The Efficient Frontier is a fundamental concept in investment theory that defines the optimal portfolio combinations that offer the highest expected return for a given level of risk, or the lowest risk for a given level of expected return. Introduced by Harry Markowitz in 1952, it serves as a cornerstone of Modern Portfolio Theory (MPT). The concept is graphically represented as a curve on a graph where the y-axis denotes expected return and the x-axis represents the standard deviation (a measure of risk). Portfolios that lie on this curve are considered “efficient” because they provide the maximum possible return for a specified level of risk. The Efficient Frontier enables investors to make informed decisions about portfolio diversification by illustrating the trade-offs between risk and return, helping them to achieve the best possible risk-adjusted returns.

What Is the Efficient Frontier?

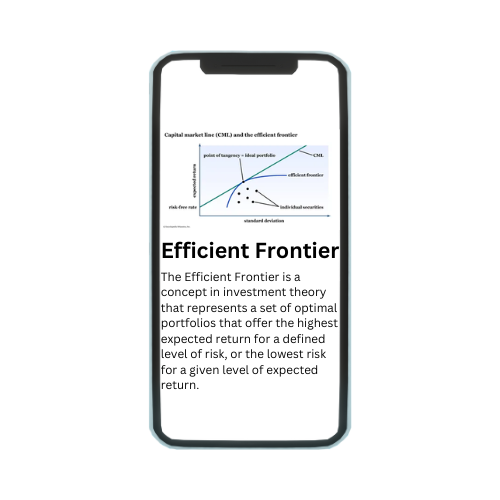

The Efficient Frontier is a concept in investment theory that represents a set of optimal portfolios that offer the highest expected return for a defined level of risk, or the lowest risk for a given level of expected return. It was first introduced by Harry Markowitz in 1952 as a key component of Modern Portfolio Theory (MPT). The concept is graphically depicted as a curve on a graph, where the y-axis shows the expected return and the x-axis displays the standard deviation (a measure of risk) of the portfolio. Portfolios that lie on the Efficient Frontier are considered “efficient” because they provide the maximum possible return for a specified level of risk. The Efficient Frontier helps investors to understand the trade-offs between risk and return and enables them to construct portfolios that best suit their risk tolerance and investment goals. By diversifying investments across different asset classes, investors can achieve the optimal mix that maximizes returns for a given level of risk or minimizes risk for a desired return.

Understanding the Concept

The Efficient Frontier is a fundamental concept in investment theory, particularly in Modern Portfolio Theory (MPT), introduced by Harry Markowitz in 1952. It represents a graphical depiction of optimal portfolios that offer the highest expected return for a given level of risk, or the lowest risk for a specified level of expected return. The concept is illustrated on a graph where the y-axis shows the expected return and the x-axis represents the standard deviation (a measure of risk) of the portfolio. Portfolios that lie on the Efficient Frontier are considered “efficient” because they provide the maximum possible return for a specified level of risk. The curve itself is derived from the expected returns and volatilities (standard deviations) of individual assets and the correlations between them.

Understanding the Efficient Frontier involves grasping the idea that investors seek to maximize returns while minimizing risk. The concept allows investors to visualize and quantify the trade-offs between risk and reward. By diversifying their investments across different asset classes—such as stocks, bonds, and commodities—investors can achieve an optimal mix that balances risk and return according to their preferences. The Efficient Frontier is not a static line but rather a dynamic concept that can shift based on market conditions, asset correlations, and investor preferences. It serves as a quantitative tool for portfolio construction, helping investors to identify the optimal portfolio that suits their risk appetite and investment objectives.

How Does an Efficient Frontier Work?

The Efficient Frontier is a critical tool in investment theory that helps investors optimize their portfolios by balancing risk and return. It works by plotting various portfolios on a graph, where the y-axis represents the expected return and the x-axis represents the standard deviation (a measure of risk). Here’s how it operates:

- Portfolio Optimization: The main objective of the Efficient Frontier is to help investors construct portfolios that offer the highest possible return for a given level of risk, or the lowest risk for a specified level of expected return. This is achieved by diversifying investments across different asset classes, such as stocks, bonds, and commodities.

- Risk-Return Trade-off: The Efficient Frontier enables investors to visualize and understand the trade-offs between risk and return. Portfolios that lie on the Efficient Frontier are considered “efficient” because they provide the maximum expected return for a given level of risk. Investors can adjust their portfolios along this curve to achieve the desired balance between risk and reward.

- Diversification: One of the key principles of the Efficient Frontier is portfolio diversification. By spreading investments across assets with different risk and return characteristics, investors can reduce the overall risk of their portfolio without sacrificing potential returns. This diversification helps in achieving a smoother risk-adjusted return profile.

- Quantitative Analysis: The Efficient Frontier uses mathematical models and optimization techniques to find the set of portfolios that offer the best risk-return trade-off. It takes into account factors such as expected returns, volatilities (standard deviations), and correlations between different assets.

- Modern Portfolio Theory (MPT): The concept of the Efficient Frontier is a cornerstone of Modern Portfolio Theory, which suggests that investors can construct an optimal portfolio by combining assets in a way that minimizes risk for a given level of expected return, or maximizes return for a given level of risk.

Significance of the Efficient Frontier in Investment Theory

The Efficient Frontier holds significant importance in investment theory, particularly in the context of Modern Portfolio Theory (MPT) and portfolio management strategies. Here are the key pointers explaining its significance:

- Risk-Return Optimization: The Efficient Frontier helps investors optimize their portfolios by balancing risk and return. It identifies the set of portfolios that offer the highest expected return for a given level of risk or the lowest risk for a specified level of expected return. This is crucial for investors seeking to achieve their financial goals while managing risk effectively.

- Diversification Strategy: It promotes diversification as a fundamental strategy for risk management. By diversifying investments across different asset classes with varying risk and return characteristics, investors can reduce the overall risk of their portfolio without necessarily sacrificing potential returns. The Efficient Frontier provides a quantitative framework to determine the optimal mix of assets that achieves the desired risk-return profile.

- Quantitative Analysis: The concept of the Efficient Frontier involves rigorous quantitative analysis. It uses mathematical models, such as mean-variance optimization, to compute the expected returns, volatilities (standard deviations), and correlations of various assets. This quantitative approach helps investors make informed decisions based on data and statistical analysis rather than intuition or speculation.

- Modern Portfolio Theory (MPT): The Efficient Frontier is a cornerstone of MPT, which was pioneered by Harry Markowitz. MPT suggests that investors can construct an optimal portfolio by combining assets in a way that minimizes risk for a given level of expected return, or maximizes return for a given level of risk. The Efficient Frontier graphically represents these optimal portfolios, illustrating the trade-offs between risk and return.

- Guidance for Portfolio Construction: By plotting portfolios on a graph with expected return on the y-axis and risk (standard deviation) on the x-axis, the Efficient Frontier provides visual guidance for portfolio construction. Investors can identify and select portfolios that lie on or near the Efficient Frontier to achieve their investment objectives while maintaining an acceptable level of risk.

- Risk Management Tool: It serves as a risk management tool by allowing investors to assess and quantify the risks associated with different investment strategies. The Efficient Frontier helps investors understand how changes in asset allocation impact the overall risk and return of their portfolios, thereby enabling them to make adjustments as needed.

Efficient Frontier Benefits

The Efficient Frontier offers several benefits that make it a valuable tool in investment theory and portfolio management:

- Risk Management: One of the primary benefits of the Efficient Frontier is its ability to manage investment risk effectively. By diversifying investments across different asset classes with varying risk and return profiles, investors can achieve a more balanced and resilient portfolio. This diversification helps in reducing the overall risk without sacrificing potential returns, thereby enhancing the risk-adjusted performance of the portfolio.

- Optimal Returns: The Efficient Frontier helps investors maximize their returns for a given level of risk. It identifies the set of portfolios that offer the highest expected return for a specified level of risk, enabling investors to achieve their financial goals more efficiently.

- Portfolio Diversification: It encourages portfolio diversification as a key strategy for risk reduction. Diversifying across assets with low correlations can help spread risk and minimize the impact of adverse market movements on the overall portfolio. This diversification is critical in achieving a smoother risk-return profile.

- Quantitative Analysis: The Efficient Frontier employs rigorous quantitative analysis to determine the optimal mix of assets. It takes into account factors such as expected returns, volatilities (standard deviations), and correlations between assets to construct portfolios that are efficient in terms of risk and return.

- Modern Portfolio Theory (MPT): The concept of the Efficient Frontier is central to Modern Portfolio Theory, which provides a framework for optimizing portfolios based on risk and return considerations. MPT suggests that investors can construct an optimal portfolio that lies on the Efficient Frontier, balancing risk and return according to their preferences.

- Decision Support Tool: It serves as a decision support tool for investors and financial advisors. The Efficient Frontier helps in visualizing and understanding the trade-offs between risk and return, allowing investors to make informed decisions about their asset allocation and portfolio construction.

- Long-Term Investment Strategy: By guiding investors towards portfolios that offer the best risk-return trade-off, the Efficient Frontier supports a long-term investment strategy. It encourages investors to focus on the overall portfolio rather than individual assets, promoting a disciplined approach to investing.

- Educational Tool: The Efficient Frontier is also used as an educational tool to teach investors about portfolio management and the principles of diversification. It helps investors understand the importance of asset allocation in achieving their investment objectives.

How Is the Efficient Frontier Calculated?

The Efficient Frontier is calculated using mathematical models and optimization techniques to identify the set of optimal portfolios that offer the best risk-return trade-off. Here are the key pointers explaining the calculation process:

- Expected Return and Standard Deviation: The calculation begins with estimating the expected return and the standard deviation (volatility) for each individual asset in the portfolio. Expected return is the anticipated gain or loss from an investment, while standard deviation measures the degree of variation of returns around the expected return.

- Covariance Matrix: A covariance matrix is constructed to capture the relationships and dependencies (correlations) between different assets in the portfolio. The covariance matrix provides a measure of how the returns of one asset move in relation to the returns of another asset. It helps in understanding the diversification benefits of combining assets with different risk and return characteristics.

- Portfolio Optimization: Portfolio optimization algorithms, such as mean-variance optimization, are then applied to find the set of portfolios that lie on the Efficient Frontier. These algorithms aim to maximize returns for a given level of risk or minimize risk for a desired level of return.

- Efficient Portfolio Calculation: The Efficient Frontier is derived by plotting these optimized portfolios on a graph. The y-axis represents the expected return, and the x-axis represents the standard deviation (risk) of the portfolio. Portfolios that lie on the curve are considered efficient because they provide the maximum possible return for a given level of risk.

- Risk-Return Trade-offs: The Efficient Frontier graphically illustrates the trade-offs between risk and return. It shows investors the combinations of assets that offer the highest returns for a given level of risk, or the lowest risk for a specified level of expected return.

- Constraints and Preferences: Portfolio optimization takes into account various constraints and investor preferences, such as minimum or maximum allocations to certain assets, sector diversification requirements, and risk tolerance levels. These constraints ensure that the resulting portfolio is both efficient and aligned with the investor’s goals.

- Rebalancing and Monitoring: The Efficient Frontier is not static and can change over time due to shifts in asset prices, correlations, and investor preferences. Therefore, it requires periodic rebalancing and monitoring to maintain its optimal risk-return profile.

Limitations or Criticisms of an Efficient Frontier

- Market Assumptions: The Efficient Frontier relies heavily on historical data and statistical assumptions about asset returns and correlations. This assumption that historical data can predict future performance may not always hold true, especially during periods of economic uncertainty or significant market volatility.

- Simplistic Model: The Efficient Frontier is based on a mean-variance optimization model, which assumes that investors make decisions solely based on expected returns and risk (standard deviation). It does not take into account other important factors such as liquidity constraints, transaction costs, taxes, and market impact, which can significantly affect portfolio performance in real-world scenarios.

- Data Sensitivity: The effectiveness of the Efficient Frontier is highly sensitive to the accuracy of the input data, including expected returns, volatilities, and correlations. Small changes in these inputs can lead to significant changes in the composition and positioning of the optimal portfolios identified by the model.

- Assumption of Normal Distribution: The model assumes that asset returns follow a normal distribution, which may not accurately capture the true distribution of returns, especially during periods of extreme market events (fat tails) or market crises. This can lead to underestimating the potential for losses in the tail ends of the distribution.

- Static Nature: The Efficient Frontier assumes that asset relationships, such as correlations, remain constant over time. In reality, correlations between asset classes can change, particularly during periods of financial stress or economic change, which can impact the diversification benefits of the portfolio.

- Single Time Horizon: The model typically focuses on a single time horizon and does not account for changes in investor preferences, goals, or market conditions over time. As a result, it may not adequately address the dynamic nature of investment decisions and the need for periodic portfolio rebalancing.

- Over-optimization: There is a risk of over-optimization or “data mining” when applying complex mathematical models to historical data. This can lead to portfolios that are highly sensitive to the specific time period or dataset used, rather than robust portfolios that perform well across different market conditions.

- Complexity and Practical Implementation: The calculations and optimization techniques used to derive the Efficient Frontier can be complex and may require specialized knowledge and software. This complexity can make it challenging for individual investors or smaller financial institutions to implement effectively.

Conclusion

In conclusion, the Efficient Frontier stands as a foundational concept in investment theory, offering a structured approach to balancing risk and return in portfolio management. Introduced by Harry Markowitz in 1952 as part of Modern Portfolio Theory, it provides investors with a quantitative framework to construct portfolios that aim to maximize returns for a given level of risk or minimize risk for a desired level of return. By visualizing the trade-offs between risk and reward, the Efficient Frontier helps investors make informed decisions about asset allocation and portfolio diversification. However, it is important to acknowledge its limitations, such as reliance on historical data, simplification of market dynamics, and the assumption of static correlations. These factors can affect its effectiveness in real-world scenarios. Despite these criticisms, the Efficient Frontier remains a valuable tool for investors seeking to optimize their portfolios and manage risk effectively. It serves as a guidepost for constructing diversified portfolios that align with individual risk preferences and investment goals, fostering a disciplined and rational approach to long-term wealth accumulation and financial planning.

fREQUENTLY ASKED QUESTIONS(FAQs)

The main purpose is to help investors find the optimal portfolio mix that balances risk and return.

You can use it to construct diversified portfolios that offer the best risk-return trade-off.

It may not account for unexpected market changes and relies heavily on historical data.

Yes, it can be adapted for different risk tolerances and investment goals.

It was introduced by Harry Markowitz in 1952 as part of Modern Portfolio Theory.