- Face Value of a Share

- What is the Face Value of a Share?

- How Does the Face Value of a Share Denote its Worth?

- How Does the Face Value of a Share Matter to an Investor?

- What if There Were No Shareholders? What Would be Different?

- Importance of Face Value of a Share

- Formula of Face Value

- How Does the Face Value of a Share Affect the Stock Market Decisions?

- How Can the Face Value of a Share Influence Your Investment Decisions?

- Face Value and Stock Shares

- Face Value vs. Market Value

- Modifying the Face Value of Stocks

- Is a bond’s par value and face value same?

- Conclusion

Face Value of a Share

The face value of a share is the value assigned to it when it was issued. The face value meaning in the Indian stock market, for example, is the amount in rupees printed on its certificate. If you want to buy or sell shares in an Indian stock exchange, this is the price you will be quoted.

Watch What is Face Value, Market Value, Stock Split?

More Articles to Explore

- Difference between NSDL and CDSL

- Lowest brokerage charges in India for online trading

- How to find your demat account number using PAN card

- What are bonus shares and how do they work?

- How to transfer shares from one demat account to another?

- What is BO ID?

- Open demat account without a PAN card - a complete guide

- What are DP charges?

- What is DP ID in a demat account

- How to transfer money from demat account to bank account

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Frequently Asked Questions

No, there is no connection between the face value and the current stock price. Face value does not get changed every now and then but the Current market price gets change due the force of demand and supply of buyer and seller into the stock market.

Face value, or the nominal value declared by the issuer, can range from ₹ 1 to ₹ 20 to ₹ 3000, and so forth. Another name for it is capital per share equity share. Conversely, the issue price is the product of the face value of all claims plus the premium that the corporation has requested for the same share.

Stock splits are one business operation that can alter the face value of equities. The value will be reduced by this stock split by splitting the existing shares into smaller units.

The Face Value of a share is calculated by dividing the net value of the company, or the difference between its assets and liabilities, by the total number of shares that have been issued.

The face value, sometimes referred to as the par value or nominal value, is the fixed value of a share set by the corporation at the time of the initial public offering (IPO). A corporation raises funds for development and expansion through an initial public offering (IPO).

Although most organizations have a face value of ₹ 100 or ₹ 1, they are founded with a face value of ₹ 10. A public limited company must have a minimum face value of ₹ 1 in order to be listed on a stock exchange, according to SEBI, which sets these rules.

This can be done with or without decreasing the liability attached to any of the company's shares or extinguishing them. (For instance, by repaying ₹ 25, fully paid-up shares with a face value of ₹ 100 can be bought for ₹ 75 each.)

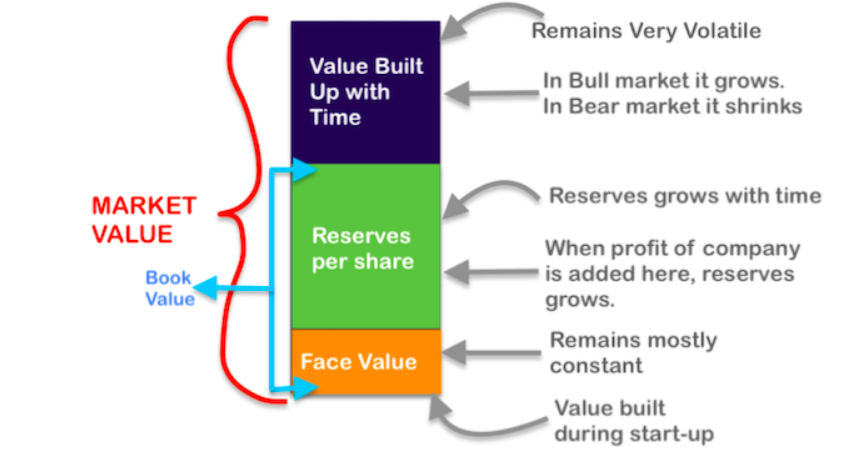

In finance, different kinds of value include face value (the nominal value of a security), market value (the current price at which an asset is traded), book value (the value of an asset according to its balance sheet), and intrinsic value (the perceived true value of an asset based on fundamental analysis).