A bull spread is an options trading strategy that enables investors to profit from a moderate increase in the price of an underlying asset while limiting risk exposure. This strategy involves simultaneously buying and selling options with different strike prices or expiration dates on the same asset.

There are two primary types of bull spreads: call bull spreads, where a trader buys a call option at a lower strike price and sells another call option at a higher strike price, and put bull spreads, which involve buying a put option at a higher strike price and selling another at a lower strike price.

Types of bull spread

Bull call spread

Bear call spread

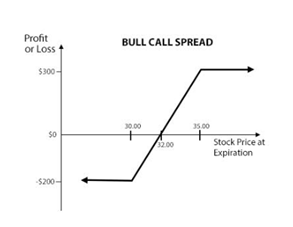

Bull Call Spread

A Bull Call Spread is an options trading strategy designed for investors who anticipate a moderate increase in the price of an underlying asset. Here’s a detailed breakdown:

How It Works

- Buy a Call Option: Purchase a call option at a lower strike price. This gives you the right to buy the asset at this price before the option expires.

- Sell a Call Option: Simultaneously, sell a call option at a higher strike price. This obligates you to sell the asset at this price if the buyer exercises the option.

Both options must have the same expiration date and underlying asset.

Key Features

- Cost: The strategy involves a net debit (cost), as the premium paid for the lower strike call is higher than the premium received for the higher strike call.

- Profit Potential: The maximum profit is capped at the difference between the two strike prices, minus the net cost of the spread.

- Risk: The maximum loss is limited to the net premium paid to establish the spread.

When to Use

This strategy is ideal when you expect the stock price to rise moderately but not drastically. It reduces the cost compared to buying a single call option but limits the profit potential.

A bull call spread can be constructed by buying a call option with a lower strike price while simultaneously selling a call option with a higher strike price, on the same underlying security, expiring on the same date.

Example

Suppose the XYZ stock is trading at Rs 32 and the option contract lot size is 100. A trader enters a bull call spread by buying ITM call at $30 for Rs 300 and writing an OTM call at Rs 35 for Rs 100. The net investment required for the spread is Rs 200.

Suppose the stock price of XYZ begins to rise and closes at Rs 36 on the expiration date. Both options expire in-the-money, with the Rs 30 long call having an intrinsic value of $600 and the Rs 35 short call having an intrinsic value of Rs 100. This means that the spread is now worth $500 at expiration and the net profit is Rs 300.

If the price of XYZ had declined to Rs 29, both options expire worthless. The trader will lose his entire investment of Rs 200 which is also his maximum possible loss.

Bull Put Spread

A Bull Put Spread is another options trading strategy, but it’s used when you expect the price of the underlying asset to increase moderately or at least not fall significantly. Here’s a detailed breakdown:

How It Works

- Sell a Put Option: You sell a put option with a higher strike price. This obligates you to buy the asset at this price if the option is exercised.

- Buy a Put Option: At the same time, you buy a put option with a lower strike price. This provides protection by limiting your maximum loss.

Both options must have the same expiration date and underlying asset.

Key Features

- Credit (Profit): The strategy generates a net credit, as the premium received from selling the higher strike put is more than the premium paid for the lower strike put.

- Profit Potential: The maximum profit is the net premium received for the spread.

- Risk: The maximum loss is limited to the difference between the two strike prices, minus the net premium received.

When to Use

This strategy is ideal when you believe the stock price will either rise or remain relatively stable. It allows you to earn income with limited risk.

Bull put spread can be constructed by buying a put option with lower strike price and simultaneously selling higher strike put option on the same underlying stock, expiring on the same date.

Example

Suppose the XYZ stock trading at Rs 33. A trader enters a bull put spread by buying OTM put at Rs 30 for Rs 100 and writing ITM put at Rs 35 for Rs 300. The trader receives a net credit of Rs 200 while entering the spread position.

Suppose the stock price of XYZ begins to rise and closes at Rs 36 on the expiration date. Both options expire worthless and the option trader keeps the entire credit of Rs 200 as profit, which is also the maximum profit possible.

If the price of XYZ is declined to Rs 29, both options expire in-the-money with the long call having an intrinsic value of Rs 100 and the short call having an intrinsic value of Rs 600. This means that the spread is now worth a negative Rs 500 at expiration. Since the trader had received a credit of Rs 200 when he entered the spread, his net loss comes to Rs 300. This is also his maximum possible loss.

Conclusion

In conclusion, a bull spread is a popular options trading strategy that allows investors to profit from a moderate rise in the price of an underlying asset while limiting their risk exposure. By simultaneously buying and selling options with different strike prices or expiration dates, traders can effectively manage their investment capital and establish a defined range of potential gains and losses.