What is Diversification?

Diversification is an investment strategy that involves spreading your investments across various asset classes, sectors, or geographical regions to reduce risk. The idea is simple: by not putting all your money into one investment, you can minimize the impact of poor performance in any single area.

In the context of mutual funds, diversification might mean investing in a mix of equity funds, debt funds, and other types of funds, or holding investments in companies from different industries like technology, healthcare, and finance. This way, if one sector underperforms, the others can potentially offset the losses

Understanding Diversification

Diversification is a fundamental principle in investing that aims to balance risk and reward by spreading investments across different assets or financial instruments. It ensures that your investment portfolio is not overly reliant on the performance of a single asset, sector, or market.

Here’s a breakdown of how diversification works:

- Types of Assets: Diversify between equity (stocks), debt (bonds), and other asset classes like real estate or commodities.

- Industries or Sectors: Invest in companies from various industries—technology, healthcare, energy, etc.—so if one industry falters, others may compensate.

- Geographic Regions: Allocate investments across different countries or regions to avoid being affected by localized economic downturns.

- Mutual Funds: Opt for diversified mutual funds, which already spread investments across multiple companies, sectors, or assets.

The key advantage of diversification is that it reduces the overall risk while maintaining potential returns. It doesn’t completely eliminate risk, but it provides a safety net against significant losses in one area.

Diversification Strategies

Asset Class Diversification

Diversifying across asset classes ensures your portfolio isn’t overly dependent on one type of investment. Here’s a breakdown:

- Equities (Stocks): Include domestic and international stocks for exposure to various markets and economic growth. Domestic stocks focus on local businesses, while international stocks benefit from global economic trends and currencies.

- Fixed Income (Bonds): Bonds are generally more stable and provide regular interest payments. Options include government bonds (low risk), corporate bonds (higher returns, but riskier), or municipal bonds (often tax-advantaged).

- Real Estate: Investing in REITs (Real Estate Investment Trusts) provides access to real estate markets without directly purchasing property. Alternatively, buying rental properties generates both income and asset appreciation.

- Commodities: Investments like gold, silver, oil, or agricultural products act as a hedge against inflation. They help maintain purchasing power during economic uncertainty.

- Cash Equivalents: Keep part of your portfolio liquid with instruments like money market funds or treasury bills, which are easy to convert into cash.

Geographic Diversification

Investing across different regions helps reduce the risk of being overly reliant on a single country’s economy. For instance:

- Emerging Markets: These markets, like India and Brazil, often offer higher growth potential but come with higher risks.

- Developed Markets: Include stable markets like the US, Europe, or Japan to ensure steady returns.

- Regional Balance: Allocating investments across Asia, Europe, North America, etc., protects against region-specific downturns like trade wars or natural disasters.

Sector Diversification

Investing across sectors spreads your risk further. Key sectors include:

- Technology: Focus on innovative companies driving growth in software, hardware, and AI.

- Healthcare: Includes pharmaceuticals, biotechnology, and medical devices—usually resilient during economic downturns.

- Finance: Comprising banks, insurance, and investment companies.

- Energy: Investments in oil, gas, renewable energy, etc., offer good long-term growth potential.

- Consumer Goods: Companies that produce essential products (FMCG) and luxury items.

- Utilities: Considered stable investments, offering steady dividends.

Diversification by Investment Style

Your portfolio can benefit from mixing different investment styles:

- Growth Stocks: These are companies expected to grow faster than others. They usually reinvest profits instead of paying dividends.

- Value Stocks: Companies whose current stock price is lower than their intrinsic value, often providing a safer investment.

- Dividend Stocks: Offer regular income through dividends, suited for conservative investors.

- Non-Dividend Stocks: Ideal for long-term capital appreciation.

Time Horizon Diversification

Plan investments based on your goals and timelines:

- Short-term Investments: Typically include less volatile assets like bonds or fixed deposits to preserve capital.

- Medium-term Investments: Instruments like mutual funds and ETFs are suitable for 3-7 years as they provide moderate returns.

- Long-term Investments: For goals 7+ years away, focus on equities, real estate, or retirement plans, which allow capital to grow significantly.

Risk Level Diversification

Adjust your portfolio to include investments with varying risk levels:

- Low-risk: Fixed deposits or treasury bills are stable but have lower returns.

- Moderate-risk: Bonds and balanced mutual funds strike a balance between safety and return.

- High-risk: Stocks and cryptocurrencies provide high returns but come with significant volatility.

Instruments Diversification

Choose a combination of investment instruments for better balance:

- Mutual Funds: These pool money from investors to invest in a mix of stocks, bonds, or other assets, managed by professionals.

- Exchange-Traded Funds (ETFs): They track specific indices or commodities, offering diversity at low costs.

- Individual Stocks or Bonds: While they provide precise control over your investments, they require in-depth research and management.

Corporate Lifecycle stages

The corporate lifecycle consists of distinct stages that businesses go through, and each stage offers unique opportunities and challenges for diversification in shares or mutual funds. Here’s how diversification strategies align with these stages

Startup Stage

In the startup stage, companies are characterized by high growth potential but also significant risk. Investors can diversify by including venture capital funds or small-cap mutual funds that focus on startups. To mitigate the higher risk involved, balancing with stable assets like blue-chip stocks or bonds can provide a safety net.

Growth Stage

During the growth stage, companies experience rapid increases in revenue and profits, often reinvesting heavily in expansion. Investors can benefit by diversifying through growth-oriented mutual funds or mid-cap stocks. Expanding the portfolio to include international funds allows for exposure to global markets and industries, further enhancing diversification.

Maturity Stage

At the maturity stage, growth slows, but revenues and dividends stabilize. This stage is ideal for focusing on large-cap stocks or dividend-focused mutual funds to secure consistent income. Diversifying geographically remains important to avoid risks from market saturation in one region. Adding bonds or fixed-income funds provides further stability to the portfolio.

Decline Stage

In the decline stage, companies face challenges like reduced revenues and increasing competition. Investors can reduce their exposure to such companies and shift focus to growth or emerging sectors. Value funds that target undervalued stocks with the potential for recovery are effective diversification options. Maintaining a balanced portfolio of equities and fixed-income assets is crucial to manage risks.

Renewal or Exit Stage

At the renewal or exit stage, companies either innovate to remain competitive or exit the market. Investing in special situation funds that focus on restructuring or turnaround opportunities can be a strategic choice. Diversifying into alternative investments like real estate or commodities can also help hedge risks during this phase.

Risk Profiles

Conservative Risk Profile

Investors with a conservative risk profile prioritize capital preservation and prefer lower-risk investments that offer stable returns. For diversification, they often focus on fixed-income securities, such as government bonds, treasury bills, and high-quality corporate bonds. Additionally, large-cap dividend-paying stocks or income-focused mutual funds provide a steady income stream. Cash equivalents like money market funds ensure liquidity and reduce portfolio volatility. Conservative investors typically avoid high-risk assets, such as small-cap stocks or emerging market funds, to safeguard their capital.

Moderate Risk Profile

A moderate risk profile reflects a balanced approach, combining growth and stability. Investors in this category often diversify by mixing equities and fixed-income instruments in nearly equal proportions. Balanced mutual funds or ETFs, which allocate assets across stocks and bonds, are a popular choice. Diversification may also include mid-cap stocks, real estate through REITs, and international mutual funds to achieve moderate growth potential while managing risk. To cushion against market volatility, moderate investors maintain a portion of low-risk investments in their portfolio.

Aggressive Risk Profile

Investors with an aggressive risk profile aim for maximum capital appreciation over the long term and have a high tolerance for risk. Their diversification strategy includes a significant allocation to equities, particularly small-cap and mid-cap stocks with high growth potential. Sector-specific mutual funds, such as those in technology or healthcare, and emerging market funds offer opportunities for higher returns. Aggressive investors often diversify globally to capture international growth and may consider alternative investments, such as cryptocurrencies or venture capital funds, as speculative options within a well-researched portfolio.

Importance of Diversification Across Risk Profiles

Regardless of the risk profile, diversification is essential for mitigating risks and optimizing returns. Conservative investors use diversification to protect capital, moderate investors achieve a balance between growth and stability, and aggressive investors blend high-risk ventures with sector and global diversification to maximize returns. Tailoring diversification strategies to an individual’s risk tolerance helps align investments with their financial goals while managing market uncertainties effectively.

Maturity lengths

Maturity lengths in the context of mutual funds refer to the time horizon for which the underlying investments in the mutual fund portfolio are held. Diversifying mutual funds based on maturity lengths allows investors to achieve a balance between liquidity, risk, and returns, catering to short-term, medium-term, and long-term financial goals.

Short-Term Mutual Funds

Short-term mutual funds, such as liquid funds or ultra-short-duration funds, invest in debt instruments with maturities typically ranging from a few days to a year. These funds provide high liquidity and low risk, making them ideal for investors with short-term needs like emergency funds or upcoming expenses. By including short-term mutual funds in a diversified portfolio, investors can ensure quick access to funds while reducing volatility.

Medium-Term Mutual Funds

Medium-term mutual funds, like short-term debt funds and dynamic bond funds, hold investments with maturities ranging from 1 to 3 years (or slightly longer). These funds balance moderate risk with stable returns, making them suitable for goals like saving for a vacation, purchasing a vehicle, or funding education in the near future. Diversifying into medium-term mutual funds helps investors earn better returns compared to short-term funds, while still maintaining a reasonable level of liquidity.

Long-Term Mutual Funds

Long-term mutual funds typically include equity funds, hybrid funds, and long-duration debt funds that invest in instruments with maturities exceeding 5 to 10 years. Equity-oriented funds, in particular, aim for long-term capital appreciation and are suitable for goals such as retirement planning or wealth creation. Diversification into long-term mutual funds allows investors to take advantage of compounding returns and ride out market volatility over time, maximizing growth potential.

Diversification Across Maturity Lengths

A well-diversified mutual fund portfolio includes funds with varying maturity lengths. For example, an investor might allocate a portion of their portfolio to short-term funds for liquidity, medium-term funds for stability, and long-term funds for growth. This approach helps manage risks associated with interest rate fluctuations, market cycles, and liquidity needs, while aligning investments with the investor’s financial goals and time horizons.

Physical Locations

When it comes to mutual funds, physical location diversification plays a significant role in managing risk and optimizing returns. By investing in mutual funds that have exposure to different geographic regions, investors can reduce location-specific risks such as economic downturns, political instability, or natural disasters, and benefit from the growth opportunities in various markets.

Domestic and International Diversification

Mutual funds that invest exclusively in domestic markets focus on companies within a single country. While this offers familiarity and reduced currency exchange risk, it can make the portfolio vulnerable to local economic or political challenges. To diversify, including international mutual funds can spread investments across multiple countries or regions. For example, an investor may combine domestic equity funds with global or emerging market equity funds, enabling exposure to diverse economies and industries.

Regional Diversification

Investing in mutual funds targeting specific regions, such as Asia-Pacific, Europe, or North America, provides geographic diversification. Different regions experience economic cycles at varying times, so regional funds help stabilize portfolio performance by balancing growth in one region with potential downturns in another.

Sector-Specific Diversification Across Locations

Some mutual funds focus on specific sectors, such as technology, healthcare, or energy, but diversify geographically within those sectors. For example, a technology fund may invest in leading tech companies across the United States, Europe, and Asia, providing exposure to global innovation hubs while reducing reliance on a single market.

Benefits of Physical Location Diversification in Mutual Funds

- Risk Mitigation: Reduces exposure to country-specific economic or political crises.

- Growth Potential: Capitalizes on opportunities in emerging and developed markets.

- Currency Diversification: Minimizes the impact of exchange rate fluctuations when investing internationally.

- Market Cycle Balance: Smooths portfolio performance by benefiting from different market cycles in various locations.

Tangibility

Tangibility in mutual fund diversification refers to the concrete benefits and measurable outcomes of spreading investments across various asset classes, sectors, or geographies. Diversification aims to reduce risk by ensuring that poor performance in one area doesn’t heavily impact the overall portfolio.

For example, mutual funds can include equity, debt, and balanced funds, each offering distinct advantages. Equity funds provide growth potential, debt funds offer stability, and balanced funds strike a mix of both. However, it’s essential to avoid overlapping investments, as owning multiple funds with similar holdings can lead to unintended concentration and increased risk.

Diversification Across Platforms

Diversification across platforms refers to spreading investments across various mutual fund platforms or asset management companies. This reduces dependency on a single platform and mitigates risks associated with platform-specific issues, such as operational inefficiencies or fund manager underperformance.

Diversification and Retail Investors

For retail investors, diversification is a key strategy to minimize risks. By investing in a mix of equity, debt, and hybrid funds, retail investors can balance their portfolios according to their risk tolerance and financial goals. Diversification helps retail investors achieve steady returns while protecting against market volatility.

Pros and Cons of Diversification

Pros:

- Reduces unsystematic risk by spreading investments.

- Provides exposure to various asset classes and sectors.

- Enhances the potential for stable returns.

Cons:

- Over-diversification can dilute returns.

- May lead to higher management fees.

- Requires regular monitoring and rebalancing.

Diversifiable vs Non-Diversifiable Risk

- Diversifiable Risk: Also known as unsystematic risk, it pertains to risks specific to a company or sector. This can be mitigated through diversification.

- Non-Diversifiable Risk: Also called systematic risk, it affects the entire market (e.g., economic downturns). Diversification cannot eliminate this risk, but it can help manage its impact.

Measuring Diversification

Diversification can be measured using metrics like the Sharpe ratio, diversification ratio, and portfolio variance. These metrics assess the risk-return trade-off and the extent to which a portfolio is diversified.

Correlation Co-efficient

The correlation coefficient measures the relationship between two assets. A value close to -1 indicates a strong negative correlation, which is ideal for diversification, as it reduces overall portfolio risk.

Standard Deviation

Standard deviation quantifies the volatility of a mutual fund’s returns. A lower standard deviation indicates less risk, while a higher one suggests greater variability in returns. It is a critical metric for assessing the risk of a diversified portfolio.

Smart Beta

Smart beta strategies combine active and passive investing by using alternative weighting methods (e.g., volatility, value, or momentum) to construct portfolios. These strategies aim to enhance returns, reduce risk, or achieve specific investment objectives.

Benefits of Diversification

- Reduces the impact of poor-performing assets.

- Provides exposure to growth opportunities across sectors and geographies.

- Enhances risk-adjusted returns.

- Helps achieve long-term financial goals with reduced volatility.

Methods of Diversification

- Asset Class Diversification: Investing in equities, bonds, and other asset classes.

- Sector Diversification: Spreading investments across industries like technology, healthcare, and finance.

- Geographical Diversification: Investing in domestic and international markets.

- Fund Type Diversification: Combining large-cap, mid-cap, and small-cap funds.

Example

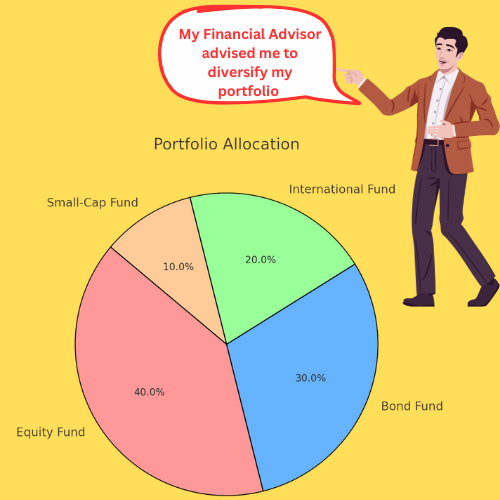

Raj, a young professional, had recently started investing to secure his financial future. He began by putting all his savings into a single equity mutual fund focused on the technology sector. For a while, the returns were fantastic, but then the tech sector faced a downturn, and Raj saw his portfolio take a big hit.

Determined to make smarter investment choices, Raj consulted with a financial advisor. The advisor explained the importance of diversification and how it could help balance the risks. Raj decided to spread his investments across different mutual funds.

He allocated 40% of his portfolio to an equity fund that invested in multiple sectors like healthcare, energy, and consumer goods. Another 30% went into a bond fund to ensure steady income with lower risk. He also put 20% in an international fund to benefit from growth in global markets, and the remaining 10% in a small-cap fund for higher-risk, high-reward potential.

When the tech sector experienced another slump a year later, Raj’s portfolio stayed relatively stable because his investments in other sectors and asset classes provided a cushion. He was relieved to see consistent growth over time, thanks to the power of diversification.

Is Diversification a Good Strategy?

Yes, diversification is a prudent strategy for mutual fund investors. It helps manage risks, ensures steady returns, and aligns with long-term financial goals. However, it is essential to strike a balance to avoid over-diversification, which can dilute returns.

Conclusion

Diversification in mutual funds is a strategic approach to reduce risks and achieve balanced returns. By spreading investments across various asset classes, sectors, and geographies, investors can protect their portfolios from the adverse impact of poor-performing assets. It helps mitigate diversifiable risks while ensuring exposure to growth opportunities. However, over-diversification may dilute returns, so striking the right balance is crucial. Diversification enhances risk-adjusted returns and aligns with long-term financial goals, making it a prudent strategy for retail and institutional investors alike. With careful planning and regular monitoring, diversification can be a powerful tool for sustainable wealth creation.