Cost-push inflation occurs when the overall price levels rise due to increasing production costs, leading businesses to pass on these costs to consumers. This type of inflation can be triggered by various factors, including rising wages, increased raw material prices, or supply chain disruptions.

As costs escalate, companies may struggle to maintain profit margins, resulting in higher prices for goods and services. Unlike demand-pull inflation, which stems from increased consumer demand, cost-push inflation can lead to stagflation—a situation characterized by stagnant economic growth and high inflation rates. Understanding this phenomenon is crucial for policymakers and economists in managing inflationary pressures.

What is cost-push inflation?

Cost-push inflation is when the overall price rises due to increased production costs. Producers face higher expenses when inputs such as labor, raw materials, or energy increase. They pass these increased costs onto consumers by raising prices to maintain profit margins. As a result, the general level of prices in the economy rises, leading to inflation.

Understanding cost-push inflation

The increase in production costs drives cost-push inflation. There are numerous potential causes, including:

- Rising Wages: When wages increase, it directly affects production costs. Higher wages mean increased business expenses, which may result in higher prices for services and goods.

- Raw Material Costs: If the cost of raw materials used in production rises, businesses will need to spend more on inputs. This increase in expenses can lead to inflationary pressures.

- Taxes and Regulations: Tax changes or new regulations imposed on businesses can increase operating costs. These additional expenses can be passed on to consumers through higher prices.

- Exchange Rate Fluctuations: If a country’s currency depreciates, it makes imports more expensive. This, in turn, can increase the cost of production and lead to cost-push inflation.

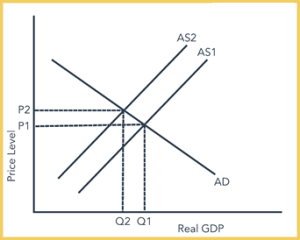

Graphic Representation of Cost-Push Inflation

Causes of Cost-Push Inflation

Several factors contribute to the occurrence of cost-push inflation:

- Rising Energy Prices: When the cost of energy, such as oil or electricity, increases, it raises the production costs for businesses. As a result, they may increase prices to maintain profitability.

- Increase in Taxes: Higher taxes imposed on businesses can lead to increased expenses, which may be passed on to consumers through higher prices.

- Labor Costs: If wages rise significantly, businesses may raise prices to compensate for the increased labor expenses.

- Supply Chain Disruptions: Disruptions, such as shortages of raw materials or transportation issues, can lead to increased production costs, which may be reflected in higher prices.

Cost-Push Inflation vs. Demand-Pull Inflation

While increases in production costs drive cost-push inflation, demand-pull inflation happens when the overall demand for goods and services surpasses the economy’s ability to supply them. In cost-push inflation, prices rise due to increased costs, whereas in demand-pull inflation, prices rise due to excess demand.

Cost-push inflation is often associated with decreased output or economic growth, as businesses may reduce production in response to higher costs. On the other hand, demand-pull inflation is typically accompanied by increased economic activity and higher employment levels.

Example of Cost-Push Inflation

An example of cost-push inflation can be seen in the oil industry. When the price of crude oil rises notably, it directly affects the cost of production for various sectors, such as transportation and manufacturing. As a result, these sectors may increase the prices of their services and goods to cover the higher expenses incurred due to the increased cost of oil.

What causes cost-push inflation?

A combination of factors can cause cost-push inflation:

- Increased Labor Costs: If labor unions negotiate higher wages for workers, it can lead to cost-push inflation as businesses raise prices to cover the increased expenses.

- Rising Commodity Prices: When the prices of essential commodities like oil, metals, or agricultural products increase, it can directly impact production costs and trigger cost-push inflation.

- Government Policies: Certain government policies, such as increased taxes or regulations, can raise business costs and contribute to cost-push inflation.

What effects cost-push inflation?

Cost-push inflation can have several effects on the economy and individuals:

- Reduced Purchasing Power: As prices rise, the purchasing power of consumers decreases. They may have to spend more on essential goods and services, leaving less money for discretionary spending.

- Lower Economic Growth: Cost-push inflation can lead to reduced economic growth as businesses face higher production costs and may cut back on investments or expansion.

- Impact on Wages: In response to cost-push inflation, workers may demand higher wages to cope with the increased cost of living. This, in turn, can contribute to a wage-price spiral and further inflationary pressures.

How is inflation measured?

Inflation is typically measured using various economic indicators, including:

- Consumer Price Index (CPI): The CPI measures changes in the average price level of a basket of services and goods commonly consumed by households. It indicates the inflation rate.

- Producer Price Index (PPI): The PPI measures changes in the average prices producers receive for their goods and services. It reflects changes in input costs and can indicate potential inflationary pressures.

- Gross Domestic Product (GDP) Deflator: The GDP deflator measures changes in the overall price level of all final services and goods produced within an economy. It reflects inflation in the entire economy.

What investments beat inflation?

To protect against the erosive effects of inflation, investors can consider the following investment options:

- Stocks: Investing in stocks of companies with a history of outperforming inflation can help preserve purchasing power.

- Real Estate: Real estate investments, such as rental properties or real estate investment trusts, can hedge against inflation, as rental income and property values tend to increase with rising prices.

- Inflation-Indexed Bonds: These bonds adjust their value based on changes in inflation, ensuring that investors’ returns keep pace with rising prices.

- Commodities: Investing in commodities like gold, silver, or agricultural products can act as a hedge against inflation, as their prices tend to rise during periods of inflation.

Can You Beat Inflation with Gold?

Gold is often considered a hedge against inflation due to its historical value and limited supply. During inflation, the price of gold tends to rise, which can help investors preserve their wealth. However, it’s important to note that various factors, including market conditions and investor sentiment, can influence gold prices.

Conclusion

Cost-push inflation occurs when increased production costs increase prices for goods and services. Factors such as rising wages, raw material costs, taxes, and exchange rate fluctuations contribute to this type of inflation. Individuals and businesses must understand the causes and effects of cost-push inflation to make informed decisions.

Inflation can erode purchasing power and impact economic growth. Therefore, investors should consider investment options that can beat inflation, such as stocks, real estate, inflation-indexed bonds, and commodities like gold.

frequently Asked Questions (FAQs)

Inflation can have both positive and negative effects. Moderate inflation can stimulate economic growth and encourage spending, but high inflation erodes purchasing power and destabilizes the economy.

To address cost-push inflation, policymakers can focus on promoting competition, implementing measures to enhance productivity, and ensuring a stable business environment.

The inflation rate in India varies over time. It is measured by the Consumer Price Index (CPI) and the Wholesale Price Index (WPI).

The four main types of inflation are demand-pull inflation, cost-push inflation, built-in inflation, and hyperinflation. Each type has distinct causes and effects.