Inheritance is more than just the transfer of money or assets from one generation to another—it represents an opportunity to build on the financial foundation set by those who came before us. However, without thoughtful planning, inheritance can become a fleeting financial windfall rather than a long-term legacy. Managing and growing inherited wealth requires a careful blend of financial strategy, emotional intelligence, and a clear vision for the future. In this comprehensive guide, we’ll delve into actionable steps to handle inheritance responsibly and maximize its potential for long-term growth.

Understanding the Value of Inheritance

Inheritance isn’t merely about receiving assets; it’s about understanding the story behind them. These assets—whether they include real estate, cash, stocks, or businesses—often represent decades of hard work, sacrifice, and foresight. Recognizing the effort behind the wealth can inspire a responsible approach to preserving and growing it.

One of the most significant aspects of inheritance is its potential to provide financial security and opportunities. It can:

- Help pay off debts or mortgages.

- Build a nest egg for future needs like education or retirement.

- Enable investments in real estate, stock markets, or businesses.

- Serve as a safety net during emergencies.

However, the emotional weight of inheritance—particularly when it’s tied to the loss of a loved one—can make decision-making challenging. Balancing respect for the inheritance’s origins with practical financial choices is key.

Step 1: Assessing Your Inheritance

The first step in managing inheritance is understanding what you’ve received. Not all inheritances come in cash; they may include:

- Real Estate (e.g., family homes or rental properties)

- Investments (e.g., stocks, mutual funds, bonds)

- Physical Assets (e.g., artwork, antiques, or collectibles)

- Businesses (e.g., a family-owned company)

- Debts (e.g., liabilities tied to certain assets)

Make an inventory of all inherited assets and liabilities. Consult with financial advisors or estate lawyers to get a clearer picture of the value, legal requirements, and tax implications of these assets. For instance, inherited properties may carry maintenance costs or tax obligations, while inherited businesses may require active management.

Step 2: Understanding Tax Implications

Taxes are a critical consideration when dealing with inheritance. Depending on your location, inheritance or estate taxes may apply, impacting the net value of your inherited assets. For instance:

- In India, inheritance is not directly taxed, but income generated from inherited assets (like rental income or capital gains) is taxable.

- In other countries, such as the U.S. or the U.K., inheritance or estate taxes might come into play.

Work with a tax consultant to understand:

- Tax liabilities on inherited investments or properties.

- Tax-efficient strategies for selling or reinvesting assets.

- Compliance with legal and financial regulations.

A clear understanding of taxation helps you preserve more of your inheritance for future growth.

Step 3: Avoiding Emotional Spending

Inheriting wealth can be both liberating and overwhelming. Many people fall into the trap of emotional spending, using the windfall to fund extravagant purchases or lifestyles that may not align with their long-term goals. While it’s natural to want to enjoy a portion of the inheritance, striking a balance between immediate gratification and future security is crucial.

Here are some tips to avoid emotional spending:

- Wait before making major financial decisions. Take a few months to assess your goals and create a plan.

- Create a budget to allocate portions of the inheritance to specific purposes, such as savings, investments, and discretionary spending.

- Consult with trusted family members or financial advisors to make objective decisions.

Step 4: Setting Financial Goals

Inheritance presents a rare opportunity to achieve financial milestones that may have otherwise taken years. Setting clear financial goals ensures that the wealth is utilized wisely and aligns with your future vision. Some common financial goals include:

- Paying off high-interest debts like credit cards or personal loans.

- Creating an emergency fund to cover unforeseen expenses.

- Investing in a retirement plan to secure long-term financial stability.

- Saving for life goals like higher education, a home purchase, or business ventures.

Defining goals provides direction and allows you to make deliberate choices with your inheritance.

Step 5: Building a Diversified Investment Portfolio

To grow inherited wealth, it’s essential to move beyond savings and explore investment opportunities. Investing allows your inheritance to generate returns over time, helping you build a sustainable financial future. Here’s how to approach investment:

- Diversify Across Asset Classes: Include equities, bonds, real estate, and commodities in your portfolio to spread risk and maximize returns.

- Understand Your Risk Tolerance: High-return investments like stocks come with higher risks, while fixed-income instruments like bonds offer stability.

- Seek Professional Guidance: If you’re unfamiliar with investing, consult with financial advisors to develop a well-balanced investment strategy.

- Consider Mutual Funds or ETFs: These are cost-effective ways to invest in diversified portfolios managed by experts.

For instance, investing in blue-chip stocks or index funds can provide steady long-term growth, while exploring alternative assets like REITs (Real Estate Investment Trusts) can offer additional income streams.

Step 6: Preserving Wealth Through Estate Planning

Once you’ve effectively managed and grown your inheritance, it’s important to plan for its transfer to the next generation. Estate planning ensures that your legacy is preserved and passed on efficiently. Key steps in estate planning include:

- Creating a Will: Clearly outline how your assets will be distributed among heirs.

- Setting Up Trusts: Trusts can protect your wealth from unnecessary taxes and ensure it’s used according to your wishes.

- Designating Beneficiaries: Review and update beneficiary designations for insurance policies, retirement accounts, and investments.

- Appointing Executors: Choose reliable individuals to execute your estate plan.

Estate planning not only safeguards your wealth but also prevents disputes and ensures a smooth transition of assets.

Step 7: Maintaining Financial Discipline

Growing inherited wealth requires consistent financial discipline. Regularly monitor your investments, track expenses, and review your financial goals to ensure you’re on the right path. Here are some tips:

- Automate savings and investments to build wealth consistently.

- Review your portfolio periodically to rebalance it based on market conditions.

- Avoid unnecessary loans or liabilities that could erode your wealth.

- Stay informed about financial markets, tax regulations, and investment opportunities.

Financial discipline not only preserves wealth but also instils habits that benefit future generations.

Step 8: Giving Back to Society

For many, inheritance provides an opportunity to support causes they care about. Philanthropy and charitable giving can create a lasting impact while also offering tax benefits. Consider:

- Donating to educational institutions, healthcare initiatives, or community programs.

- Setting up a charitable trust or foundation to fund long-term projects.

- Supporting family or friends in meaningful and sustainable ways.

- Giving back not only enriches your life but also strengthens your legacy as a positive force in society.

Step 9: Balancing Family Dynamics

Inheritance often comes with emotional and family dynamics that can complicate decision-making. Transparent communication with family members is essential to prevent misunderstandings and foster collaboration. In cases where multiple heirs are involved, consider:

- Discussing shared responsibilities for maintaining or managing inherited assets like family businesses or properties.

- Seeking mediation or legal advice to resolve potential conflicts.

- Ensuring fairness in asset distribution while respecting individual needs and priorities.

Strong family relationships can enhance the value and meaning of inherited wealth.

Step 10: Turning Inheritance into Generational Wealth

Generational wealth goes beyond managing and growing inheritance—it’s about creating a financial legacy that empowers future generations. Educate your children and heirs about financial management, investment principles, and the value of wealth preservation. Encourage them to continue the cycle of responsible inheritance by:

- Instilling the importance of saving, investing, and philanthropy.

- Involving them in financial planning discussions to prepare them for future responsibilities.

- Documenting lessons learned from your own experience with inheritance.

By turning inherited wealth into a source of empowerment and opportunity, you ensure that your legacy endures for years to come.

Example

Ravi, a 35-year-old software engineer living in Mumbai, inherited ₹1 crore and his late grandfather’s small ancestral home in Pune. Ravi’s grandfather, an enterprising trader, had spent his life accumulating wealth with the hope that it would support future generations. Though deeply grateful, Ravi felt overwhelmed by the responsibility of managing such a substantial inheritance. His grandparents’ hard work deserved more than careless spending. At first, Ravi considered splurging on luxuries—a brand-new SUV, vacations abroad, and an expensive apartment closer to work. But after talking to his wife and reflecting on his grandparents’ dedication to securing their legacy, he decided to take a pause and approach the inheritance thoughtfully.

Ravi started by assessing the inheritance. The ₹1 crore cash in the bank presented opportunities, but the ancestral property required maintenance and came with legal documents to review. He consulted an estate lawyer to understand the legal implications of owning the property and hired a tax consultant to identify any obligations tied to the inheritance. The ancestral home was in an area ripe for development. Ravi researched its market value and discovered that converting it into a rental property could yield consistent monthly income. But before making any decisions, he decided to weigh his broader financial goals.

Ravi and his wife sat down to create a list of financial priorities. Their short-term goals included building an emergency fund and saving for their 3-year-old daughter’s education. For the long term, they wanted to retire comfortably while ensuring they had a safety net for unforeseen circumstances. These goals became the backbone of their inheritance plan. Next, Ravi avoided emotional spending. Though tempted to buy that luxury SUV he had his eyes on, he realized a ₹20 lakh car would depreciate quickly, adding little value to his financial stability. Instead, he set aside ₹5 lakh for discretionary spending, using it for smaller indulgences like a family vacation and upgrades to their current apartment.

With the bulk of his inheritance intact, Ravi met a financial advisor to discuss investment options. The advisor recommended diversifying his portfolio. Ravi allocated:

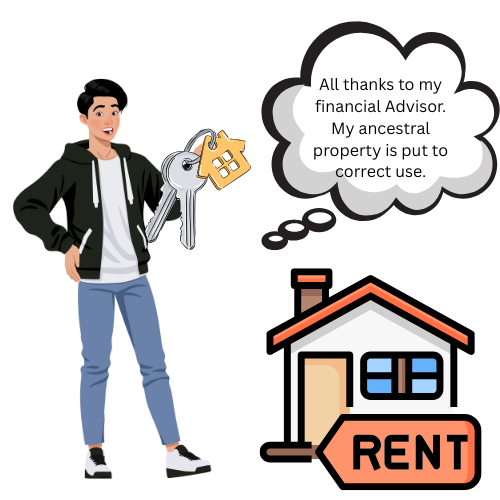

Ravi decided to renovate the ancestral home in Pune. Rather than sell it, he turned it into a rental property, generating ₹25,000 per month in steady passive income. Over time, the property’s value increased, turning it into a lucrative asset for future generations.

Recognizing the importance of preserving wealth, Ravi set up a trust fund for his daughter. By investing part of the inheritance in high-growth mutual funds, he ensured she would have access to resources when she pursued higher education. Additionally, he updated his own estate plan, creating a will and appointing his wife as the executor to safeguard their assets. Ravi also wanted to honour his grandfather’s legacy through philanthropy. With ₹5 lakh allocated to charity, he supported local educational initiatives in Pune, including providing scholarships to underprivileged students. This act of giving not only honoured his grandparents’ values but enriched the lives of others.

As the years passed, Ravi’s careful management and disciplined approach yielded tangible results. His investments grew, his rental property provided consistent income, and his daughter’s education fund steadily accumulated value. Ravi’s journey wasn’t just about receiving an inheritance—it was about transforming that gift into lasting wealth that honoured the past while securing the future. By making thoughtful decisions, Ravi turned a moment of uncertainty into a lifetime of stability. The inheritance became a meaningful legacy, not just a financial windfall.

Conclusion

Inheritance is both a privilege and a responsibility. It provides a unique opportunity to honour the hard work and foresight of previous generations while building a secure financial future for yourself and your heirs. By following these steps—assessing inherited assets, avoiding emotional spending, setting financial goals, investing wisely, and engaging in estate planning—you can effectively manage and grow your legacy.

Ultimately, inheritance is not just about accumulating wealth; it’s about creating a meaningful impact, fostering financial stability, and passing on values that transcend material assets. With a thoughtful and disciplined approach, you can transform your inheritance into a lasting source of security, growth, and positive influence.