- Why Adjustments Matter in an Iron Butterfly

- Rolling the Iron Butterfly

- Hedging the Iron Butterfly

- Profit Booking Techniques

- Common Mistakes to Avoid During Adjustments

- Final Thoughts: The Art of Adjustment

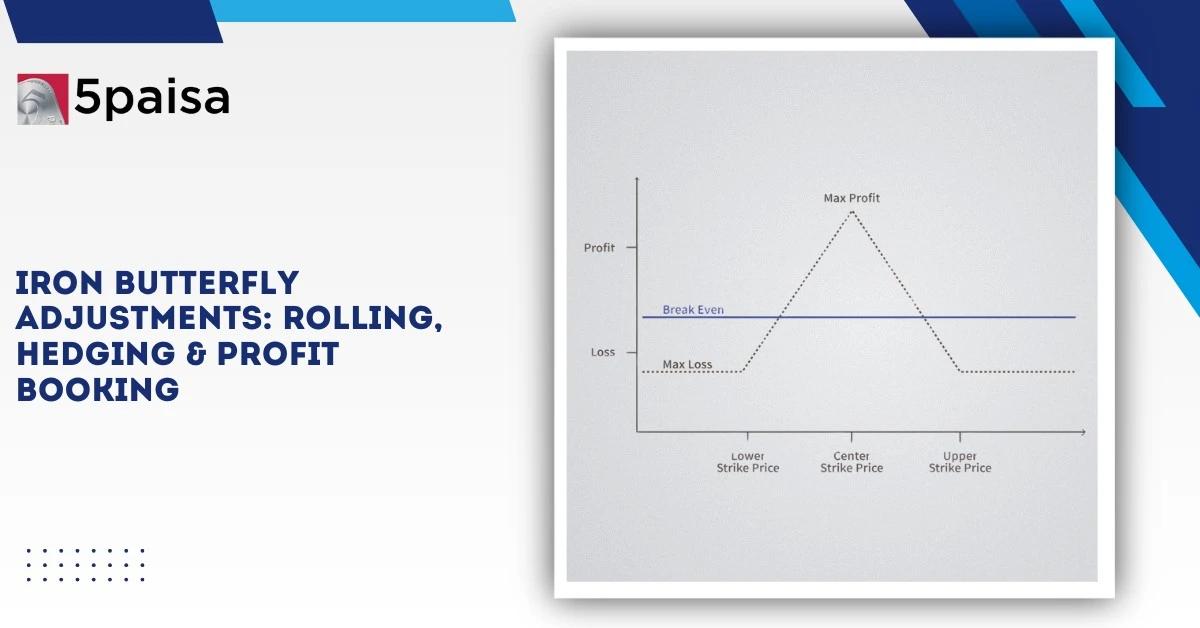

When it comes to options trading, planning the trade is only half the job, the other half is knowing how to manage it once you're in. That’s especially true for strategies like the Iron Butterfly, where profit and risk zones are tightly packed. While this strategy works best in range-bound markets, markets aren’t always cooperative. That’s where adjustments come in.

In this article, we’ll walk you through the key techniques traders use to manage and fine-tune an Iron Butterfly trade—rolling, hedging, and profit booking. Whether you're new to this or have some experience, understanding these adjustments can help you protect profits and minimize losses more effectively.

More Articles to Explore

- Difference between NSDL and CDSL

- Lowest brokerage charges in India for online trading

- How to find your demat account number using PAN card

- What are bonus shares and how do they work?

- How to transfer shares from one demat account to another?

- What is BO ID?

- Open demat account without a PAN card - a complete guide

- What are DP charges?

- What is DP ID in a demat account

- How to transfer money from demat account to bank account

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.