A deflationary gap occurs when an economy’s actual output is below its potential output, indicating underutilized resources such as labor and capital. This gap arises due to insufficient aggregate demand, leading to high unemployment and downward pressure on prices, often resulting in deflation.

It reflects a situation where the economy is producing less than it could at full employment, causing slower growth. Governments and central banks often respond by implementing expansionary fiscal and monetary policies, such as lowering interest rates or increasing spending, to stimulate demand and close the gap, restoring economic balance.

Causes of Deflationary Gap

Fall in the money supply

A central bank may use a tighter monetary policy by increasing interest rates. Thus, people, instead of spending their money immediately, prefer to save more of it. In addition, increasing interest rates lead to higher borrowing costs, which also discourages spending in the economy.

Decline in confidence

Negative events in the economy, such as recession, may also cause a fall in aggregate demand. For example, during a recession, people can become more pessimistic about the future of the economy. Subsequently, they prefer to increase their savings and reduce current spending. An increase in aggregate supply is another trigger for deflation. Subsequently, producers will face fiercer competition and be forced to lower prices. The growth in aggregate supply can be caused by the following factors:

Lower production costs

A decline in price for key production inputs (e.g., oil) will lower production costs. Producers will be able to increase production output, which will lead to an oversupply in the economy. If demand remains unchanged, producers will need to lower their prices on goods to keep people buying them.

Technological advances

Advances in technology or rapid application of new technologies in production can cause an increase in aggregate supply. Technological advances will allow producers to lower costs. Thus, the prices of products will likely go down.

Differences between the inflationary gap and deflationary gap. | ||

Basis | Inflationary Gap | Deflationary Gap |

Meaning | The excess of aggregate demand above the level that is required to maintain full employment level of equilibrium is termed as inflationary gap. | The shortfall of aggregate demand below the level that is required to maintain full employment level of equilibrium is termed as a deflationary gap. |

Effect | Inflationary gap causes inflation and increases wages and price level in the economy. | Deflationary gap causes deflation and decreases wages and price level in the economy. |

Causes | Some of the causes are as follows: Rise in one or more components of AD Fall in tax rate Rise in money supply | Some of the causes are as follows: Fall in one or more components of AD Rise in tax rate Fall in money supply |

Meaning | The excess of aggregate demand above the level that is required to maintain full employment level of equilibrium is termed as inflationary gap. | The shortfall of aggregate demand below the level that is required to maintain full employment level of equilibrium is termed as a deflationary gap. |

Effect | Inflationary gap causes inflation and increases wages and price level in the economy. | Deflationary gap causes deflation and decreases wages and price level in the economy. |

Impact of Deflationary Gap

If an economy experiences a deflationary gap, then it will have the following impact on the wider macro economy.

- Rising Unemployment: We will get demand-deficient unemployment and possibly higher structural unemployment

- Low/negative rates of economic growth.: Negative impact on government’s budget. With lower economic growth, the government will receive lower tax revenue and lower government spending.

- Low rates of inflation/disinflation: Possibly deflation. With a deflationary gap, firms have excess capacity, this tends to put downward pressure on prices and wages.

Conclusion

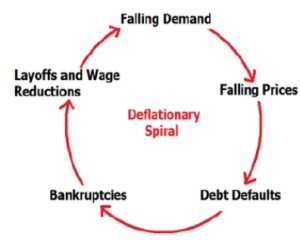

When the economy experiences a deflationary gap, economic growth and inflation rate are lower . When a decrease in aggregate demand bring the economy into a recession, real GDP and the price level fall. A deflationary gap occurs when the actual real GDP is below its potential output. In this situation, some economic resources are underutilized, which in turn, creating a downward pressure on price level.

This term is synonymous with the recessionary gap. Companies face excess capacity. Prices and wages put on the downward pressure. Their profit margins shrink and force them to reduce labour, causing a higher unemployment rate. Households become more pessimistic on their future job and income prospects. As a result, they spend less on goods and services.

For the government, a decline in economic activity causes tax revenues to fall. In financial markets, investors will usually reduce investment in cyclical companies and commodity-based companies. They began to reallocate investment more on defensive companies as they have a more stable performance during an economic slowdown.