Zero based budgeting is an approach to plan and prepare the budget from the scratch. Zero-based budgeting starts from zero, rather than a traditional budget that is based on previous budgets. With this budgeting approach, you need to justify each and every expense before adding it to the actual budget. The primary objective of zero-based budgeting is the reduction of unnecessary cost by looking at where costs can be cut. To create a zero base budget involvement of the employees is required. You can ask your employees what kind of expenses the business will have to bear and figure out where you can control such expenses. If a particular expense fails to benefit the business, the same should be axed from the budget.

What is Zero Based Budgeting?

Zero-based budgeting (ZBB) is a budgeting method where each new period starts from a “zero base,” meaning every expense must be justified from scratch. Unlike traditional budgeting, which adjusts prior budgets, ZBB requires organizations to justify all expenditures for each period, ensuring that only essential and efficient costs are funded. This approach increases accountability and helps eliminate unnecessary spending, as all expenses must align with strategic goals. However, ZBB can be a time-consuming process due to the detailed analysis required, making it more resource-intensive than traditional budgeting methods.

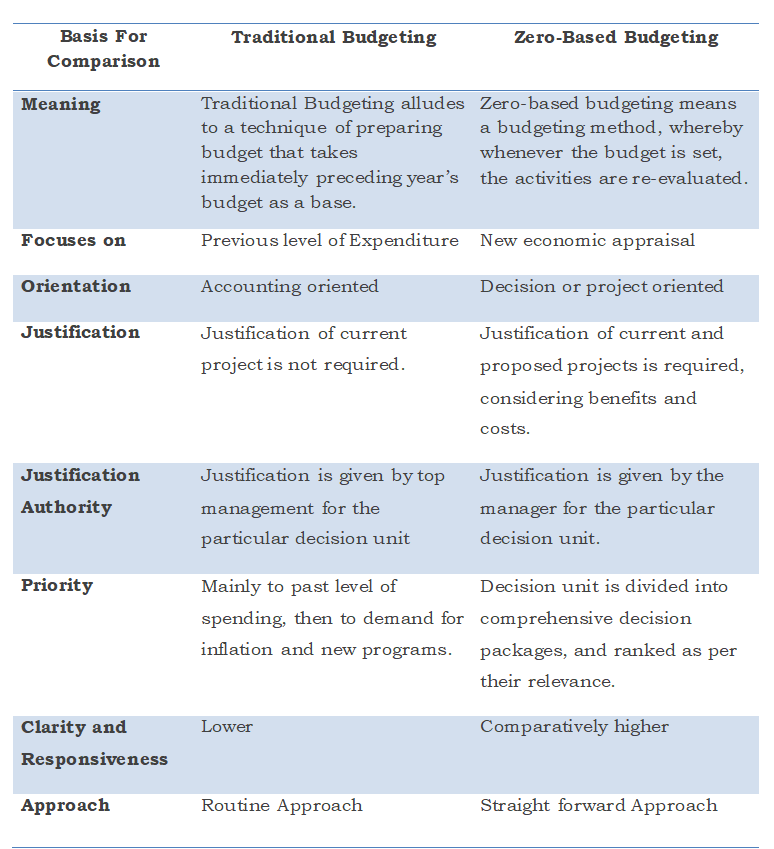

Difference between Zero-based budgeting & Traditional Budgeting

Features of Zero Based Budgeting

Zero-based budgeting (ZBB) has several key features that differentiate it from traditional budgeting approaches:

- Starting from Zero: Each new budgeting period begins with a zero base. Every expense must be justified from scratch, without assuming previous budgets.

- Cost Justification: Every department or unit must justify the necessity and value of each expense, ensuring all funds are allocated based on need and priorities.

- Resource Allocation: Resources are allocated based on careful analysis and alignment with organizational goals, ensuring efficient use of funds.

- Decision Packages: Expenses are grouped into decision packages, which are evaluated and ranked based on their cost-benefit analysis, ensuring strategic allocation of resources.

- Cost Control: ZBB promotes stringent cost control and management, helping organizations identify and eliminate unnecessary expenditures.

- Management Involvement: Requires active involvement from managers at all levels, as they need to justify each line item, fostering increased accountability.

- Flexibility: Adaptive to changing economic conditions and organizational priorities, making it suitable for dynamic environments.

- Time-Consuming: ZBB can be time-consuming and resource-intensive due to the detailed evaluation and justification process required.

Advantage of zero based budgeting

- Efficiency: Zero-based Budgeting helps a business in the allocation of resources efficiently (department-wise) as it does not look at the previous budget numbers, instead looks at the actual numbers

- Budget inflation: As mentioned above every expense is to be justified. Zero-based budget compensates the weakness of incremental budgeting of budget inflation.

- Coordination and Communication: Zero-based budgeting provides better coordination and communication within the department and motivation to employees by involving them in decision-making.

- Reduction in redundant activities: This approach leads to identify optimum opportunities and more cost-efficient ways of doing things by eliminating all the redundant or unproductive activities

Disadvantage of zero based budgeting

- High Manpower Turnover: The foundation of zero-based budgeting itself is a zero. Budget under this concept is planned and prepared from the scratch and require the involvement of a large number of employees. Many departments may not have adequate human resource and time for the same.

- Time-Consuming: This Zero-based budgeting approach is a highly time-intensive for a company to do annually as against incremental budgeting approach, which is a far easier method.

- Lack of Expertise: Providing an explanation for every line item and every cost is a problematic task and requires training for the managers.

Conclusion

Zero-based budgeting targets at presenting true expenses to be incurred by a department. Although this budgeting method is time-consuming, this is a more appropriate way of budgeting. This includes all-inclusive analysis of the budget proposal and if the managers make irrelevant variations so as to achieve what they want, they are probably exposed.