- Why Directional Moves Break Iron Condors

- Spotting Early Signs of a Directional Market

- Adjustment Strategies with Simple Examples

- When It’s Better Not to Adjust

- Wrapping Up

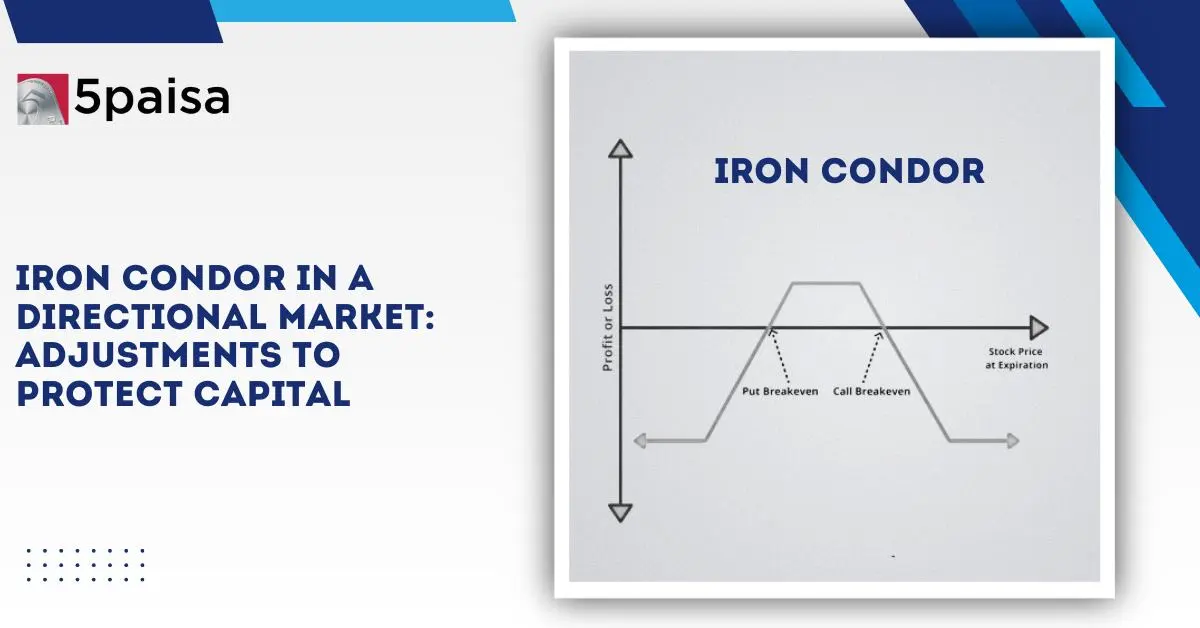

An Iron Condor is a popular options strategy that works best when the market is calm and trades within a specific range. It allows traders to collect premiums from both sides—by selling an out-of-the-money call spread and an out-of-the-money put spread. This setup works well when the market doesn’t move much in either direction.

But sometimes, the market doesn’t stay still. It breaks out strongly—either moving up or crashing down. In such cases, the Iron Condor starts to lose money on one side. To avoid big losses, traders often adjust the trade. These adjustments are like tuning the setup based on how the market is moving.

This article breaks down why Iron Condors fail in directional markets and explains simple adjustments to protect your capital—each followed by easy-to-understand examples.

More Articles to Explore

- Difference between NSDL and CDSL

- Lowest brokerage charges in India for online trading

- How to find your demat account number using PAN card

- What are bonus shares and how do they work?

- How to transfer shares from one demat account to another?

- What is BO ID?

- Open demat account without a PAN card - a complete guide

- What are DP charges?

- What is DP ID in a demat account

- How to transfer money from demat account to bank account

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.