

5. Release of new varieties

109 new high-yielding and climate resilient varieties of 32 field and horticulture crops will be release for cultivation by farmers.

6. Natural Farming

- 1 crore farmers across the country will be initiated into natural farming, supported by certification and branding in next 2 years.

- 10,000 need-based bio-input resource center’s to be established.

7. Shrimp Production & Export

- Financing for Shrimp farming, processing and export will be facilitated through NABARD

8. Digital Public Infrastructure (DPI)

- DPI for coverage of farmers and their lands in 3 years.

- Digital crop survey in 400 districts

- Issuance of Jan Samarth based Kisan Credit Cards

2. Employment & Skilling

Government will implement following 3 schemes for ‘Employment Linked Incentive’, as part of the Prime Minister’s package. These will be based on enrolment in the EPFO, and focus on recognition of first-time employees, and support to employees and employers.

Scheme A: First Timers

This scheme will provide one-month wage to all persons newly entering the workforce in all formal sectors. The direct benefit transfer of one-month salary in 3 instalments to first-time employees, as registered in the EPFO, will be up to ` 15,000. The eligibility limit will be a salary of ` 1 lakh per month. The scheme is expected to benefit 210 lakh youth.

Scheme B: Job Creation in manufacturing

This scheme will incentivize additional employment in the manufacturing sector, linked to the employment of first-time employees. An incentive will be provided at specified scale directly both to the employee and the employer with respect to their EPFO contribution in the first 4 years of employment. The scheme is expected to benefit 30 lakh youth entering employment, and their employers.

Scheme C: Support to employers

This employer-focussed scheme will cover additional employment in all sectors. All additional employment within a salary of ` 1 lakh per month will be counted. The government will reimburse to employers up to ` 3,000 per month for 2 years towards their EPFO contribution for each additional employee. The scheme is expected to incentivize additional employment of 50 lakh persons.

Participation of women in the workforce

Government will facilitate higher participation of women in the workforce through setting up of working women hostels in collaboration with industry, and establishing creches. In addition, the partnership will seek to organize women-specific skilling programmes, and promotion of market access for women SHG enterprises.

- Skilling programme

20 lakh youth will be skilled over a 5-year period. 1,000 Industrial Training Institutes will be upgraded in hub and spoke arrangements with outcome orientation. Course content and design will be 6 aligned to the skill needs of industry, and new courses will be introduced for emerging needs.

- Skilling Loans

The Model Skill Loan Scheme will be revised to facilitate loans up to ` 7.5 lakh with a guarantee from a government promoted Fund. This measure is expected to help 25,000 students every year.

- Education Loans

For helping our youth who have not been eligible for any benefit under government schemes and policies, government has announced a financial support for loans upto ` 10 lakh for higher education in domestic institutions. E-vouchers for this purpose will be given directly to 1 lakh students every year for annual interest subvention of 3 per cent of the loan amount.

3. Inclusive Human Resource Development and Social Justice

Purvodaya-Vikas bhi Virasat bhi

- Plan for endowment rich states in the Eastern parts covering Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh for generation of economic opportunities to attain Viksit Bharat.

- Amritsar Kolkata Industrial Corridor with development of an industrial node at Gaya. This corridor will catalyse industrial development of the eastern region. The industrial node at Gaya will also be a good model for developing our ancient centers of cultural importance into future centres of modern economy.

- Allocation of more than ₹3 lakh crore for schemes benefitting women and girls.

- Pradhan Mantri Janjatiya Unnat Gram Abhiyan: Improving the socio-economic condition of tribal communities covering 63,000 villages benefitting 5 crore tribal people.

- More than 100 branches of India Post Payment Bank will be set up in the North East region

- Development of road connectivity projects, namely

- Patna-Purnea Expressway,

- Buxar-Bhagalpur Expressway,

- Bodhgaya, Rajgir, Vaishali and Darbhanga spurs, and

- Additional 2-lane bridge over river Ganga at Buxar at a total cost of ` 26,000 crore.

- Power projects, including setting up of a new 2400 MW power plant at Pirpainti, will be taken up at a cost of ` 21,400 crore.

- New airports, medical colleges and sports infrastructure in Bihar will be constructed.

Andhra Pradesh Reorganization Act:

- Financial support of ₹15,000 crores will be arranged in FY 24- 25.

- Completion of Polavaram Irrigation Project ensuring food security of the nation.

- Essential infrastructure such as water, power, railways and roads in Kopparthy node on the Vishakhapatnam-Chennai Industrial Corridor and Orvakal node on Hyderabad-Bengaluru Industrial Corridor.

4) Manufacturing & Services

- Credit Guarantee Scheme for MSMEs in the Manufacturing Sector.

For facilitating term loans to MSMEs for purchase of machinery and equipment without collateral or third-party guarantee, a credit guarantee scheme will be introduced. The scheme will operate on pooling of credit risks of such MSMEs. A separately constituted self-financing guarantee fund will provide, to each applicant, guarantee cover up to ` 100 crore, while the loan amount may be larger. The borrower will have to provide an upfront guarantee fee and an annual guarantee fee on the reducing loan balance.

- New assessment model for MSME credit.

Public sector banks will build their in-house capability to assess MSMEs for credit, instead of relying on external assessment. They will also take a lead in developing or getting developed a new credit assessment model, based on the scoring of digital footprints of MSMEs in the economy. This is expected to be a significant improvement over the traditional assessment of credit eligibility based only on asset or turnover criteria. That will also cover MSMEs without a formal accounting system.

- Enhanced scope for mandatory on boarding in TReDS.

For facilitating MSMEs to unlock their working capital by converting their trade receivables into cash, government has proposed to reduce the turnover threshold of buyers for mandatory onboarding on the TReDS platform from ` 500 crore to ` 250 crore. This measure will bring 22 more CPSEs and 7000 more 10 companies onto the platform. Medium enterprises will also be included in the scope of the suppliers

- SIDBI branches in MSME clusters

SIDBI will open new branches to expand its reach to serve all major MSME clusters within 3 years, and provide direct credit to them. With the opening of 24 such branches this year, the service coverage will expand to 168 out of 242 major clusters.

- MSME Units for Food Irradiation, Quality & Safety Testing

Financial support for setting up of 50 multi-product food irradiation units in the MSME sector will be provided. Setting up of 100 food quality and safety testing labs with NABL accreditation will be facilitated. To enable MSMEs and traditional artisans to sell their products in international markets, E-Commerce Export Hubs will be set up in public[1]private-partnership (PPP) mode . These hubs, under a seamless regulatory and logistic framework, will facilitate trade and export related services under one roof.

- Mudra Loans:

The limit enhanced to ₹ 20 lakh from the current ₹ 10 lakh under the ‘Tarun’ category.

- Credit Support to MSMEs during Stress Period

A new mechanism for facilitating continuation of bank credit to MSMEs during their stress period. While being in the ‘special mention account’ (SMA) stage for reasons beyond their control, MSMEs need credit to continue their business and to avoid getting into the NPA stage. Credit availability will be supported through a guarantee from a government promoted fund.

- Industrial Parks

Twelve industrial parks under the National Industrial Corridor Development Programme. Government will facilitate development of investment-ready “plug and play” industrial parks with complete infrastructure in or near 100 11 cities, in partnership with the states and private sector, by better using town planning schemes.

- Rental Housing

Rental housing with dormitory type accommodation for industrial workers in PPP mode with VGF support

- Critical Minerals Mission for domestic production, recycling and overseas acquisition.

Critical Mineral Mission for domestic production, recycling of critical minerals, and overseas acquisition of critical mineral assets. Its mandate will include technology development, skilled workforce, extended producer responsibility framework, and a suitable financing mechanism

- Strengthening of the tribunal and appellate tribunals to speed up insolvency resolution and additional tribunals to be established

The IBC has resolved more than 1,000 companies, resulting in direct recovery of over ` 3.3 lakh crore to creditors. In addition, 28,000 cases involving over ` 10 lakh crore have been disposed of, even prior to admission. Appropriate changes to the IBC, reforms and strengthening of the tribunal and appellate tribunals will be initiated to speed up insolvency resolution. Additional tribunals will be established. Out of those, some will be notified to decide cases exclusively under the Companies Act.

- Internship Opportunities

- Scheme for providing internship opportunities in 500 top companies to 1 crore youth in 5 years.

- Allowance of ₹5,000 per month along with a one-time assistance of ₹6,000 through the CSR funds.

- Companies will be expected to bear the training cost and 10 per cent of the internship cost from their CSR funds.

5. Urban Development

Government will facilitate development of ‘Cities as Growth Hubs’. This will be achieved through economic and transit planning, and orderly development of peri-urban areas utilising town planning schemes.

- Creative redevelopment of cities

For creative brownfield redevelopment of existing cities with a transformative impact, government will formulate a framework for enabling policies, market-based mechanisms and regulation.

- Transit Oriented Development

Transit Oriented Development plans for 14 large cities with a population above 30 lakh will be formulated, along with an implementation and financing strategy.

- Urban Housing

Under the PM Awas Yojana Urban 2.0, housing needs of 1 crore urban poor and middle-class families will be addressed with an investment of ₹ 10 lakh crore. This will include the central assistance of ₹ 2.2 lakh crore in the next 5 years. A provision of interest subsidy to facilitate loans at affordable rates is also envisaged.In addition, enabling policies and regulations for efficient and transparent rental housing markets with enhanced availability will also be put in place.

- Water Supply and Sanitation

In partnership with the State Governments and Multilateral Development Banks we will promote water supply, sewage treatment and solid waste management projects and services for 100 large cities through bankable projects. These projects will also envisage use of treated water for irrigation and filling up of tanks in nearby areas.o

- Street Markets

Building on the success of PM SVANidhi Scheme in transforming the lives of street vendors, Government envisions a scheme to support each year, over the next five years, the development of 100 weekly ‘haats’ or street food hubs in select cities.

- Stamp Duty

Encourage states which continue to charge high stamp duty to moderate the rates for all, and also consider further lowering duties for properties purchased by women. This reform will be made an essential component of urban development schemes.

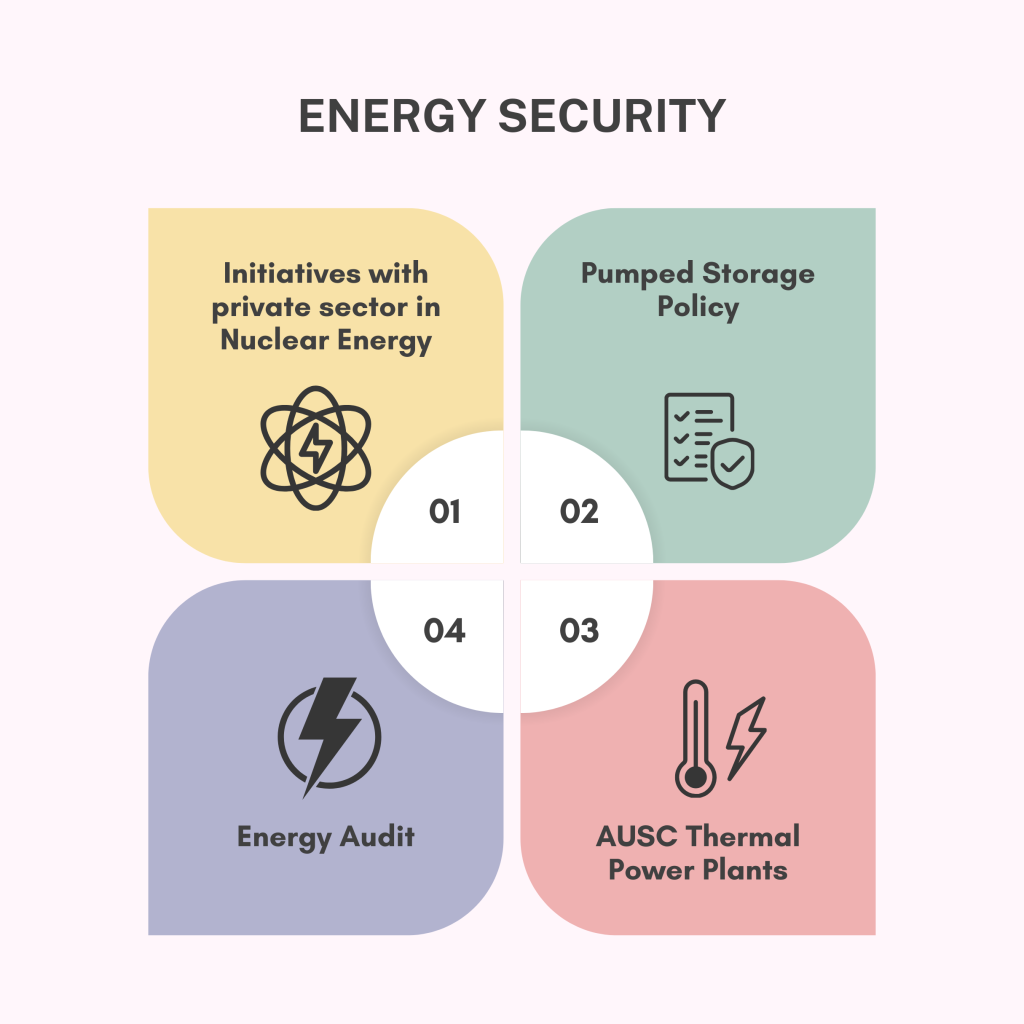

6. Energy Security

- Energy Transition

Policy document will be bought on appropriate energy transition pathways that balances the imperatives of employment, growth and environmental sustainability.

- PM Surya Ghar Muft Bijli Yojana

PM Surya Ghar Muft Bijli Yojana has been launched to install rooftop solar plants to enable 1 crore households obtain free electricity up to 300 units every month. The scheme has generated remarkable response with more than 1.28 crore registrations and 14 lakh applications, and we will further encourage it.

- Pumped Storage Policy

A policy for promoting pumped storage projects will be brought out for electricity storage and facilitating smooth integration of the growing share of renewable energy with its variable & intermittent nature in the overall energy mix.

- Research and development of small and modular nuclear reactors

Nuclear energy is expected to form a very significant part of the energy mix for Viksit Bharat. Towards that pursuit, our government will partner with the private sector for setting up Bharat Small Reactors, research & development of Bharat Small Modular Reactor, and research & development of newer technologies for nuclear energy. The R&D funding announced in the interim budget will be made available for this sector.

- Advanced Ultra Super Critical Thermal Power Plants

The development of indigenous technology for Advanced Ultra Super Critical (AUSC) thermal power plants with much higher efficiency has been completed. A joint venture between NTPC and BHEL will set up a full scale 800 MW commercial plant using AUSC technology. The government will provide the required fiscal support. Moving forward, development of indigenous capacity for the production of high-grade steel and other 15 advanced metallurgy materials for these plants will result in strong spin-off benefits for the economy.

- Roadmap for ‘hard to abate’ industries

A roadmap for moving the ‘hard to abate’ industries from ‘energy efficiency’ targets to ‘emission targets’ will be formulated. Appropriate regulations for transition of these industries from the current ‘Perform, Achieve and Trade’ mode to ‘Indian Carbon Market’ mode will be put in place.

- Support to traditional micro and small industries

An investment-grade energy audit of traditional micro and small industries in 60 clusters, including brass and ceramic, will be facilitated. Financial support will be provided for shifting them to cleaner forms of energy and implementation of energy efficiency measures. The scheme will be replicated in another 100 clusters in the next phase.

7. Infrastructure

- Infrastructure investment by Central Government

Significant investment the Central Government has made over the years in building and improving infrastructure has had a strong multiplier effect on the economy. We will endeavour to maintain strong fiscal support for infrastructure over the next 5 years, in conjunction with imperatives of other priorities and fiscal consolidation. This year` 11,11,111 crore for capital expenditure. This would be 3.4 per cent of our GDP

- Infrastructure investment by state governments

A provision of ` 1.5 lakh crore for long-term interest free loans has been made this year also to support the states in their resource allocation.

- Private investment in infrastructure

Investment in infrastructure by private sector will be promoted through viability gap funding and enabling policies and regulations. A market[1]based financing framework will be brought out.

- Pradhan Mantri Gram Sadak Yojana (PMGSY)

Phase IV of PMGSY will be launched to provide all-weather connectivity to 25,000 rural habitations which have become eligible in view of their population increase.

- Irrigation and Flood Mitigation

Financial support for projects with estimated cost of ` 11,500 crore such as the Kosi-Mechi intra-state link and 20 other ongoing and new schemes including barrages, river pollution abatement and irrigation projects. In addition, survey and investigation of Kosi related flood mitigation and irrigation projects will be undertaken.

- Tourism

- Development of Vishnupad Temple Corridor and Mahabodhi Temple Corridor modelled on Kashi Vishwanath Temple Corridor

- Comprehensive development initiative for Rajgir will be undertaken which holds religious significance for Hindus, Buddhists and Jains.

- The development of Nalanda as a tourist centre besides reviving Nalanda University to its glorious stature.

- Assistance to development of Odisha’s scenic beauty, temples, monuments, craftsmanship, wildlife sanctuaries, natural landscapes and pristine beaches making it an ultimate tourism destination.

8. Innovation, Research & Development

- Operationalization of the Anusandhan National Research Fund for basic research and prototype development.

- Private sector-driven research and innovation at commercial scale with a financing pool of ₹1 lakh crore Space Economy: A venture capital fund of ₹1,000 crore is to be set up=

9. Next Generation Reforms

- Economic Policy Framework

Economic Policy Framework is formulated to delineate the overarching approach to economic development and set the scope of the next generation of reforms for facilitating employment opportunities and sustaining high growth.

- Government will initiate and incentivize reforms for

- Improving productivity of factors of production, and

- Facilitating markets and sectors to become more efficient. These reforms will cover all factors of production, 18 namely land, and labour, capital and entrepreneurship, and technology as an enabler of improving total factor productivity and bridging inequality.

Effective implementation of several of these reforms requires collaboration between the Centre and the states and building consensus, as development of the country lies in development of the states. For promoting competitive federalism and incentivizing states for faster implementation of reforms, government has proposed to earmark a significant part of the 50-year interest-free loan. Working with the states, we will initiate the following reforms.

- Land-related reforms by state governments

Land-related reforms and actions, both in rural and urban areas, will cover (1) land administration, planning and management, and (2) urban planning, usage and building bylaws. These will be incentivized for completion within the next 3 years through appropriate fiscal support.

- Rural Land related actions

Rural land related actions will include (1) assignment of Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all lands, (2) digitization of cadastral maps, (3) survey of map sub-divisions as per current ownership, (4) establishment of land registry, and (5) linking to the farmers registry. These actions will also facilitate credit flow and other agricultural services.

- Urban Land related actions

Land records in urban areas will be digitized with GIS mapping. An IT based system for property record administration, updating, and tax administration will be established. These will also facilitate improving the financial position of urban local bodies.

Labour related reforms

- Services to Labour

Government will facilitate the provision of a wide array of services to labour, including those for employment and skilling. A comprehensive integration of e-shram portal with other portals will facilitate such one-stop solution. Open architecture databases for the rapidly changing labour market, skill requirements and available job roles, and a mechanism to connect job-aspirants with potential employers and skill providers will be covered in these services.

- Shram Suvidha & Samadhan Portal

Shram Suvidha and Samadhan portals will be revamped to enhance ease of compliance for industry and trade.

- Capital and entrepreneurship related reforms

Financial sector vision and strategy

For meeting financing needs of the economy, our government will bring out a financial sector vision and strategy document to prepare the sector in terms of size, capacity and skills. This will set the agenda for the next 5 years and guide the work of the government, regulators, financial institutions and market participants.

Taxonomy for climate finance

Taxonomy for climate finance for enhancing the availability of capital for climate adaptation and mitigation. This will support achievement of the country’s climate commitments and green transition.

- Variable Capital Company structure

Provide an efficient and flexible mode for financing leasing of aircrafts and ships, and pooled funds of private equity through a ‘variable company structure’.

- Foreign Direct Investment and Overseas Investment

The rules and regulations for Foreign Direct Investment and Overseas Investments will be simplified to (1) facilitate foreign direct investments, (2) nudge prioritization, and (3) promote opportunities for using Indian Rupee as a currency for overseas investments.

- NPS Vatsalya

NPS-Vatsalya, a plan for contribution by parents and guardians for minors will be started. On attaining the age of majority, the plan can be converted seamlessly into a normal NPS account.

- Use of Technology

Public investment in digital infrastructure and innovations by the private sector have helped in improving access of all citizens, particularly the common people, to market resources, education, health and services.

- Ease of Doing Business

For enhancing ‘Ease of Doing Business’, government is already working on the Jan Vishwas Bill 2.0. Further, states will be incentivized for implementation of their Business Reforms Action Plans and digitalization

- Data and Statistics

For improving data governance, collection, processing and management of data and statistics, different sectoral data bases, including those established under the Digital India mission, will be utilized with active use of technology tools.

- New Pension Scheme (NPS)

Staff Side of the National Council of the Joint Consultative Machinery for Central Government Employees have taken a constructive approach. A solution will be evolved which addresses the relevant issues while maintaining fiscal prudence to protect the common citizens.

BUDGET ESTIMATES

For the year 2024-25, the total receipts other than borrowings and the total expenditure are estimated at ` 32.07 lakh crore and ` 48.21 lakh crore respectively. The net tax receipts are estimated at ` 25.83 lakh crore. The fiscal deficit is estimated at 4.9 per cent of GDP. The gross and net market borrowings through dated securities during 2024-25 are estimated at ` 14.01 lakh crore and ` 11.63 lakh crore respectively. Both will be less than that in 2023-24.

The fiscal consolidation path announced in 2021 has served our economy very well, and government aims to reach a deficit below 4.5 per cent next year. The Government is committed to staying the course. From 2026-27 onwards, government will endeavor to keep the fiscal deficit each year such that the Central Government debt will be on a declining path as percentage of GDP.

TAX PROPOSALS

- Medicines and Medical Equipment

To provide relief to cancer patients, government has proposed to fully exempt three more medicines from customs duties. Government has also proposed changes in the BCD on x-ray tubes & flat panel detectors for use in medical x-ray machines under the Phased Manufacturing Programme, so as to synchronize them with domestic capacity addition.

- Mobile Phone and Related Parts

With a three-fold increase in domestic production and almost 100-fold jump in exports of mobile phones over the last six years, the Indian mobile phone industry has matured. In the interest of consumers, government has now proposed to reduce the BCD on mobile phone, mobile PCBA and mobile charger to 15 per cent.

- Critical Minerals

Minerals such as lithium, copper, cobalt and rare earth elements are critical for sectors like nuclear energy, renewable energy, space, defence, telecommunications, and high-tech electronics. Government has now proposed to fully exempt customs duties on 25 critical minerals and reduce BCD on two of them. This will provide a major fillip to the processing and refining of such minerals and help secure their availability for these strategic and important sectors.

- Solar Energy

Energy transition is critical in the fight against climate change. To support energy transition, Government has proposed to expand the list of exempted capital goods for use in the manufacture of solar cells and panels in the country. Further, in view of sufficient domestic manufacturing capacity of solar glass and tinned copper interconnect, government has proposed not to extend the exemption of customs duties provided to them.

- Marine products

India’s seafood exports in the last financial year touched an all-time high of more than ₹ 60,000 crore. Frozen shrimp accounted for about two-thirds of these exports. To enhance their competitiveness, government has proposed to reduce BCD on certain broodstock, polychaete worms, shrimp and fish feed to 5 per cent and also proposed to exempt customs duty on various inputs for manufacture of shrimp and fish feed

- Leather and Textile

Similarly, to enhance the competitiveness of exports in the leather and textile sectors, government has proposed to reduce BCD on real down filling material from duck or goose. Also government will make additions to the list of exempted goods for manufacture of leather and textile garments, footwear and other leather articles for export. To rectify inversion in duty, government has proposed to reduce BCD, subject to conditions, on methylene diphenyl diisocyanate (MDI) for manufacture of spandex yarn from 7.5 to 5 per cent. Furthermore, the export duty structure on raw hides, skins and leather is proposed to be simplified and rationalized

- Precious Metals

To enhance domestic value addition in gold and precious metal jewellery in the country, government has proposed to reduce customs duties on gold and silver to 6 per cent and that on platinum to 6.4 per cent.

- Other Metals

Steel and copper are important raw materials. To reduce their cost of production, government has proposed to remove the BCD on ferro nickel and blister copper. Also government will be continuing with nil BCD on ferrous scrap and nickel cathode and concessional BCD of 2.5 per cent on copper scrap.

- Electronics

To increase value addition in the domestic electronics industry, government has proposed to remove the BCD, subject to conditions, on oxygen free copper for manufacture of resistors and also propose to exempt certain parts for manufacture of connectors.

- Chemicals and Petrochemicals

To support existing and new capacities in the pipeline, government has proposed to increase the BCD on ammonium nitrate from 7.5 to 10 per cent.

- Plastics

PVC flex banners are non-biodegradable and hazardous for environment and health. To curb their imports, government has proposed to raise the BCD on them from 10 to 25 per cent.

- Telecommunication Equipment

To incentivize domestic manufacturing, government has proposed to increase the BCD from 10 to 15 per cent on PCBA of specified telecom equipment.

- Trade facilitation

To promote domestic aviation and boat & ship MRO, government has proposed to extend the period for export of goods imported for repairs from six months to one year. In the same vein, government has proposed to extend the time-limit for re-import of goods for repairs under warranty from three to five years

DIRECT TAX PROPOSALS

- Comprehensive Review of the Income-tax Act, 1961

The purpose is to make the Act concise, lucid, easy to read and understand. This will reduce disputes and litigation, thereby providing tax certainty to the tax payers. It will also bring down the demand embroiled in litigation. It is proposed to be completed in six months. 138. A beginning is being made in the Finance Bill by simplifying the tax regime for charities, TDS rate structure, provisions for reassessment and search provisions and capital gains taxation.

- Simplification for Charities and of TDS

The two tax exemption regimes for charities are proposed to be merged into one. The 5 per cent TDS rate on many payments is being merged into the 2 per cent TDS rate and the 20 per cent TDS rate on repurchase of units by mutual funds or UTI is being withdrawn. TDS rate on e-commerce operators is proposed to be reduced from one to 0.1 per cent. Moreover, credit of TCS is proposed to be given in the TDS to be deducted on salary. Government has further proposed to decriminalize delay for payment of TDS up to the due date of filing statement for the same. Government has also planned to provide a standard operating procedure for TDS defaults and simplify and rationalise the compounding guidelines for such defaults.

- Simplification of Reassessment

An assessment hereinafter can be reopened beyond three years from the end of the assessment year only if the escaped income is ₹ 50 lakh or more, up to a maximum period of five years from the end of the assessment year. Even in search cases, a time limit of six years before the year of search, as against the existing time limit of ten years, is proposed. This will reduce tax-uncertainty and disputes

- Simplification and Rationalisation of Capital Gains

Capital gains taxation is also proposed to be hugely simplified. Short term gains on certain financial assets shall henceforth attract a tax rate of 20 per cent, while that on all other financial assets and all non-financial assets shall continue to attract the applicable tax rate. Long term gains on all financial and non-financial assets, on the other hand, will attract a tax rate of 12.5 per cent. For the benefit of the lower and middle-income classes, I propose to increase the limit of exemption of capital gains on certain financial assets to ₹ 1.25 lakh per year. Listed financial assets held for more than a year will be classified as long term, while unlisted financial assets and all non-financial assets will have to be held for at least two years to be classified as long-term. Unlisted bonds and debentures, debt mutual funds and market linked debentures, irrespective of holding period, however, will attract tax on capital gains at applicable rates

- Tax Payer Services.

All the major tax payer services under GST and most services under Customs and Income Tax have been digitalised. All remaining services of Customs and Income Tax including rectification and order giving effect to appellate orders shall be digitalized and made paper-less over the next two year

- Litigation and Appeals

To dispose of the backlog of first appeals, government has planned to deploy more officers to hear and decide such appeals, especially those with large tax effect.For resolution of certain income tax disputes pending in appeal, government is also proposing Vivad Se Vishwas Scheme, 2024. Further, It is proposed to increase monetary limits for filing appeals related to direct taxes, excise and service tax in the Tax Tribunals, High Courts and Supreme Court to ₹ 60 lakh, ₹ 2 crore and ₹ 5 crore respectively. With a view to reduce litigation and provide certainty in international taxation, government will expand the scope of safe harbour rules and make them more attractive.

- Employment and Investment

First of all, to bolster the Indian start-up eco-system, boost the entrepreneurial spirit and support innovation, I propose to abolish the so[1]called angel tax for all classes of investors. 154. Second, there is tremendous potential for cruise tourism in India. To give a fillip to this employment generating industry, I am proposing a simpler tax regime for foreign shipping companies operating domestic cruises in the country. 155. Third, India is a world leader in the diamond cutting and polishing industry, which employs a large number of skilled workers. To further promote the development of this sector, we would provide for safe harbour rates for foreign mining companies selling raw diamonds in the country. 156. Fourth, to attract foreign capital for our development needs, I propose to reduce the corporate tax rate on foreign companies from 40 to 35 per cent.

- Deepening the tax base

First, Security Transactions Tax on futures and options of securities is proposed to be increased to 0.02 per cent and 0.1 per cent respectively. Second, for reasons of equity, I propose to tax income received on buy back of shares in the hands of the recipient.

- Others

To improve social security benefits, deduction of expenditure by employers towards NPS is proposed to be increased from 10 to 14 per cent of the employee’s salary. Similarly, deduction of this expenditure up to 14 per cent of salary from the income of employees in private sector, public sector banks and undertakings, opting for the new tax regime, is proposed to be provided. Indian professionals working in multinationals get ESOPs and invest in social security schemes and other movable assets abroad. Non-reporting of such small foreign assets has penal consequences under the Black Money Act. Such non-reporting of movable assets up to ₹ 20 lakh is proposed to be de-penalized.

Other major proposals in the Finance Bill relate to:

- Withdrawal of equalization levy of 2 per cent;

- Expansion of tax benefits to certain funds and entities in IFSCs; and

- Immunity from penalty and prosecution to benamidar on full and true disclosure so as to improve conviction under the Benami Transactions (Prohibition) Act, 1988.

PERSONAL INCOME TAX

Coming to Personal Income Tax Rates, I have two announcements to make for those opting for the new tax regime. First, the standard deduction for salaried employees is proposed to be increased from ₹50,000/- to ₹75,000/-. Similarly, deduction on family pension for pensioners is proposed to be enhanced from ₹ 15,000/- to ₹ 25,000/-. This will provide relief to about four crore salaried individuals and pensioners.

Second, in the new tax regime, the tax rate structure is proposed to be revised, as follows:

0-3 lakh rupees | Nil |

3-7 lakh rupees | 5 per cent |

7-10 lakh rupees | 10 per cent |

10-12 lakh rupees | 15 per cent |

12-15 lakh rupees | 20 per cent |

15 lakh rupees | Above 30 per cent |

As a result of these changes, a salaried employee in the new tax regime stands to save up to ₹ 17,500/- in income tax.